2022 Annual

Homeowners & Private Passenger Automobile

Insurance Comparison Tables

The comparison tables provide examples of four zip codes in Utah. The zip codes used in the comparison samples

are; 84060 – Park City, 84713 - Beaver, 84015 - Clearfield, 84738 - Ivins. Look at the comparisons for the zip code

that is most similar to where you live. A comparison table of earthquake premium is located on page 7.

The insurance companies providing information for this comparison are the top 20 companies based on the highest

volume of homeowners and private passenger auto insurance premiums in Utah. This list is NOT A

"RECOMMENDATION" by the Insurance Department. Your insurance professional can provide you with a

premium quote to fit your circumstances. Consumers are cautioned that price is not the only factor to consider when

choosing an insurance company. You should also consider the service provided by the company and the agent, the

financial stability of the company, as well as the available coverages. Most insurers use their own credit criteria to

determine premium and eligibility. Your premium will also vary based on eligible credits and/or discounts,

surcharges, and additional coverages you select. Your insurance professional can advise you about additional

coverages, available credits and/or discounts for your situation. If you decide to change companies make sure the

coverage is the same or better. To avoid possible early cancellation charges, the best time to change companies is on

your renewal date. Check with your current company to determine potential additional amounts owed and early

cancellation charges.

Loss & Expense Ratios

In general terms, the loss ratio is, losses paid compared to premiums. The expense ratio is, administrative expense

compared to premiums. The combined loss and expense ratio is, losses paid combined with administrative expenses

compared to premiums. If the combined loss and expense ratio is more than 1.000 it means the company has paid out

more for claims and expenses than it collected in premiums. Example: a ratio of 1.150 means the company paid out

$1.15 for every $1.00 of premium received.

Complaint Ratio

By statute the Utah Insurance Department is required to calculate a complaint ratio for each company in the table.

Showing a ratio rather than the actual number of complaints levels the playing field between the companies.

Companies with a larger portion of the market are expected to have more complaints than companies with a smaller

amount of the market. Comparing the number of complaints is like comparing apples to oranges. The ratio gives a

comparison of apples to apples. The Department reviews complaints from consumers to determine whether there

was a violation of Utah Code or Rules. Complaints opened in 2021, determined to be valid, are used to calculate the

complaint ratio for each company. The ratio calculation is based on the valid complaints per $100,000 of earned

premium.

This is how a complaint ratio is calculated for a sample company with 10 complaints and $20,000,000 earned premium:

Step 1: 20,000,000/100,000 = 200

Step 2: 10 ÷ 200 = 0.0500 (complaint ratio per $100k earned premium, similar to ratios shown in the tables)

Reversing the formula shown will give the actual number of complaints for a company.

Step 1: 20,000,000/100,000 = 200

Step 2: 0.0500 x 200 = 10 (number of complaints calculated by reversing the formula)

2022

As required by law, the Utah Insurance Department has prepared this guide to auto

and homeowners insurance. This annual guide provides general information about

auto and homeowners insurance, and about some of the insurance companies that

write this coverage in Utah. It is hoped this will be helpful to you.

Taylorsville State Office Building

4315 S 2700 W STE 2300

Taylorsville, UT 84129

(801)957-9305

(800)439-3805 (toll free in Utah)

http://www.insurance.utah.gov

State of Utah

Insurance Department

Jonathan T. Pike

Commissioner

HOMEOWNERS INSURANCE

Homeowner premiums can vary according to the age of the home, location, condition and your credit information.

Eligibility requirements and premium for coverage may be determined by previous loss experience and age of the

dwelling. Other factors may also be considered.

Your home policy consists of these types of coverage: your home (dwelling), the contents, and your liability to

others. For more definitions of coverage types and optional coverages see page 6.

Our comparison table shows three types of homeowners policies:

1) Homeowner: the most common owner-occupied homeowners policy insuring the dwelling,

personal property and liability of the owner.

2) Renters: insuring the personal property and liability of tenants.

3) Condominium Unit Owner: insures personal property and liability of the unit owner. Coverage should

include the association’s insurance deductible for which the unit owner is responsible. [U.C.A. 57-8-43]

The examples included in this comparison assume that the dwelling is ten years old and located in a fire protection

class of one through six. Unless otherwise noted, the policy has a $1000 deductible. The personal liability limit is

$300,000. Medical payment limit is $1,000. Higher limits may be available through your insurance company.

The

Department of Insurance does not recommend limits of coverage.

No discounts or special coverages are included.

(The Insurance Department Does Not SET Homeowners Insurance Rates.)

