2021 Annual

Private Passenger Automobile & Homeowners

Insurance Comparison Tables

The comparison tables provide examples of four zip codes in Utah. The zip codes used in the comparison samples

are; 84660 – Spanish Fork, 84511 Blanding, 84642 Manti, 84335 - Smithfield. Look at the comparisons for the zip

code that is most similar to where you live. A comparison table of earthquake premium is located on page 7.

The insurance companies providing information for this comparison are the top 20 companies based on the highest

volume of homeowners and private passenger auto insurance premiums in Utah. This list is NOT A

"RECOMMENDATION" by the Insurance Department. Your insurance professional can provide you with a

premium quote to fit your circumstances. Consumers are cautioned that price is not the only factor to consider when

choosing an insurance company. You should also consider the service provided by the company and the agent, the

financial stability of the company, as well as the available coverages. Most insurers use their own credit criteria to

determine premium and eligibility. Your premium will also vary based on eligible credits and/or discounts,

surcharges, and additional coverages you select. Your insurance professional can advise you about additional

coverages, available credits and/or discounts for your situation. If you decide to change companies make sure the

coverage is the same or better. To avoid possible early cancellation charges, the best time to change companies is on

your renewal date. Check with your current company to determine potential additional amounts owed and early

cancellation charges.

Loss & Expense Ratios

In general terms, the loss ratio is, losses paid compared to premiums. The expense ratio is, administrative expense

compared to premiums. The combined loss and expense ratio is, losses paid combined with administrative expenses

compared to premiums. If the combined loss and expense ratio is more than 1.000 it means the company has paid out

more for claims and expenses than it collected in premiums. Example: a ratio of 1.150 means the company paid out

$1.15 for every $1.00 of premium received.

Complaint Ratio

By statute the Utah Insurance Department is required to calculate a complaint ratio for each company in the table.

Showing a ratio rather than the actual number of complaints levels the playing field between the companies.

Companies with a larger portion of the market are expected to have more complaints than companies with a smaller

amount of the market. Comparing the number of complaints is like comparing apples to oranges. The ratio gives a

comparison of apples to apples. The Department reviews complaints from consumers to determine whether there

was a violation of Utah Code or Rules. Complaints opened in 2020, determined to be valid, are used to calculate the

complaint ratio for each company. The ratio calculation is based on the valid complaints per $100,000 of earned

premium.

This is how a complaint ratio is calculated for a sample company with 10 complaints and $20,000,000 earned premium:

Step 1: 20,000,000/100,000 = 200

Step 2: 10 ÷ 200 = 0.0500 (complaint ratio per $100k earned premium, similar to ratios shown in the tables)

Reversing the formula shown will give the actual number of complaints for a company.

Step 1: 20,000,000/100,000 = 200

Step 2: 0.0500 x 200 = 10 (number of complaints calculated by reversing the formula) 1

2021

As required by law, the Utah Insurance Department has prepared this guide to auto

and homeowners insurance. This annual guide provides general information about

auto and homeowners insurance, and about some of the insurance companies that

write this coverage in Utah. It is hoped this will be helpful to you.

Taylorsville State Office Building

4315 S 2700 W STE 2300

Taylorsville, UT 84129

(801)957-9305

(800)439-3805 (toll free in Utah)

http://www.insurance.utah.gov

State of Utah

Insurance Department

Jonathan T. Pike

Commissioner

HOMEOWNERS INSURANCE

Homeowner premiums can vary according to the age of the home, location, condition and your credit information.

Eligibility requirements and premium for coverage may be determined by previous loss experience and age of the

dwelling. Other factors may also be considered.

Your home policy consists of these types of coverage: your home (dwelling), the contents, and your liability to

others. For more definitions of coverage types and optional coverages see page 6.

Our comparison table shows three types of homeowners policies:

1) Homeowner: the most common owner-occupied homeowners policy insuring the dwelling,

personal property and liability of the owner.

2) Renters: insuring the personal property and liability of tenants.

3) Condominium Unit Owner: insures personal property and liability of the unit owner. Coverage should

include the association’s insurance deductible for which the unit owner is responsible. [U.C.A. 57-8-43]

The examples included in this comparison assume that the dwelling is ten years old and located in a fire protection

class of one through six. Unless otherwise noted, the policy has a $1000 deductible. The personal liability limit is

$300,000. Medical payment limit is $1,000. Higher limits may be available through your insurance company.

The

Department of Insurance does not recommend limits of coverage.

No discounts or special coverages are included.

(The Insurance Department Does Not SET Homeowners Insurance Rates.)

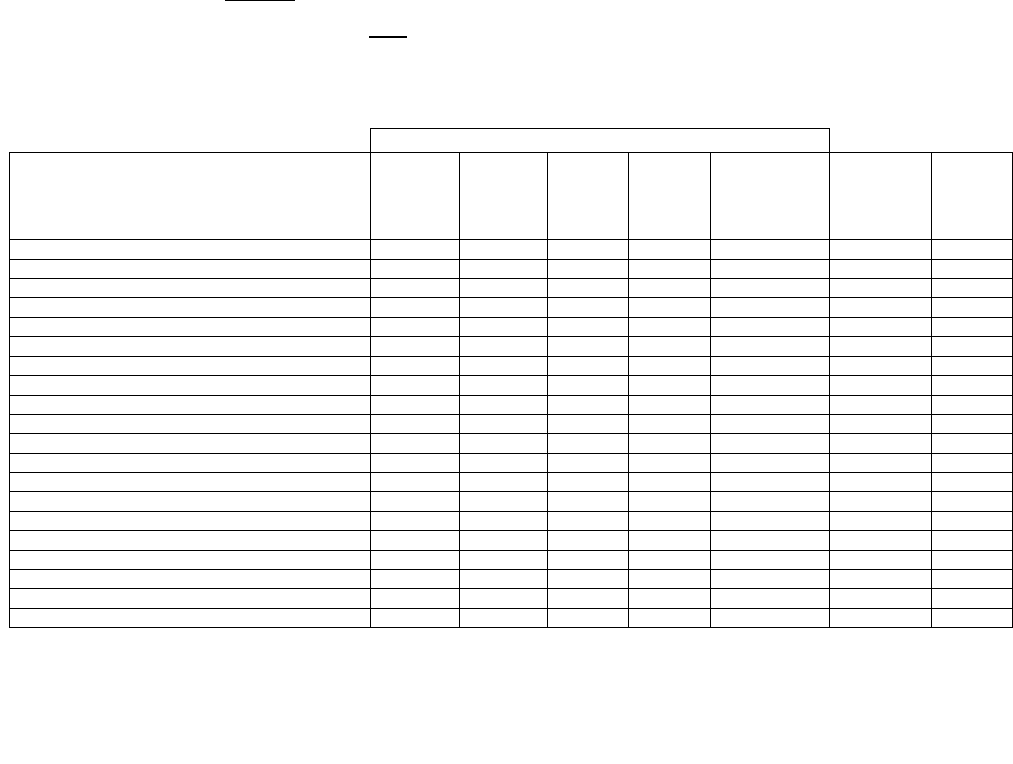

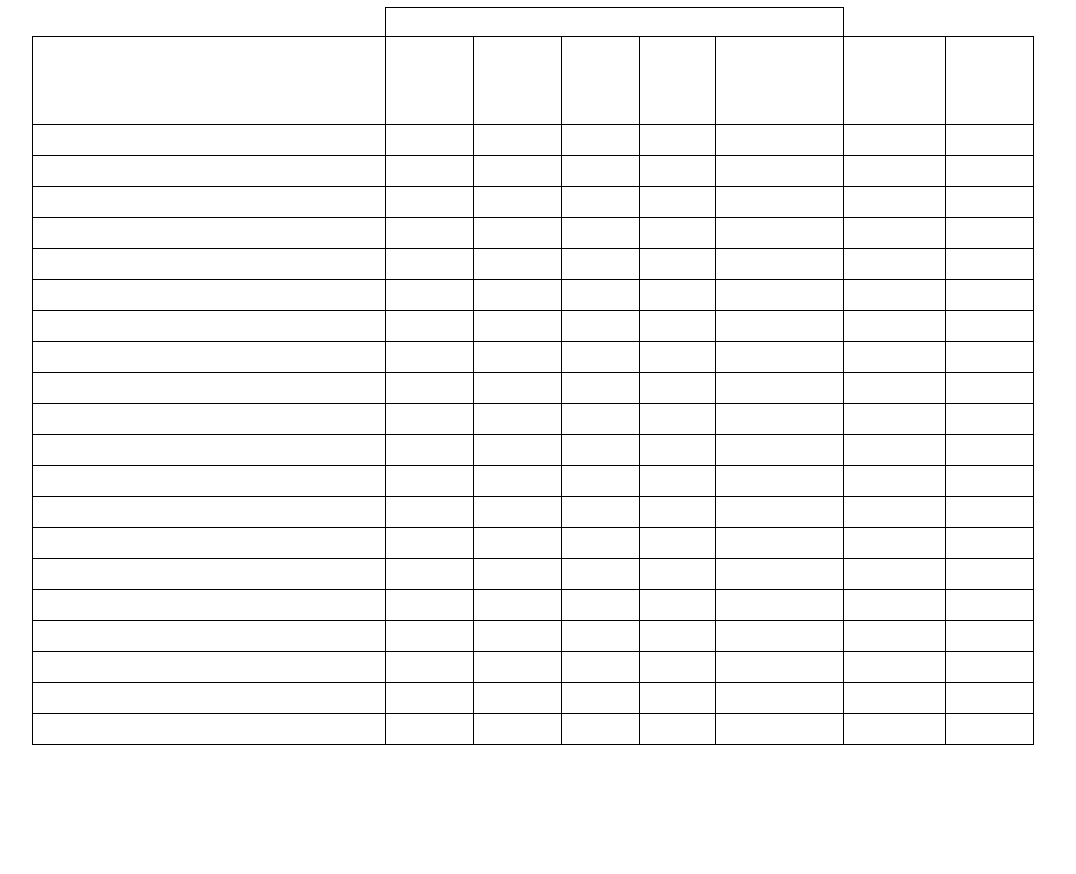

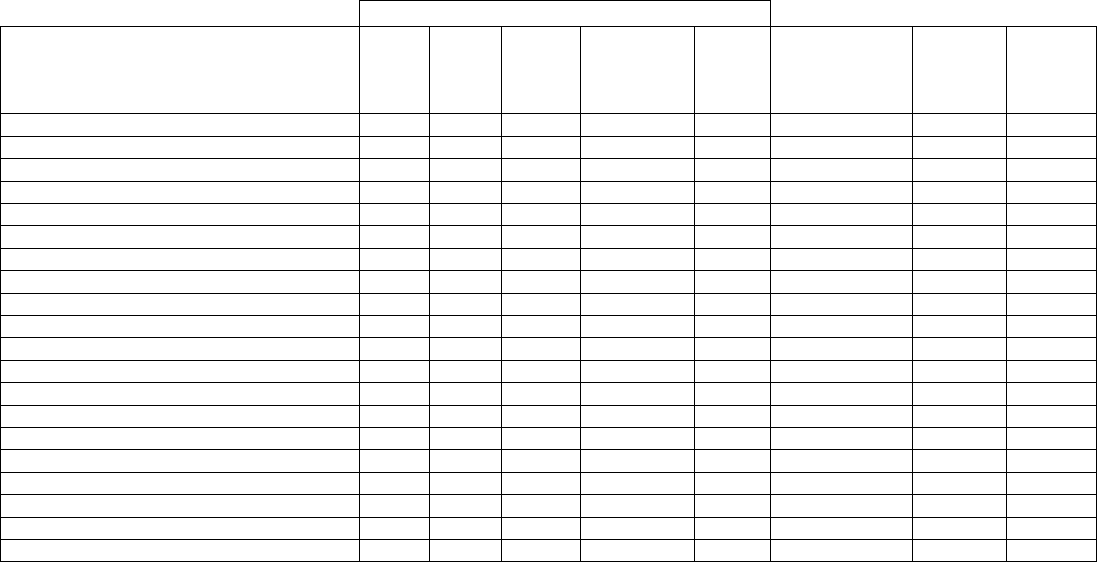

2021 Annual Homeowners Insurance Comparison Table

Zip Code 84660 Spanish Fork

Premium for 1-year policy (2021 rates)

Insurance Company

Home

$250,000

Brick

Home

$250,000

Frame

Renters

HO-4

Condo

Unit

HO-6

Earned

Premium

(Utah)

Complaint

Ratio per

100K of

Earned

Premium

#

Nat'l

Comb.

Loss &

Exp.

Ratio

State Farm Fire & Cas Co $729 $808 $177 $331 $104,220,547 0.000 0.971

Bear River Mut Ins Co 425 440 115 159 48,196,273 0.000 0.955

Farmers Ins Exch (a) 575 529 44,337,541 0.000 1.046

Auto Owners Ins Co 959 990 261 582 26,962,626 0.004 0.956

Allstate Vehicle & Prop Ins Co + 683 702 26,653,546 0.000 0.930

Fire Ins Exchange + 19,428,522 0.000 1.101

United Services Auto Assn 2,001 1,731 473 569 16,729,853 0.003 0.904

Allstate Prop & Cas Ins Co + 16,071,668 0.000 0.883

Liberty Mutual Personal Ins Co 1,047 1,039 473 712 5,780,207 0.034 0.628

USAA Cas Ins Co 2,185 1,913 457 512 14,937,337 0.002 0.846

Farm Bureau Property Casualty Ins Co (b) 1,117 1,124 250 204 14,453,934 0.007 1.019

CSE SafeGuard (c) 364 400 174 237 13,619,581 0.000 1.198

Safeco Insurance Co of America 819 852 111 154 13,140,076 0.008 0.755

Travelers Personal Ins Co 829 848 165 369 12,510,514 0.000 1.120

Allstate Indemnity Co + 174 240 11,539,184 0.009 0.933

American Family Mutual Ins co of SI 10,575,802 0.000 1.245

Pacific Indemnity Co (d) 305 479 10,305,534 0.000 1.201

Travelers Home & Marine Ins Co 846 864 153 501 9,356,542 0.000 0.944

CSAA Fire & Casualty Ins Co 813 839 139 435 8,838,992 0.000 0.989

Allstate Insurance Co + 8,227,628 0.000 0.760

A blank cell indicates this company is no longer writing this type of policy as new business, or has never written this type of

policy. An affiliated company may write it.

+ The companys does not offer earthquake insurance.

(a) This company no longer writes new business for HO 4 or HO 6

(b) Uses a lower other structures limits.