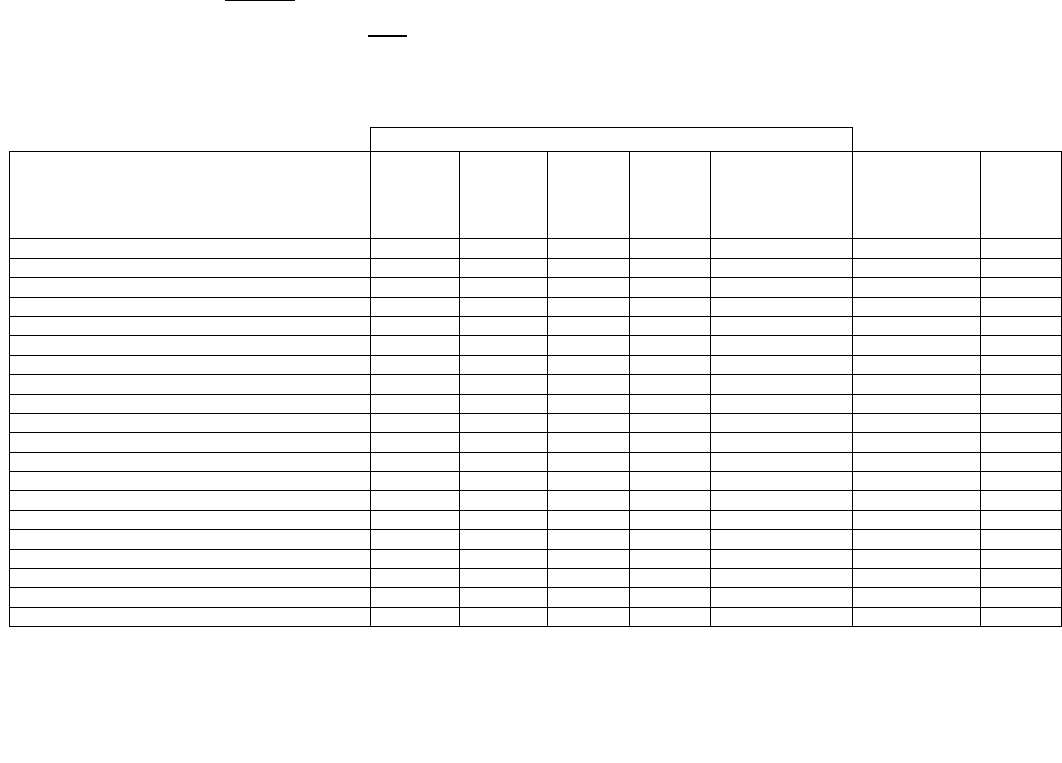

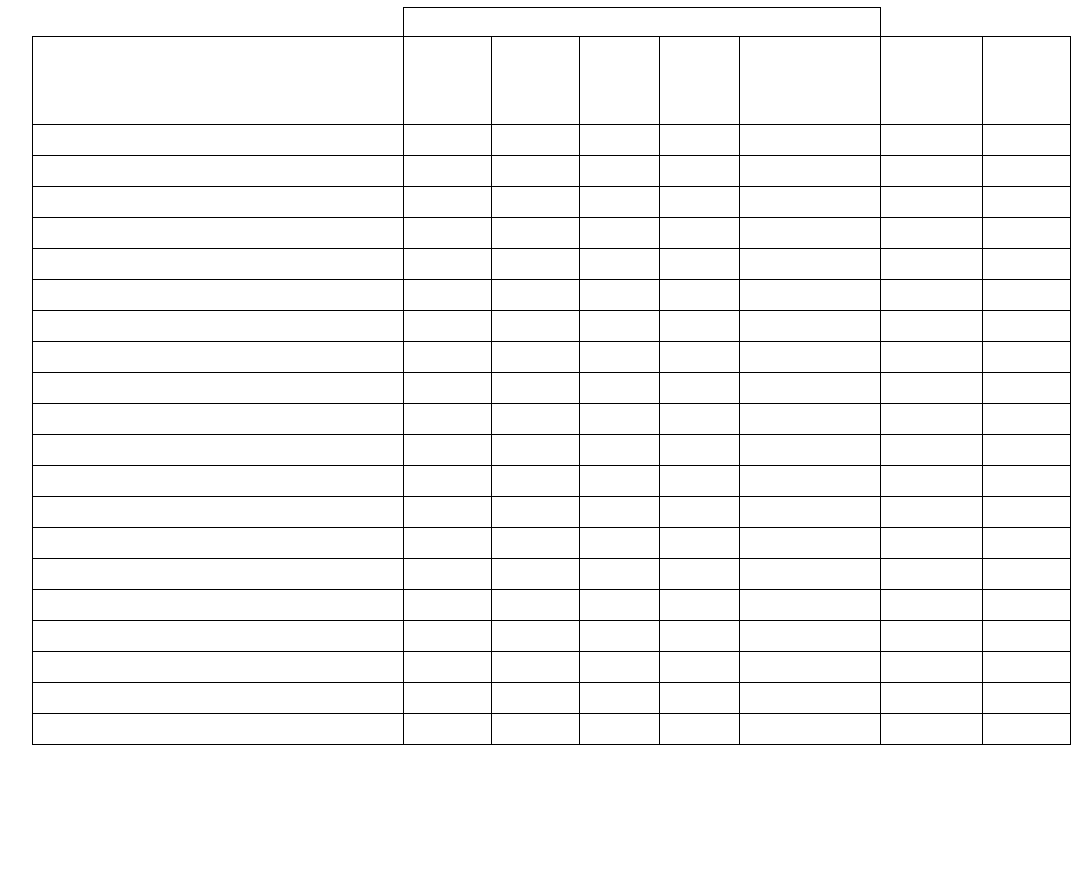

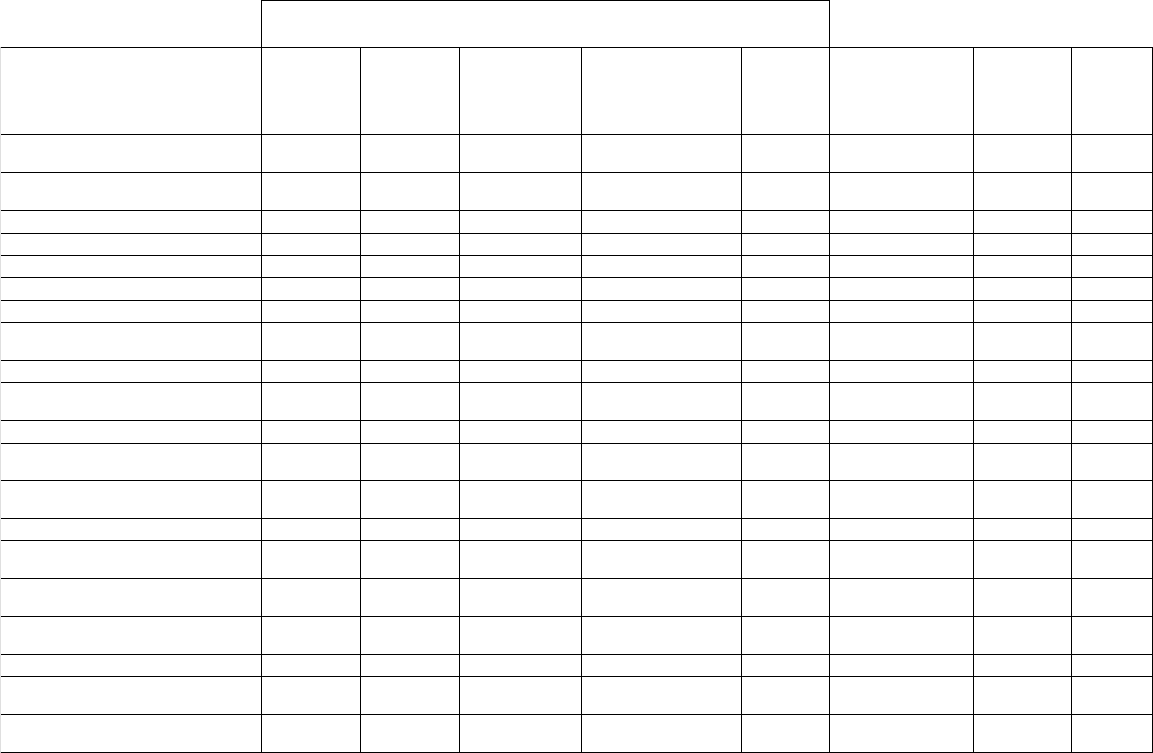

2022 Annual Homeowners Insurance Comparison Table

Zip Code 84060 – Park City

Premium for 1-year policy (2022 rates)

Insurance Company

Home

$250,000

Brick

Home

$250,000

Frame

Renters

HO-4

Condo

Unit

HO-6

Earned Premium

(Utah)

Complaint

Ratio per 100K

of Earned

Premium

#

Nat'l

Comb.

Loss &

Exp.

Ratio

State Farm Fire & Casualty Co

$858.00

$953.00

$177.00

$331.00

$114,193,742.00

0.000

1.080

Bear River Mutual Insurance Co

$425.00

$440.00

$115.00

$159.00

$50,899,002.00

0.000

0.983

Farmers Insurance Exchange (a)

$670.41

$629.02

N/A

N/A

$46,827,712.12

0.009

1.076

Allstate Vehicle & Property Insurance Co

$821.00

$846.00

N/A

N/A

$33,374,243.00

0.000

1.107

Auto Owners Insurance Co

$1033.17

$1066.42

$262.99

$702.75

$30,216,540.00

0.000

0.950

Liberty Mutual Personal Insurance Co

$1030.00

$974.00

$427.00

$692.00

$21,886,055.00

0.023

0.796

Travelers Personal Insurance Co

$953.00

$975.00

$158.00

$312.00

$19,964,470.32

0.000

113.5

United Service Automobile Assn

$1672.52

$1592.22

$494.30

$743.78

$17,856,609.00

0.001

102.5

Fire Insurance Exchange (b)

$17,395,688.55

0.006

1.013

USAA Casualty Insurance Co

$1977.26

$1900.03

$476.25

$674.86

$16,709,091.00

0.000

100.8

Allstate Property & Casualty Insurance Co (b)

$15,229,065.00

0.000

0.971

Farm Bureau Property Casualty Insurance Co

$1022.75

$1029.43

$236.69

$194.06

$14883.502.00

0.000

0.994

CSE Safeguard Insurance Co (c)

$366.00

$402.00

$213.00

$289.00

$14,705,742.00

0.000

0.941

Allstate Indemnity Co (d)

$174.00

$295.00

$11,848,434.00

0.000

0.974

Pacific Indemnity Co (e)

$1051.00

$1051.00

$290.00

$458.00

$11,839,064.00

0.000

0.852

Safeco Insurance Co of America (d)

$142.00

$202.00

$11,789,035.00

0.034

0.763

Homesite Insurance Co

$723.00

$738.00

$151.00

N/A

$11,345,117.00

0.000

0.918

American Family Mutual Insurance Co of SI (b)

$10,042,339.00

0.000

0.010

CSAA Fire & Casualty Insurance Co

$727.00

$727.00

$129.00

$273.00

$9,938,218.00

0.000

1.005

American Economy Insurance Co (f)

$1112.00

$1142.00

N/A

N/A

$8,604,340.00

0.000

1.125

A blank cell indicates this company is no longer writing this type of policy as new business, or has never written this type of

policy.