(c) Must qualify for the preferred homeowners program

(d) Only writes policies with coverage A of $750,000.00 or higher

2

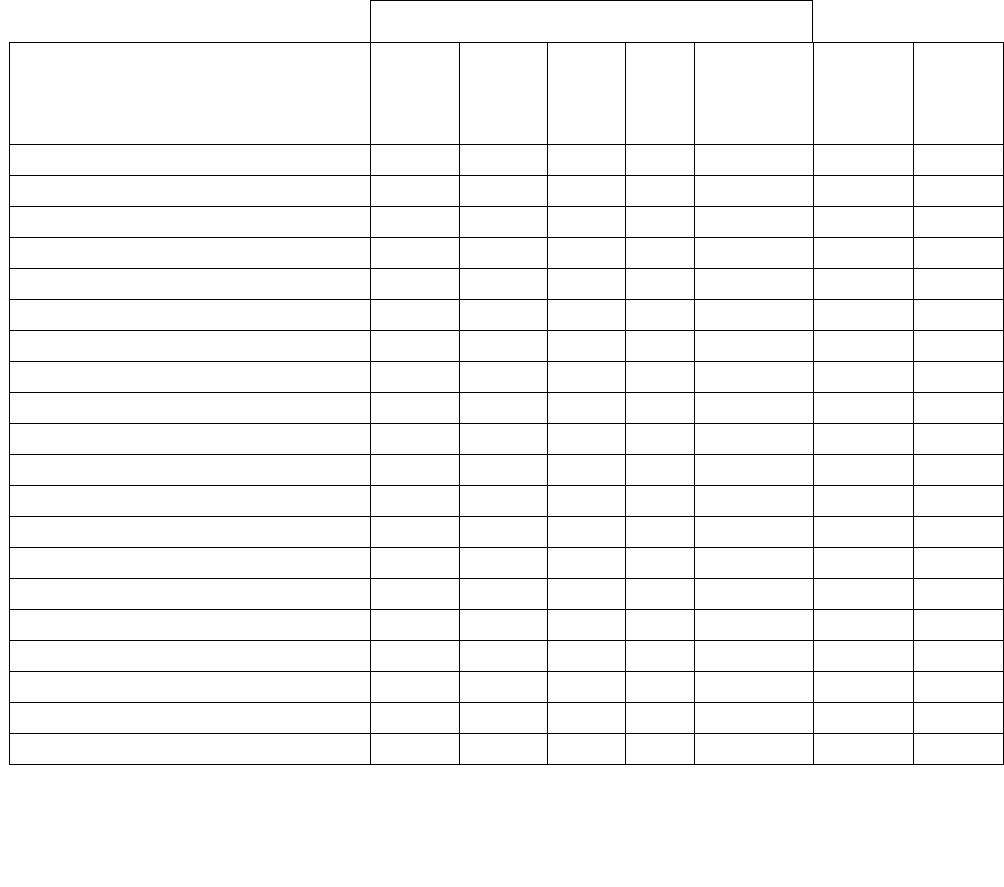

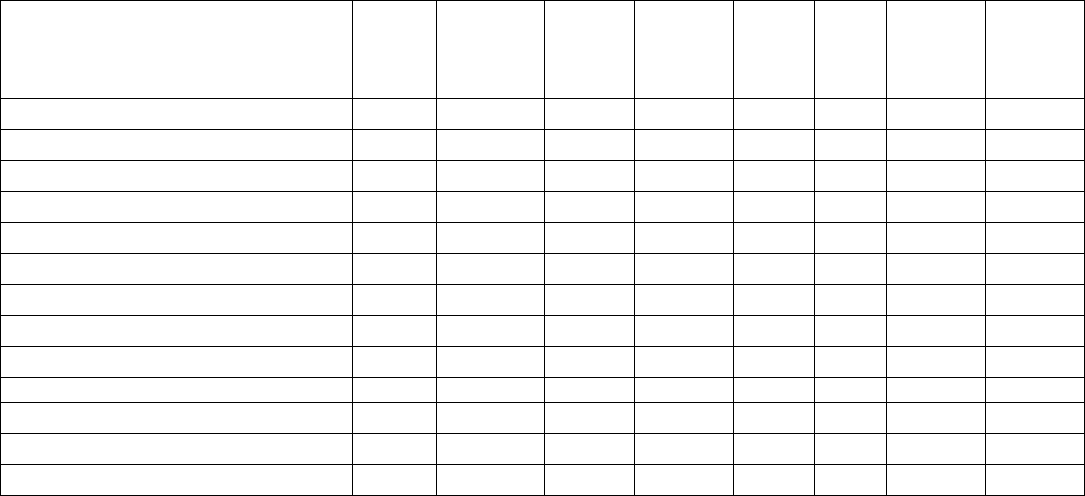

Homeowners Table (continued)

Zip Code 84511 Blandin

g

Premium for 1-year policy (2021

rates)

Insurance Company

Home

$250,000

Brick

Home

$250,000

Frame

Renters

HO-4

Condo

Unit

HO-6

Earned

Premium

(Utah)

Complaint

Ratio per

100K of

Earned

Premium

#

Nat'l

Comb.

Loss &

Exp.

Ratio

State Farm Fire & Cas Co

$931 $1,034 $167 $312 $104,220,547 0.000 0.971

Bear River Mut Ins Co

457 473 115 159 48,196,273 0.000 0.955

Farmers Ins Exch (a)

506 476 44,337,541 0.000 1.046

Auto Owners Ins Co

1,010 1,048 261 561 26,962,626 0.004 0.956

Allstate Vehicle & Prop Ins Co +

827 850 26,653,546 0.000 0.930

Fire Ins Exchange +

19,428,522 0.000 1.101

United Services Auto Assn

1,668 1,511 425 599 16,729,853 0.003 0.904

Allstate Prop & Cas Ins Co +

16,071,668 0.000 0.883

Liberty Mutual Personal Ins Co

1,049 1,039 427 625 5,780,207 0.034 0.628

USAA Cas Ins Co

1,841 1,684 409 545 14,937,337 0.002 0.846

Farm Bureau Property Casualty Ins Co (b)

1,135 1,146 267 209 14,453,934 0.007 1.019

CSE SafeGuard (c)

317 348 174 237 13,619,581 0.000 1.198

Safeco Insurance Co of America

935 977 142 202 13,140,076 0.008 0.755

Travelers Personal Insurance Co

869 906 168 312 12,510,514 0.000 1.120

Allstate Indemnity Co +

174 232 11,539,184 0.009 0.933

American Family Mutual Ins co of SI

10,575,802 0.000 1.245

Pacific Indemnity Co (d)

305 478 10,305,534 0.000 1.201

Travelers Home & Marine InsCo

1,051 1,220 148 547 9,356,542 0.000 0.944

CSAA Fire & Casualty Ins Co

872 901 141 405 8,838,992 0.000 0.989

Allstate Ins Co +

8,227,628 0.000 0.760

3

A blank cell indicates this company is no longer writing this type of policy as new business, or has never written this type of

policy. An affiliated company may write it.

+ The companys does not offer earthquake insurance.

(a) This company no longer writes new business for HO 4 or HO 6

(b) Uses a lower other structures limits.