(a) This company only offers HO5 and no longer writes new business for HO4 or HO6.

(b) This company no longer writes new business.

(c) Must qualify for the preferred homeowners program.

(d) This company no longer writes HO3 business.

(e) Standard policy form only. Medical payment minimum $25,000.

(f) This company does not write HO4 or HO6

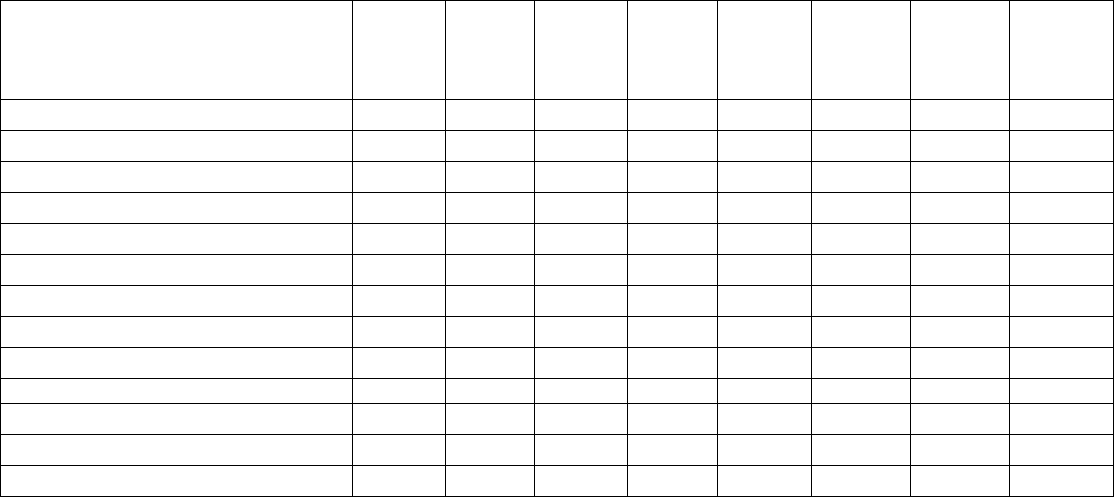

Homeowners Table (continued)

Zip Code 84713 Beaver

Premium for 1-year policy (2022 rates)

Insurance Company

Home

$250,000

Brick

Home

$250,000

Frame

Renters

HO-4

Condo

Unit

HO-6

Earned Premium

(Utah)

Complaint

Ratio per

100K of

Earned

Premium

#

Nat'l

Comb.

Loss &

Exp.

Ratio

State Farm Fire & Casualty Co

$910.00

$1011.00

$167.00

$312.00

$114,193,742.00

0.000

1.080

Bear River Mutual Insurance Co

$457.00

$473.00

$115.00

$159.00

$50,899,002.00

0.000

0.993

Farmers Insurance Exchange (a)

$713.33

$670.22

N/A

N/A

$46,827,712.00

0.009

1.076

Allstate Vehicle & Property Insurance Co

$833.00

$855.00

N/A

N/A

$33,374,243.00

0.000

1.107

Auto Owners Insurance Co

$1136.77

$11769.99

$262.99

$677.19

$30,216,540.00

0.000

0.950

Liberty Mutual Personal Insurance Co

$1016.00

$957.00

$427.00

$962.00

$21,886,055.00

0.023

0.796

Travelers Personal Insurance Co

$915.00

$1042.00

$164.00

$306.00

$19,964,470.32

0.000

113.5

United Service Automobile Assn

$1580.33

$1496.70

$446.18

$670.79

$17,856,609.00

0.001

102.5

Fire Insurance Exchange (b)

$17,395,688.55

0.006

1.013

USAA Casualty Insurance Co

$1830.74

$1749.95

$427.83

$616.10

$16,709,091.00

0.000

100.8

Allstate Property & Casualty Insurance Co (b)

$15,229,065.00

0.000

0.971

Farm Bureau Property Casualty Insurance Co

$1193.47

$1206.65

$299.58

$246.44

$14,883,502.00

0.000

0.994

CSE Safeguard Insurance Co (c)

$382.00

$419.00

$213.00

$289.00

$14,705,742.00

0.000

0.941

Allstate Indemnity Co (d)

$174.00

$259.00

$11,848,434.00

0.000

0.974

Pacific Indemnity Co (e)

$1004.00

$1004.00

$305.00

$479.00

$11,839,064.00

0.000

0.852

Safeco Insurance Co of America (d)

$142.00

$202.00

$11,789,035.00

0.034

0.763

Homesite Insurance Co

$699.00

$716.00

$124.00

N/A

$11,345,117.00

0.000

0.918

American Family Mutual Insurance Co of SI (b)

$10,042,339.00

0.000

0.010

CSAA Fire & Casualty Insurance Co

$569.00

$569.00

$130.00

$289.00

$9,938,218.00

0.000

1.005

American Economy Insurance Co (f)

$1095.00

$1146.00

N/A

N/A

$8,604,340.00

0.000

1.125

A blank cell indicates this company is no longer writing this type of policy as new business, or has never written this type of

policy.

(a) This company only offers HO5 and no longer writes new business for HO4 or HO6.

(b) This company no longer writes new business.

(c) Must qualify for the preferred homeowners program.

(d) This company no longer writes HO3 business.

(e) Standard policy form only. Medical payment minimum $25,000.

(f) This company does not write HO4 or HO6

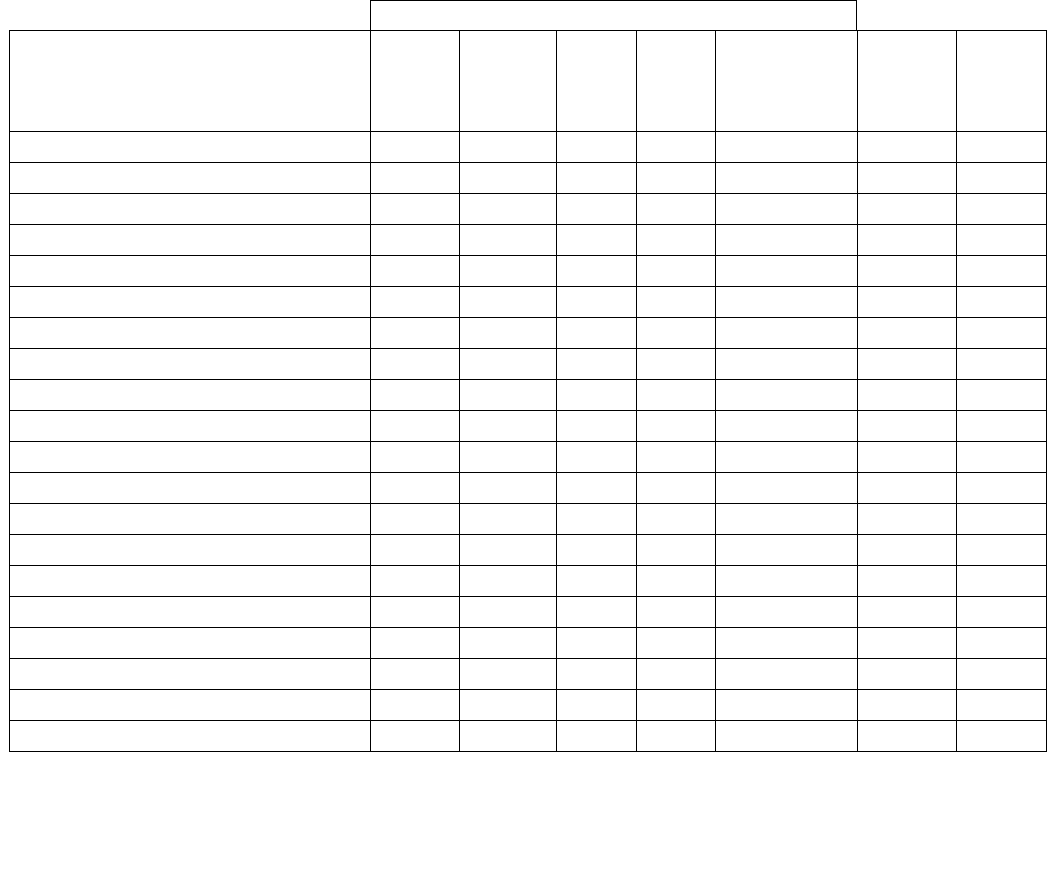

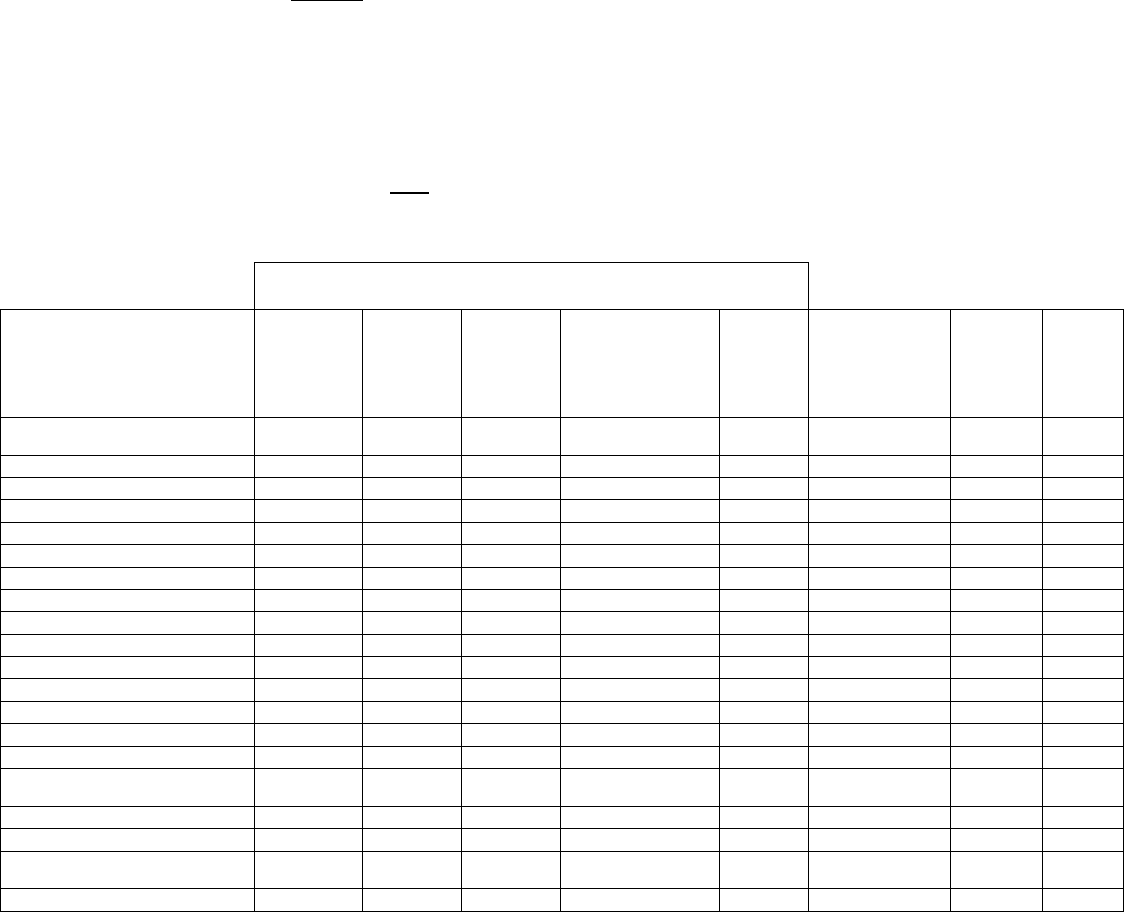

Homeowners Table (continued)

Zip Code 84015 - Clearfield

Premium for 1-year policy (2022 rates)

Insurance Company

Home

$250,000

Brick

Home

$250,000

Frame

Renters

HO-4

Condo

Unit

HO-6

Earned Premium

(Utah)

Complaint

Ratio per

100K of

Earned

Premium

#

Nat'l

Comb.

Loss &

Exp. Ratio

State Farm Fire & Casualty Co

$741.00

$823.00

$144.00

$315.00

$114,193,742.00

0.000

1.080

Bear River Mutual Insurance Co

$425.00

$440.00

$115.00

$159.00

$50,899,002.00

0.000

0.993

Farmers Insurance Exchange (a)

$872.64

$806.30

N/A

N/A

$46,827,712.00

0.009

1.076

Allstate Vehicle & Property Insurance Co

$726.00

$745.00

N/A

N/A

$33,374,243.00

0.000

1.107

Auto Owners Insurance Co

$1011.88

1041.92

$262.99

$703.75

$30,216,540.00

0.000

0.950

Liberty Mutual Personal Insurance Co

$988.00

$932.00

$419.00

$688.00

$21,886,055.00

0.023

0.796

Travelers Personal Insurance Co

$1009.00

$1042.00

$158.00

$235.00

$19,964,470.32

0.000

113.5

United Service Automobile Assn

1,992.90

$1716.90

4494.30

$549.89

$17,856,609.00

0.001

102.5

Fire Insurance Exchange (b)

$17,395,688.55

0.006

1.013

USAA Casualty Insurance Co

$2182.80

$1912.94

$476.25

4501.03

$16,709,091.00

0.000

100.8

Allstate Property & Casualty Insurance Co (b)

$15,229,065.00

0.000

0.971

Farm Bureau Property Casualty Insurance Co

1,020.72

1028.13

240.27

198.61

$14,883,502.00

0.000

0.994

CSE Safeguard Insurance Co (c)

$504.00

$555.00

$213.00

$289.00

$14,705,742.00

0.000

0.941

Allstate Indemnity Co (d)

$174.00

$265.00

$11,848,434.00

0.000

0.974

Pacific Indemnity Co (e)

$1018.00

$1018.00

$305.00

$479.00

$11,839,064.00

0.000

0.852

Safeco Insurance Co of America (d)

$115.00

$173.00

$11,789,035.00

0.034

0.763

Homesite Insurance Co

$1171.00

$1250.00

$153.00

N/A

$11,345,117.00

0.000

0.918

American Family Mutual Insurance Co of SI (b)

$10,042,339.00

0.000

0.010

CSAA Fire & Casualty Insurance Co

$571.00

$571.00

$130.00

$279.00

$9,938,218.00

0.000

1.005

American Economy Insurance Co (f)

$884.00

$916.00

N/A

N/A

$8,604,340.00

0.000

1.125

A blank cell indicates this company is no longer writing this type of policy as new business, or has never written this type of

policy.

(a) This company only offers HO5 and no longer writes new business for HO4 or HO6.

(b) This company no longer writes new business.

(c) Must qualify for the preferred homeowners program.

(d) This company no longer writes HO3 business.

(e) Standard policy form only. Medical payment minimum $25,000.

(f) This company does not write HO4 or HO6

.

Homeowners Table (continued)

A blank cell indicates this company is no longer writing this type of policy as new business, or has never written this type of

policy.

(a) This company only offers HO5 and no longer writes new business for HO4 or HO6.

(b) This company no longer writes new business.

(c) Must qualify for the preferred homeowners program.

(d) This company no longer writes HO3 business.

(e) Standard policy form only. Medical payment minimum $25,000.

(f) This company does not write HO4 or HO6

Zip Code 84738 - Ivins

Premium for 1-year policy (2022 rates)

Insurance Company

Home

$250,000

Brick

Home

$250,000

Frame

Renters

HO-4

Condo

Unit

HO-6

Earned Premium

(Utah)

Complaint

Ratio per

100K of

Earned

Premium

#

Nat'l

Comb.