(c) Must qualify for the preferred homeowners program

(d) Only writes policies with coverage A of $750,000.00 or higher

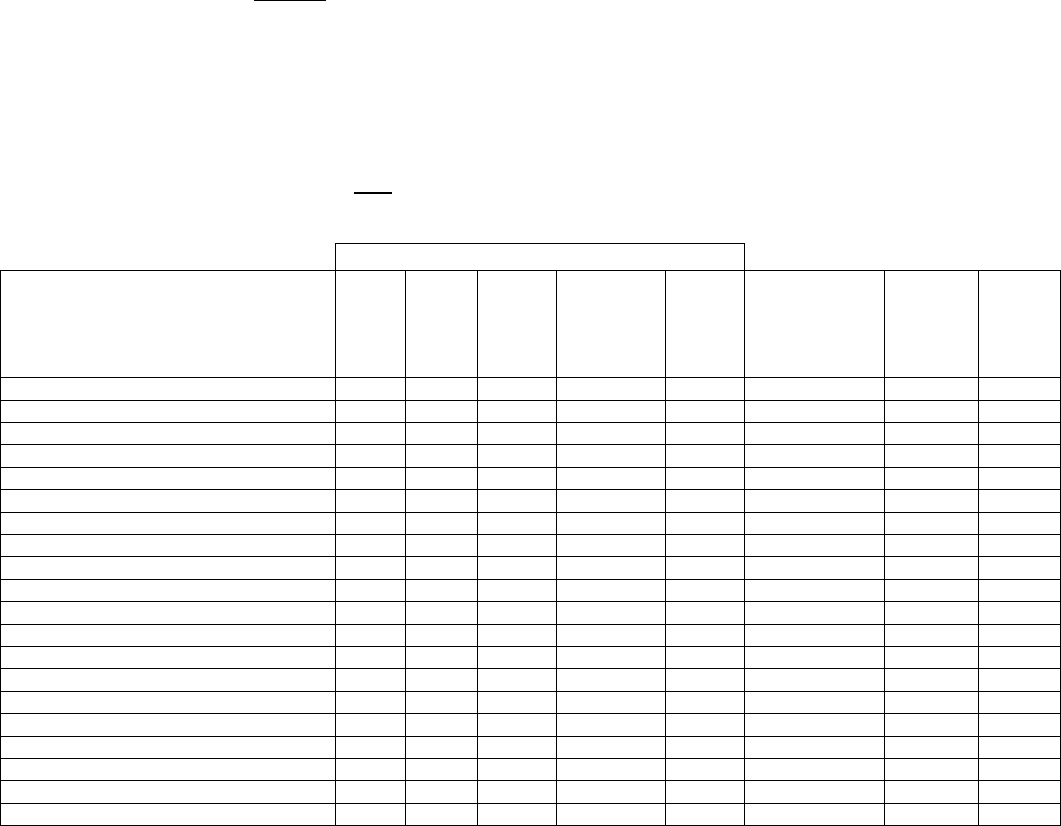

Homeowners Table (continued)

Zip Code 84642 Manti

Premium for 1-year policy (2021 rates)

Insurance Company

Home

$250,000

Brick

Home

$250,000

Frame

Renters

HO-4

Condo

Unit

HO-6

Earned

Premium

(Utah)

Complaint

Ratio per

100K of

Earned

Premium

#

Nat'l

Comb.

Loss &

Exp. Ratio

State Farm Fire & Cas Co

$826 $917 $167 $312 $104,220,547 0.000 0.971

Bear River Mut Ins Co

457 473 115 159 48,196,273 0.000 0.955

Farmers Ins Exch (a)

474 445 44,337,541 0.000 1.046

Auto Owners Ins Co

1,230 1,287 261 582 26,962,626 0.004 0.956

Allstate Vehicle & Prop Ins Co +

763 782 26,653,546 0.000 0.930

Fire Ins Exchange +

19,428,522 0.000 1.101

United Services Auto Assn

1,981 1,747 425 623 16,729,853 0.003 0.904

Allstate Prop & Cas Ins Co +

16,071,668 0.000 0.883

Liberty Mutual Personal Ins Co

1,094 1,085 427 625 5,780,207 0.034 0.628

USAA Cas Ins Co

2,189 1,954 409 563 14,937,337 0.002 0.846

Farm Bureau Property Casualty Ins Co (b)

1,053 1,062 249 195 14,453,934 0.007 1.019

CSE SafeGuard (c)

308 337 174 237 13,619,581 0.000 1.198

Safeco Ins Co of America

1,024 1,074 142 202 13,140,076 0.008 0.755

Travelers Personal Ins Co

906 935 157 232 12,510,514 0.000 1.120

Allstate Indemnity Co +

174 259 11,539,184 0.009 0.933

American Family Mutual Ins co of SI

10,575,802 0.000 1.245

Pacific Indemnity Co (d)

305 479 10,305,534 0.000 1.201

Travelers Home & Marine Ins Co

874 916 160 529 9,356,542 0.000 0.944

CSAA Fire & Casualty Ins Co

819 845 142 409 8,838,992 0.000 0.989

Allstate Ins Co +

8,227,628 0.000 0.760

4

A blank cell indicates this company is no longer writing this type of policy as new business, or has never written this type of

policy. An affiliated company may write it.

+ The companys does not offer earthquake insurance.

(a) This company no longer writes new business for HO 4 or HO 6

(b) Uses a lower other structures limits.