Loss &

Exp.

Ratio

State Farm Fire & Casualty Co

$810.00

$898.00

$167.00

$312.00

$114,193,742.00

0.000

1.080

Bear River Mutual Insurance Co

$457.00

$473.00

$115.00

$159.00

$50,899,002.00

0.000

0.993

Farmers Insurance Exchange (a)

$754.51

$711.72

N/A

N/A

$46,827,712.00

0.009

1.076

Allstate Vehicle & Property Insurance Co

$717.00

$735.00

N/A

N/A

$33,374,243.00

0.000

1.107

Auto Owners Insurance Co

$955.33

$987.44

$262.99

$677.19

$30,216,540.00

0.000

0.950

Liberty Mutual Personal Insurance Co

$1063.00

$997.00

4427.00

$692.00

$21,886,055.00

0.023

0.796

Travelers Personal Insurance Co

$923.00

$952.00

4162.00

4277.00

$19,964,470.32

0.000

113.5

United Service Automobile Assn

$1728.28

$1649.33

$494.13

$723.86

$17,856,609.00

0.001

102.5

Fire Insurance Exchange (b)

$17,395,688.55

0.006

1.013

USAA Casualty Insurance Co

$1999.19

$1923.20

$470.35

$672.52

$16,709,091.00

0.000

100.8

Allstate Property & Casualty Insurance Co (b)

$15,229,065.00

0.000

0.971

Farm Bureau Property Casualty Insurance Co

$1016.47

$1023.27

$246.19

$203.12

$14,883,502.00

0.000

0.994

CSE Safeguard Insurance Co (c)

$453.00

$499.00

$213.00

$289.00

$14,705,742.00

0.000

0.941

Allstate Indemnity Co (d)

$174.00

$227.00

$11,848,434.00

0.000

0.974

Pacific Indemnity Co (e)

$1004.00

$1004.00

$305.00

$479.00

$11,839,064.00

0.000

0.852

Safeco Insurance Co of America (d)

$126.00

$160.00

$11,789,035.00

0.034

0.763

Homesite Insurance Co

$802.00

$819.00

$126.00

N/A

$11,345,117.00

0.026

0.918

American Family Mutual Insurance Co of SI (b)

$10,042,339.00

0.000

0.010

CSAA Fire & Casualty Insurance Co

$764.00

$764.00

$126.00

$274.00

$9,938,218.99

0.000

1.005

American Economy Insurance Co (f)

$922.00

$946.00

N/A

N/A

$8,604,340.00

0.012

1.125

Common Coverages in a Homeowners Policy

Dwelling – Covers damage to your house and structures attached to your house. (Coverage A)*

Other Structures – Pays for damage to fences, sheds, unattached garages and other structures not attached to your

house. (Coverage B)*

Personal Property – Reimburses you for the value of your possessions, including furniture, electronics, appliances

and clothing, damaged or lost. They may be covered even when the items are not at your house. (Coverage C)*

Loss of Use – Covers your additional living expenses, above your normal costs, while your home is being repaired.

(Coverage D)*

Personal Liability – Covers your financial loss against a claim of lawsuit and found legally responsible for injuries

or damages to another person. (Coverage E)*

Medical Payments – Pays for medical bills for people hurt on your property or hurt by your pets. (Coverage F)*

*Indicates coverage name or reference used by many companies.

Optional Homeowners Coverage/Policies

Sewer Back Up – This is not covered under the standard policy. Sewer back up coverage can be added to your

policy by an endorsement.

Earthquake Coverage - The standard homeowners, condominium and renters policies will not cover earthquake

damage. Many companies will add this coverage as an endorsement with additional premium to your existing policy

or you may purchase it as a separate policy. If your company does not offer earthquake coverage you may get it

through another company. This coverage will have a separate deductible. The average rate per $1,000 in value

(based on a 10% deductible) is $3.24 for a brick dwelling and $1.64 for a frame dwelling, structure only. For more

information and an exact quote, contact your insurance professional. Earthquake covers landslide, but only if

triggered by the earthquake. See the next page for a comparison of earthquake premiums for the same home used in

our 2022 scenario.

Flood Insurance Policy – The standard homeowners, condominium and renters policies will not cover damage due

to flood. If you live in a designated flood zone you may be required to buy flood insurance. However, you may

consider buying a flood policy if your home could be flooded by an overflowing creek, melting snow or water

running down a steep hill, or unusual and rapid accumulation or runoff of surface waters from any source. You may

purchase a flood policy through your insurance professional or directly from the Federal Flood Insurance Program.

(www.floodsmart.gov) In most situations, there is a 30-day waiting period before coverage takes effect.

Difference in Conditions Policy - These policies provide catastrophe coverage not normally included in

homeowners policies. Earthquake, landslides and flood coverage are included in these policies. Contact your

insurance professional for information regarding this type of policy.

Landslide – Landslides are not covered by homeowner policies. Coverage cannot be added to your policy except as

noted above as a Difference in Conditions Policy or in an Earthquake endorsement or policy under specific

circumstances.

It is always important to understand the policy and the coverage it affords. The Department recommends you review

your insurance needs and the coverages available through various types of policies prior to purchase. We suggest you

review your policy when you receive it and ask your insurance professional questions about anything you do not

understand

.

The Department advises consumers to have an annual check-up with their insurance professional.

2022 Annual Earthquake Comparison Table

The following comparisons are earthquake premiums from companies included in the homeowner table that

offer earthquake insurance. The scenario is for a $250,000 home. The premium is based upon a 10%

deductible ($25,000) unless otherwise noted. For more information and an exact quote for your home

contact your insurance professional.

Insurance Company

Park City

84060

Brick

Park

City

84060

Frame

Beaver

84713

Brick

Beaver

84713

Frame

Clearfield

84015

Brick

Clearfield

84015

Frame

Ivins

84738

Brick

Ivins

84738

Frame

State Farm Fire & Cas Co

$396.00

$248.00

$396.00

$248.00

$508.00

$361.00

$363.00

$246.00

Bear River Mut Ins Co

$426.00

$426.00

$426.00

$426.00

Farmers Ins Exchange

$1202.00

$846.00

$1202.00

$846.00

$2072.00

$1458.00

$1202.00

$846.00

Auto-Owners Ins Co

$3089.67

$1484.92

$1971.52

$1413.99

$3997.63

$1795.66

$1790.08

$1221.44

Liberty Mutual Personal Ins Co

$1439.00

$581.00

$1320.00

$534.00

$1439.00

$581.00

$1320.00

$534.00

United Service Automobile Association

$302.40

$212.39

$304.55

$213.90

$949.23

$666.69

$306.28

$215.11

USAA Casualty Ins Co

$297.50

$208.95

$299.62

$210.44

$933.86

$655.90

$301.32

$211.63

Farm Bureau Property & Casualty Ins Co

$1940.40

$338.08

$1278.90

$255.78

$2513.70

$502.74

$1278.90

$255.78

CSE Safeguard Insurance Co

$193.00

$193.00

$325.00

$193.00

Pacific Indemnity Co

$275.00

$275.00

$275.00

$275.00

$275.00

$275.00

$275.00

$275.00

Homesite Ins Co

$490.00

$108.00

$490.00

$108.00

$1293.00

$455.00

$490.00

$490.00

Pacific Indemnity Co

$368.00

$80.00

$368.00

$80.00

$1138.00

$400.00

$368.00

$80.00

American Economy Ins Co

$414.00

$614.00

$414.00

$614.00

$414.00

$614.00

$414.00

$614.00

A blank cell indicates this company does not write this

type of policy as new business.

AUTOMOBILE INSURANCE

Auto insurance premium varies based on many factors, which may include the vehicle type, age, garaging location and

annual miles driven. The auto premium is also based on the driver's record, age, gender, credit information, home

ownership, and additional coverages selected. Additional factors considered in the premium rating include marital status,

how the car is used, longevity with the company and years without incidents. The number of autos in an area, traffic

congestion and average number of auto accidents in a particular location play an important role in premium

determinations. Premiums in metropolitan areas tend to be higher for these reasons. The following may help lower your

auto insurance premiums: drive safely, compare companies’ premiums, higher physical damage deductibles, insure all

vehicles under one policy, buy packaged policies, and look for possible discounts.

All licensed drivers who reside in the household need to be listed on the policy. Please check with your insurance

company regarding their requirements.

[U.C.A. 41-1a-1101(2)(a)] allows law enforcement officers to impound uninsured vehicles.

The vehicle used in our comparisons is 2020 Dodge Ram 1500. The examples listed in the auto comparison assume that

the driver has a clean driving record, mid-range credit information, and drives to work between 3 & 15 miles one way.

The Department of Insurance does not recommend limits of coverage. Check with the company for limits available that

will fit your circumstances. For more definitions of coverages see page 12 of this table.

Unless otherwise noted, the coverages quoted in our examples provide for the following limits of insurance:

Bodily Injury: $50,000 Per Person / $100,000 Per Accident / Property Damage: $50,000 Per Accident

Uninsured Motorist Bodily Injury: $50,000 Per Person / $100,000 Per Accident

Underinsured Motorist Bodily Injury: $50,000 Per Person / $100,000 Per Accident

Personal Injury Protection: $3,000

Optional Physical Damage limits are: Comprehensive: $500 deductible / Collision: $500 deductible

(The Insurance Department Does Not SET Automobile Insurance Rates.)

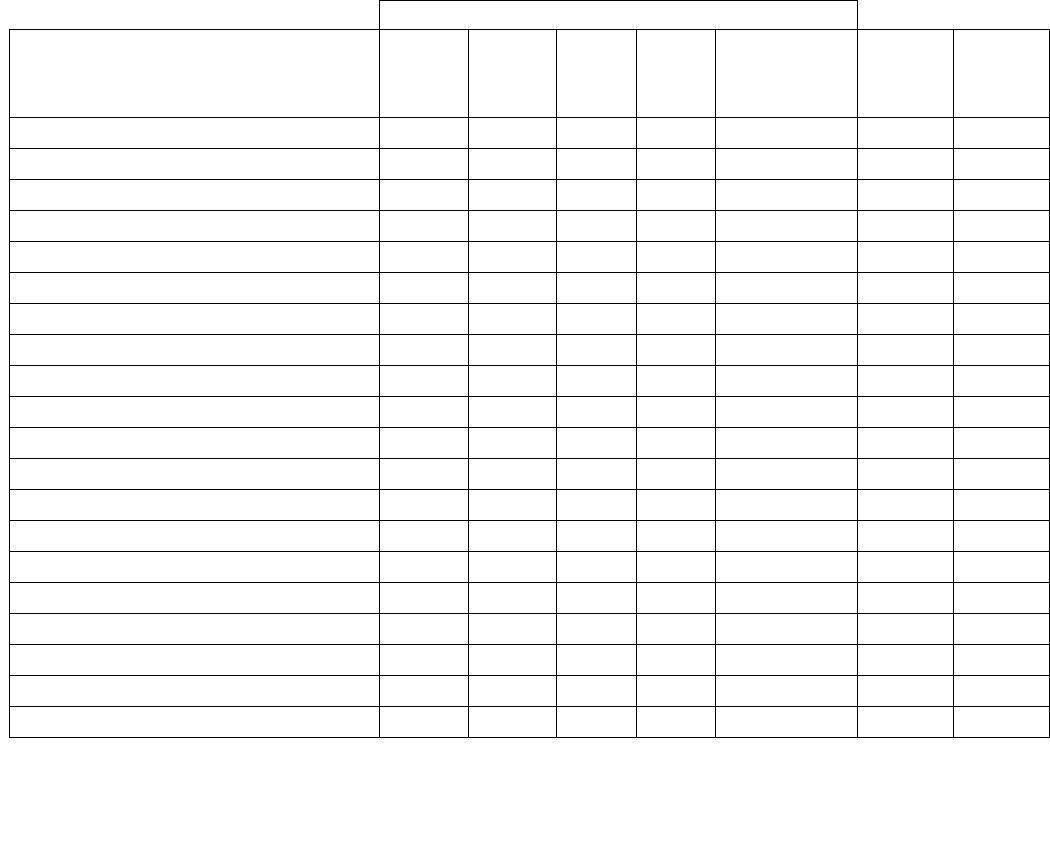

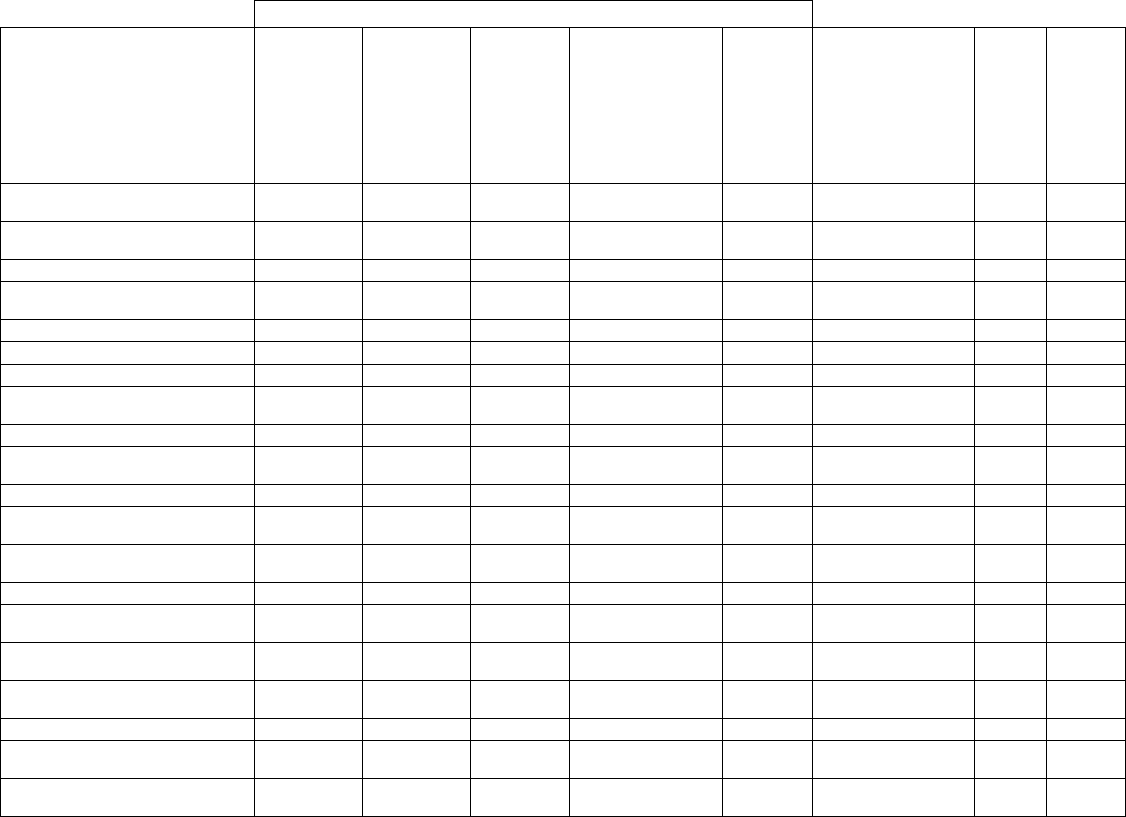

2022 Annual Auto Insurance Comparison Table

A blank cell indicates this company is no longer writing this type of policy as new business but an affiliated company may write it.

Zip Code 84060 – Park

City

Premium for 6-month policy (2022 rates)

Insurance Company

Single Male

Age 20

Single

Female

Age 20

Married

Couple

Age 39

Single Male/Female

Age 39

Married

Couple

Age 66

Earned Premiums

(UTAH)

Complaint

Ratio Per

100K of

Earned

Premium

#

Nat'l

Comb.