(c) Must qualify for the preferred homeowners program

(d) Only writes policies with coverage A of $750,000.00 or higher

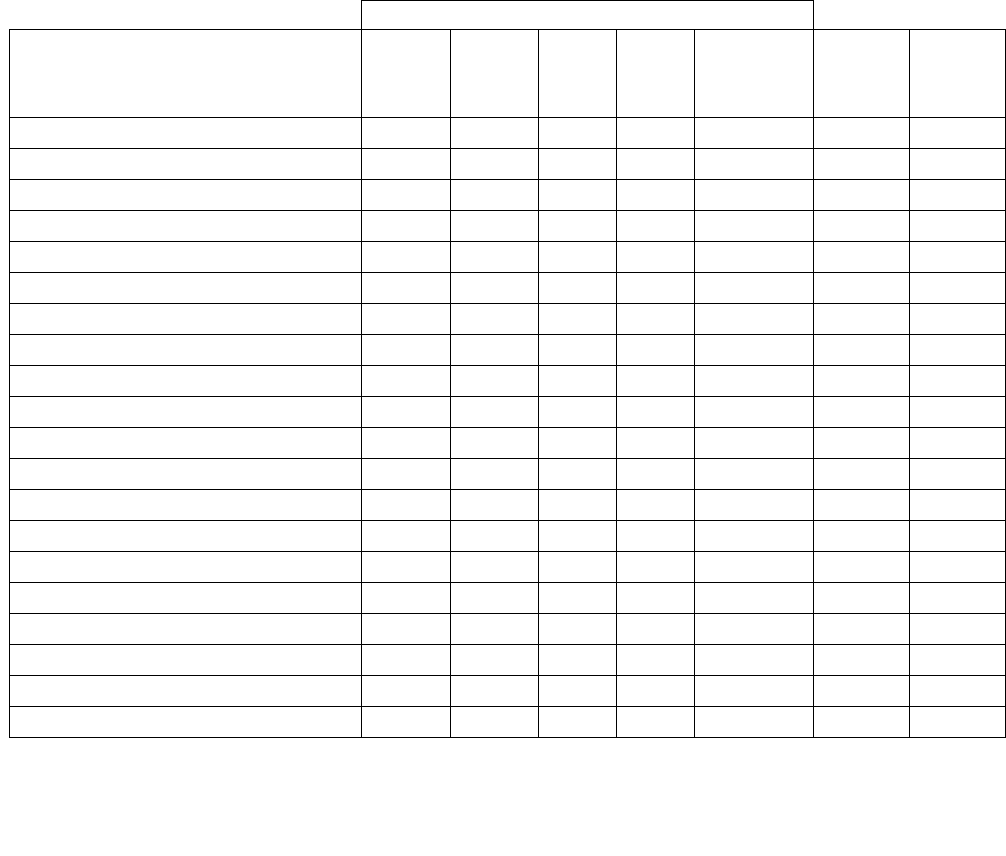

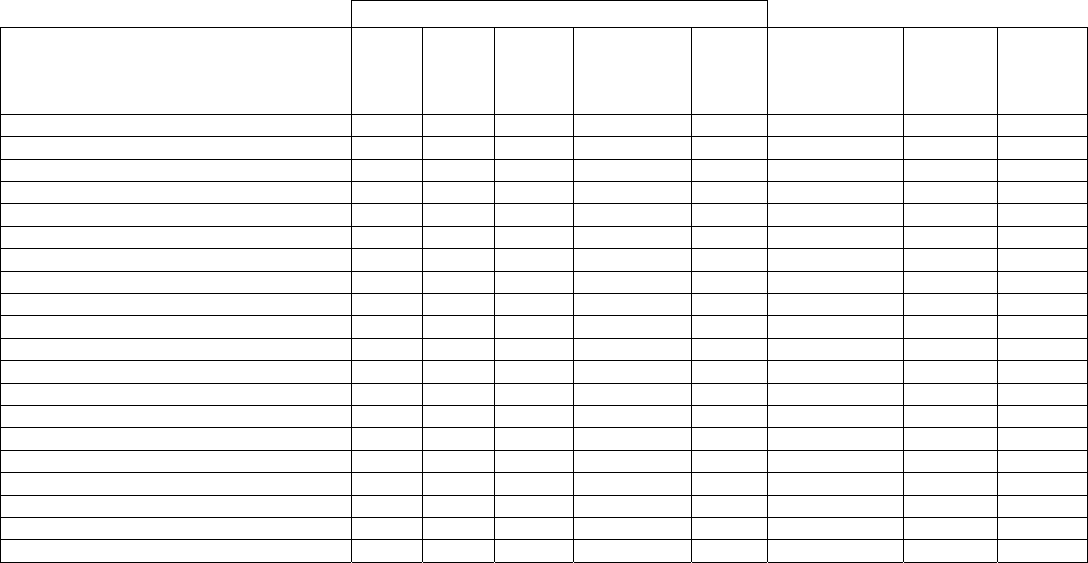

Homeowners Table (continued)

A blank cell indicates this company is no longer writing this type of policy as new business, or has never written this type of

policy. An affiliated company may write it.

+ The companys does not offer earthquake insurance.

(a) This company no longer writes new business for HO 4 or HO 6

(b) Uses a lower other structures limits.

(c) Must qualify for the preferred homeowners program

(d) Only writes policies with coverage A of $750,000.00 or higher

5

Zip Code 84335 Smithfield

Premium for 1-year policy (2021 rates)

Insurance Company

Home

$250,000

Brick

Home

$250,000

Frame

Renters

HO-4

Condo

Unit

HO-6

Earned

Premium

(Utah)

Complaint

Ratio per

100K of

Earned

Premium

#

Nat'l

Comb.

Loss &

Exp.

Ratio

State Farm Fire & Cas Co

$846 $939 $144 $315 $104,220,547 0.000 0.971

Bear River Mut Ins Co

457 473 115 159 48,196,273 0.000 0.955

Farmers Ins Exch (a)

543 509 44,337,541 0.000 1.046

Auto Owners Ins Co

1,028 1,068 261 582 26,962,626 0.004 0.956

Allstate Vehicle & Prop Ins Co +

670 689 26,653,546 0.000 0.930

Fire Ins Exchange +

19,428,522 0.000 1.101

United Services Auto Assn

1,768 1,565 419 557 16,729,853 0.003 0.904

Allstate Prop & Cas Ins Co +

16,071,668 0.000 0.883

Liberty Mutual Personal Ins Co

1,036 1,030 427 625 5,780,207 0.034 0.628

USAA Cas Ins Co

1,950 1,747 403 507 14,937,337 0.002 0.846

Farm Bureau Property Casualty Ins Co (b)

1,075 1,084 256 200 14,453,934 0.007 1.019

CSE SafeGuard (c)

349 382 174 237 13,619,581 0.000 1.198

Safeco Ins Co of America

816 848 111 141 13,140,076 0.008 0.755

Travelers Personal Ins Co

830 855 160 274 12,510,514 0.000 1.120

Allstate Indemnity Co +

174 232 11,539,184 0.009 0.933

American Family Mutual Ins co of SI

10,575,802 0.000 1.245

Pacific Indemnity Co (d)

305 479 10,305,534 0.000 1.201

Travelers Home & Marine Ins Co

865 889 136 495 9,356,542 0.000 0.944

CSAA Fire & Casualty Ins Co

769 791 140 402 8,838,992 0.000 0.989

Allstate Ins Co +

8,227,628 0.000 0.760

Common Coverages in a Homeowners Policy

Dwelling – Covers damage to your house and structures attached to your house. (Coverage A)*

Other Structures – Pays for damage to fences, sheds, unattached garages and other structures not attached to your

house. (Coverage B)*

Personal Property – Reimburses you for the value of your possessions, including furniture, electronics, appliances

and clothing, damaged or lost. They may be covered even when the items are not at your house. (Coverage C)*

Loss of Use – Covers your additional living expenses, above your normal costs, while your home is being repaired.

(Coverage D)*

Personal Liability – Covers your financial loss against a claim of lawsuit and found legally responsible for injuries

or damages to another person. (Coverage E)*

Medical Payments – Pays for medical bills for people hurt on your property or hurt by your pets. (Coverage F)*

*Indicates coverage name or reference used by many companies.

Optional Homeowners Coverage/Policies

Sewer Back Up – This is not covered under the standard policy. Sewer back up coverage can be added to your

policy by an endorsement.

Earthquake Coverage - The standard homeowners, condominium and renters policies will not cover earthquake

damage. Many companies will add this coverage as an endorsement with additional premium to your existing policy

or you may purchase it as a separate policy. If your company does not offer earthquake coverage you may get it

through another company. This coverage will have a separate deductible. The average rate per $1,000 in value

(based on a 10% deductible) is $4.37 for a brick dwelling and $1.85 for a frame dwelling, structure only. For more

information and an exact quote, contact your insurance professional. Earthquake covers landslide, but only if

triggered by the earthquake. See the next page for a comparison of earthquake premiums for the same home used in

our 2021 scenario.

Flood Insurance Policy – The standard homeowners, condominium and renters policies will not cover damage due

to flood. If you live in a designated flood zone you may be required to buy flood insurance. However, you may

consider buying a flood policy if your home could be flooded by an overflowing creek, melting snow or water

running down a steep hill, or unusual and rapid accumulation or runoff of surface waters from any source. You may

purchase a flood policy through your insurance professional or directly from the Federal Flood Insurance Program.

(www.floodsmart.gov) In most situations, there is a 30-day waiting period before coverage takes effect.

Difference in Conditions Policy - These policies provide catastrophe coverage not normally included in

homeowners policies. Earthquake, landslides and flood coverage are included in these policies. Contact your

insurance professional for information regarding this type of policy.

Landslide – Landslides are not covered by homeowner policies. Coverage cannot be added to your policy except as

noted above as a Difference in Conditions Policy or in an Earthquake endorsement or policy under specific

circumstances.

It is always important to understand the policy and the coverage it affords. The Department recommends you review

your insurance needs and the coverages available through various types of policies prior to purchase. We suggest you

review your policy when you receive it and ask your insurance professional questions about anything you do not

understand

.

The Department advises consumers to have an annual check-up with their insurance professional.

6

2021 Annual Earthquake Comparison Table

The following comparisons are earthquake premiums from companies included in the homeowner table that

offer earthquake insurance. The scenario is for a $250,000 home. The premium is based upon a 10%

deductible ($25,000) unless otherwise noted. For more information and an exact quote for your home

contact your insurance professional.