Loss &

Expense

Ratio

State Farm Mutual Automobile

Ins Co

$2019.40

$1615.28

$833.97

$833.97

$770.87

$301,180,145.00

0.000

1.080

Allstate Fire & Casualty Ins Co

$1891.00

$1527.00

$910.00

$951.00

$1001.00

$224,659,220.00

0.001

1.015

GEICO Casualty Co

$199,609,724.00

0.000

0.980

Mid Century Ins Co

$2003.50

$1849.10

$1528.80

$1330.10/$1440.30

$1368.60

$169,078,956.77

0.002

1.006

Bear River Mutual Ins Co

$1081.50

$1016.50

$610

$658.50/$614.00

$649.00

$15,091,600.00

0.000

0.993

Progressive Direct Ins Co

$1196.00

$1069.00

$567.00

$558.00/$607.00

$505.00

$70,598,822.00

0.024

0.942

Auto Owners Ins Co

$1578.36

$1313.82

$683.19

$681.55

$671.53

$68,973,896.00

0.000

0.950

Progressive Advantage Ins Co

$1011.00

$905.00

$491.00

$485.00/$525.00

$441.00

$65,113,059.00

0.018

0.997

Safeco Insurance Co of IL

$1918.00

$1819.00

$853.00

$1007.00/$994.00

$696.00

$63,378,013.30

0.014

0.807

Progressive Preferred Ins Co

$1051.00

$941.00

$469.00

$469.00/$525.00

$358.00

$58,796,371.00

0.013

0.787

Standard Fire Ins Co

$1528.00

$1300.00

$836.00

$726.00/$699.00

$899.00

$57,183,000.63

0.000

0.989

Progressive Classic Ins Co

$1214.00

$1088.00

$546.00

$541.00/$608.00

$410.00

$51,720,348.00

0.007

0.762

Farm Bureau Prop & Cas Ins Co

$2365.13

$2163.47

$1062.18

$980.84/$1101.41

$1021.20

$49,927,547.00

0.000

0.994

USAA Casualty Ins Co

$890.00

4805.00

$425.00

$503.00/$496.00

$417.00

$48,462,795.00

0.000

1.008

LM General Casualty Ins Co

United Service Automobile

Association

$759.00

4669.00

$397.00

$459.00/$455.00

$371.00

$37,866,100.00

0.003

1.025

CSAA Fire & Casualty Ins Co

$1282.00

$1197.00

$661.00

$716.00/$671.00

$625.00

$29,967,723.00

0.000

1.005

USAA General Indemnity Co

$863.00

$809.00

$417.00

$495.00/$482.00

$409.00

$24,529,643.00

0.010

1.004

Garrison Property & Casualty

Ins Co

$948.00

$882.00

$405.00

$485.00/$476.00

$394.00

$23,241,307.00

0.010

1.009

Liberty Mutual Personal Ins Co

$6,172.00

$5721.00

$3586.00

$4336.00/$4062.00

$4132.00

$22,476,277.00

0.044

0.796

Automobile Table (continued)

A blank cell indicates this company is no longer writing this type of policy as new business but an affiliated company may write it.

Zip Code 84713 - Beaver

Premium for 6-month policy (2022 rates)

Insurance Company

Single Male

Age 20

Single

Female Age

20

Married

Couple

Age 39

Single

Male/Female Age

39

Married

Couple

Age 66

Earned Premiums

(UTAH)

Compl

aint

Ratio

Per

100K

of

Earned

Premiu

m

#

Nat'l

Comb.

Loss &

Expens

e Ratio

State Farm Mutual Automobile

Insurance Co

$1762.23

$1408.19

$740.54

$740.54

$679.70

$301,180,145.00

0.000

1.080

Allstate Fire & Casualty

Insurance Co

$1673.00

$1382.00

$872.00

$904.00/$960.00

$807.00

$224,659,220.00

0.001

1.015

GEICO Casualty Co

$199,609,724.00

0.000

0.980

Mid Century Insurance Co

$1903.50

$1755.30

$1421.10

$1246.70/

$1,269.80

$1269.80

$169,078,956.77

0.002

1.006

Bear River Mutual Insurance Co

$1044.50

$983.00

$605.00

$648.50/$606.50

$637.50

$15,091,600.00

0.000

0.993

Progressive Direct Insurance Co

$1134.00

41015.00

$559.00

$549.00/$604.00

$497.00

$70,598,822.00

0.024

0.942

Auto Owners Insurance Co

$1443.15

$1200.67

$642.04

$640.30

$628.31

$68,973,896.00

0.000

0.950

Progressive Advantage

Insurance Co

$963.00

$864.00

$485.00

$479.00/$521.00

$434.00

$65,113,059.00

0.018

0.997

Safeco Insurance Co of IL

$1816.00

$1720.00

$839.00

$988.00/$972.00

$686.00

$63,378,013.30

0.014

0.807

Progressive Preferred Insurance

Co

$991.00

$897.00

$476.00

$461.00/$527.00

$355.00

$58,796,371.00

0.013

0.787

Standard Fire Insurance Co

$1290.00

$1111.00

$742.00

$637.00/$616.00

$777.00

$57,183,000.63

0.000

0.989

Progressive Classic Insurance

Co

$1148.00

$1037.00

$551.00

$533.00/$611.00

$407.00

$51,720,348.00

0.007

0.762

Farm Bureau Prop & Cas

Insurance Co

$2133.40

$1943.18

$985.54

$913.20/$1025.37

$945.09

$49,927,547.00

0.000

0.994

USAA Casualty Insurance Co

$858.00

$776.00

$411.00

$486.00/$480.00

$404.00

$48,462,795.00

0.000

1.008

LM General Casualty Insurance

Co

United Service Automobile

Association

$739.00

$652.00

$388.00

$448.00/$444.00

$363.00

$37,866,100.00

0.003

1.025

CSAA Fire & Casualty Insurance

Co

$1272.00

$1190.00

$667.00

$724.00/$680.00

$632.00

$29,967,723.00

0.000

1.005

USAA General Indemnity Co

$846.00

$795.00

$407.00

$484.00/$473.00

$401.00

$24,529,643.00

0.010

1.004

Garrison Property & Casualty

Insurance Co

$916.00

$854.00

$390.00

$467.00/$459.00

$381.00

$23,241,307.00

0.010

1.009

Liberty Mutual Personal

Insurance Co

$6704.00

$6168.00

$3787.00

$4520.00/

$4235.00

$4295.00

$22,476,277.00

0.044

0.796

Automobile Table (continued)

A blank cell indicates this company is no longer writing this type of policy as new business but an affiliated company may write it.

Zip Code 84015 -

Clearfield

Premium for 6-month policy (2022 rates)

Insurance Company

Single

Male Age

20

Single

Female

Age 20

Married

Couple Age 39

Single Male/Female

Age 39

Married

Couple

Age 66

Earned Premiums

(UTAH)

Complaint

Ratio Per

100K of

Earned

Premium

#

Nat'l

Comb.

Loss &

Expense

Ratio

State Farm Mutual Automobile

Insurance Co

$2233.65

$1796.78

$911.57

$911.57

$850.81

$301,180,145.00

0.000

1.080

Allstate Fire & Casualty

Insurance Co

$1776.00

$1443.00

$872.00

$904.00/$960.00

$873.00

$224,659,220.00

0.001

1.015

GEICO Casualty Co

$199,609,724.00

0.000

0.980

Mid Century Insurance Co

$1693.70

$1737.70

$1439.50

$1080.10/$1174.10

$1131.70

$169,078,956.77

0.002

1.006

Bear River Mutual Insurance Co

$1060.50

$1002.00

$577.50

$625.00/$581.50

$624.50

$15,091,600.00

0.000

0.993

Progressive Direct Insurance Co

$1278.00

$1149.00

$599.00

$581.00/$642.00

$534.00

$70,598,822.00

0.024

0.942

Auto Owners Insurance Co

$1561.48

$1309.99

$666.07

$664.24

$667.04

$68,973,896.00

0.000

0.950

Progressive Advantage

Insurance Co

$1074.00

$967.00

$514.00

$502.00/$550.00

$463.00

$65,113,059.00

0.018

0.997

Safeco Insurance Co of IL

$2064.00

$1958.00

$861.00

$1024.00/$1015.00

$702.00

$63,378,013.30

0.014

0.807

Progressive Preferred Insurance

Co

$1198.00

$1077.00

$536.00

$524.00/$598.00

$406.00

$58,796,371.00

0.013

0.787

Standard Fire Insurance Co

$1561.00

$1315.00

$846.00

$737.00/$710.00

$915.00

$57,183,000.63

0.000

0.989

Progressive Classic Insurance

Co

$1389.00

$1252.00

$623.00

$609.00/$697.00

$464.00

$51,720,348.00

0.007

0.762

Farm Bureau Prop & Cas

Insurance Co

$2490.49

$2310.44

$1107.23

$1019.59/$1143.93

$1066.76

$49,927,547.00

0.000

0.994

USAA Casualty Insurance Co

$935.00

$845.00

$441.00

$521.00/516.00

437.00

$48,462,795.00

0.000

1.008

LM General Casualty Insurance

Co

United Service Automobile

Association

$781.00

$686l.00

$404.00

$466.00/$463.00

$383.00

$37,866,100.00

0.003

1.025

CSAA Fire & Casualty Insurance

Co

$1301.00

$1215.00

$661.00

$716.00/$671.00

$626.00

$29,967,723.00

0.000

1.005

USAA General Indemnity Co

$904.00

$850.00

$430.00

$510.00/$500.00

$427.00

$24,529,643.00

0.010

1.004

Garrison Property & Casualty

Insurance Co

$980.00

$914.00

$413.00

$493.00/$487.00

$407.00

$23,241,307.00

0.010

1.009

Liberty Mutual Personal

Insurance Co

$6836.00

$6359.00

$4050.00

$4917.00/$4612.00

$4686.00

$22,476,277.00

0.044

0.796

Automobile Table (continued)

A blank cell indicates this company is no longer writing this type of policy as new business but an affiliated company may write it.

Zip Code 84738 - Ivins

Premium for 6-month policy (2022 rates)

Insurance Company

Single

Male Age

20

Single

Female

Age 20

Married Couple

Age 39

Single Male/Female

Age 39

Married

Couple

Age 66

Earned Premiums

(UTAH)

Complaint

Ratio Per

100K of

Earned

Premium

#

Nat'l

Comb.

Loss &

Expense

Ratio

State Farm Mutual Automobile

Insurance Co

$1862.37

$1498.58

$766.31

$766.31

$714.05

$301,180,145.00

0.000

1.080

Allstate Fire & Casualty

Insurance Co

$1533.00

$1251.00

$766.00

$795.00/$839.00

$754.00

$224,659,220.00

0.001

1.015

GEICO Casualty Co

Mid Century Insurance Co

$1755.20

$1619.50

$1319.10

$1148.80/$1243.60

$1178.40

$169,078,956.77

0.002

1.006

Bear River Mutual Insurance Co

$1035.50

$977.00

$575.00

$621.50/$579.50

$618.00

$15,091,600.00

0.000

0.993

Progressive Direct Insurance Co

$1210.00

$1087.00

$573.00

$556.00/$615.00

$512.00

$70,598,822.00

0.024

0.942

Auto Owners Insurance Co

$1391.76

$1164.80

$597.60

$595.92/$595.92

$597.02

$68,973,896.00

0.000

0.950

Progressive Advantage

Insurance Co

$1019.00

$918.00

$494.00

$482.00/$528.00

$445.00

$65,113,059.00

0.018

0.997

Safeco Insurance Co of IL

$1805.00

$1708.00

$769.00

$914.00/$903.00

$630.00

$63,378,013.30

0.014

0.807

Progressive Preferred Insurance

Co

$1076.00

$971.00

$492.00

$476.00/$548.00

$370.00

$58,796,371.00

0.013

0.787

Standard Fire Insurance Co

$1395.00

$1180.00

$771.00

$672.00/$646.00

$827.00

$57,183,000.63

0.000

0.989

Progressive Classic Insurance

Co

$1247.00

$1125.00

$572.00

$553.00/$636.00

$425.00

$51,720,348.00

0.007

0.762

Farm Bureau Prop & Cas

Insurance Co

$2213.07

$2050.49

$991.75

$914.02/$1024.99

$955.14

$49,927,547.00

0.000

0.994

USAA Casualty Insurance Co

$938.00

$847.00

$444.00

$525.00/$520.00

$438.00

$48,462,795.00

0.000

1.008

LM General Casualty Insurance

Co

United Service Automobile

Association

$800.00

$703.00

$415.00

$479.00/$476.00

$390.00

$37,866,100.00

0.003

1.025

CSAA Fire & Casualty

Insurance Co

$1248.00

$1165.00

$640.00

$695.00/$651.00

$609.00

$29,967,723.00

0.000

1.005

USAA General Indemnity Co

$921.00

$865.00

$438.00

$521.00/$510.00

$433.00

$24,529,643.00

0.010

1.004

Garrison Property & Casualty

Insurance Co

$988.00

$921.00

$416.00

$498.00/$491.00

$408.00

$23,241,307.00

0.010

1.009

Liberty Mutual Personal

Insurance Co

$5,784.00

$5356.00

$3385.00

$4101.00/$3843.00

$3913.00

$22,476,277.00

0.044

0.796

Coverages in an Auto Policy

Required by Utah Law

Bodily Injury Liability – Pays for injuries to another person for whom you may be found legally

responsible. Minimum limits are $25,000 per person / $65,000 per accident.

Property Damage Liability – Covers damages you cause to another person’s car or property. Minimum

limit is $15,000 per accident.

Personal Injury Protection (PIP) – Sometimes called “No-Fault” coverage. Provides benefits to all

persons injured in your auto, regardless of fault; including but not limited to, medical expenses, loss of

income and essential services. Pedestrians injured by an auto are also extended PIP benefits. Minimum limit

is $3,000 per person. Note, motorcycle policies do not have PIP coverage but can add medical payment

coverage.

Required by Law; but in writing may reject or select lower limits than your Bodily Injury limit

Uninsured Motorist Bodily Injury (UM) - Covers you and others in your automobile for bodily injury in

an accident caused primarily by a driver who does not have insurance or a hit and run. Minimum limit is

$25,000 per person / $65,000 per accident.

Underinsured Motorist Bodily Injury (UIM) – Provides protection to you and others in your motor vehicle

in an accident caused by an at-fault driver who does not have sufficient bodily injury liability limits to cover

the full amount of your loss. Minimum limit is $10,000 per person / $20,000 per accident.

Uninsured Motorist Property Damage (UM-PD) – Covers you for damage to your automobile in an

accident caused by a driver who does not have insurance. If you do not have collision coverage on your

policy, and you request this coverage the company is required to provide it. Maximum limit is $3,500 with a

$250 deductible.

Optional Coverages, but may be required if you have an auto Loan

Collision – Pays for damage to your car from a collision with another car or object or if it overturns.

Comprehensive (Other Than Collision) – Covers damage or loss to your car due to causes other than

collision. These include but are not limited to fire, hitting animals, windstorm, hail, vandalism, theft and

flood.

Other Optional Coverages

Towing - Reimburses you when your vehicle must be towed to a repair shop or other location

Rental Reimbursement – Pays the rental fee if you must rent a vehicle for a reasonable time while your

vehicle is being repaired.

Electronic Devices – These items, including cell phones are not covered under your standard auto policy.

There may be an endorsement to add coverage for these type items to your policy. These devices may be

covered by your homeowners policy.

The Department advises consumers to have an annual check-up with their insurance professionals.

If you have any questions or need additional information call the Insurance Department at 801-957- 9305 or Toll free

at 1-800-439-3805.