Insurance Company

Spanish

Fork

84660

Brick

Spanish

Fork 84660

Frame

Blanding

84511

Brick

Blanding

84511

Frame

Manti

84642

Brick

Manti

84642

Frame

Smithfield

84335

Brick

Smithfield

84335

Frame

State Farm Fire & Cas Co $406 $283 $313 $226 $396 $248 $406 $283

Bear River Mut Ins Co 426 426 426 426

Farmers Ins Exchange 1451 770 770 770

Auto-Owners Ins Co 3945 1744 1469 1192 4216 2032 4014 1822

United Services Auto Assoc 927 651 540 379 801 563 699 491

Liberty Mutual Personal Ins Co 5004 2103 5013 2103 5228 2196 4951 2085

USAA Casualty Ins Co 937 658 546 383 809 568 706 496

Farm Bureau Property & Casualty Ins Co (a) 2513 502 882 176 2513 502 2513 502

CSE Safeguard Insurance Co 250 180 212 180

Safeco Insurance Co of America 1555 1829 1009 1052 1241 1352 1230 1462

Travelers Personal Ins Co 548 209 116 70 199 75 548 209

American Family Mutual Ins Co (b) 1083 1086 967 969 1063 1065 1043 1046

Pacific Indemnity Co (c) 275 275 275 275 275 275 275 275

A blank cell indicates this company does not write this

type of policy as new business.

(a) This company uses a 5% deductible

(b) This company uses a 15% deductible

(c) Coverage only available with specific policy types

7

AUTOMOBILE INSURANCE

Auto insurance premium varies based on many factors, which may include the vehicle type, age, garaging location and

annual miles driven. The auto premium is also based on the driver's record, age, gender, credit information, home

ownership, and additional coverages selected. Additional factors considered in the premium rating include marital status,

how the car is used, longevity with the company and years without incidents. The number of autos in an area, traffic

congestion and average number of auto accidents in a particular location play an important role in premium

determinations. Premiums in metropolitan areas tend to be higher for these reasons. The following may help lower your

auto insurance premiums: drive safely, compare companies’ premiums, higher physical damage deductibles, insure all

vehicles under one policy, buy packaged policies, and look for possible discounts.

All licensed drivers who reside in the household need to be listed on the policy. Please check with your insurance

company regarding their requirements.

[U.C.A. 41-1a-1101(2)(a)] allows law enforcement officers to impound uninsured vehicles.

The vehicle used in our comparisons is 2019 Volkswagen Jetta. The examples listed in the auto comparison assume that

the driver has a clean driving record, mid-range credit information, and drives to work between 3 & 15 miles one way.

The Department of Insurance does not recommend limits of coverage. Check with the company for limits available that

will fit your circumstances. For more definitions of coverages see page 12 of this table.

Unless otherwise noted, the coverages quoted in our examples provide for the following limits of insurance:

Bodily Injury: $50,000 Per Person / $100,000 Per Accident / Property Damage: $50,000 Per Accident

Uninsured Motorist Bodily Injury: $50,000 Per Person / $100,000 Per Accident

Underinsured Motorist Bodily Injury: $50,000 Per Person / $100,000 Per Accident

Personal Injury Protection: $3,000

Optional Physical Damage limits are: Comprehensive: $500 deductible / Collision: $500 deductible

(The Insurance Department Does Not SET Automobile Insurance Rates.)

2021 Annual Auto Insurance Comparison Table

A blank cell indicates this company is no longer writing this type of policy as new business but an affiliated company may w

r

ite it.

* These companies consider writing non-standard insurance, primarily high risk drivers or special types of automobiles. The

other companies may have affiliated companies that may offer coverage for non-standard risks.

(a) This company only writes 12 month policies. The premium shown is for 12 months.

(b) This company only writes 12 month policies. The premium shown is for 6 months only

(c) Available to employer sponsored groups only.

8

Zip Code 84660 Spanish Fork Premium for 6-month polic

y

(

2021 rates

)

InsuranceCompany

Single

Male

Age 20

Single

Female

Age 20

Married

Couple

Age 39

Single

Male/Female

Age 39

Married

Couple

Age 66

Earned

Premiums

(UTAH)

Complaint

Ratio Per

100K of

Earned

Premium

#

Nat'l

Comb.

Loss &

Expense

Ratio

State Farm Mutual Automobile Ins Co $1,754 $1,417 $725 $725 $676 $296,235,301 0.000 0.971

Allstate Fire & Casualty Ins Co 1,505 1,205 702 731 / 780 701 202,326,246 0.000 0.884

GEICO Casualty Co * 1,325 1,260 528 568 / 650 491 191,700,297 0.002 0.910

Mid Century Ins Co 1,782 1,639 1,442 1289 / 1361 1,279 161,955,275 0.000 1.061

Bear River Mutual Ins Co 1,087 1,023 586 633 / 587 634 147,481,843 0.000 0.955

Progressive Direct Ins Co 1,330 1,173 595 588 / 637 534 75,056,413 0.037 0.840

Auto Owners Ins Co 1,716 1,443 721 720 733 67,874,867 0.000 0.956

Safeco Insurance Co of IL 1,492 1,425 668 796 / 795 619 56,217,646 0.016 0.787

Progressive Classic Ins Co 1,254 1,105 528 540 / 593 406 55,546,375 0.004 0.842

LM General Ins Co (a) 5,437 5,082 2,733 3067 / 2937 3,356 50,910,263 0.016 0.629

Progressive Advantage Ins Co 1,122 991 513 507 / 547 464 48,439,860 0.027 0.879

Farm Bureau Prop & Cas Ins Co (b) 2,039 1,939 1,158 1066 / 1195 1,117 47,346,972 0.000 1.019

Standard Fire Ins Co 1,648 1,404 674 772 / 748 727 45,543,973 0.000 0.912

USAA Casualty Ins Co 1,048 918 469 499 / 495 458 44,623,467 0.002 0.846

Progressive Preferred Ins Co 1,090 959 456 470 / 514 351 38,950,802 0.018 0.870

United Service Automobile Association 924 811 456 484 / 480 426 36,709,185 0.004 0.904

CSAA Fire & Casualty Ins Co 1,796 1,626 783 875 / 795 773 29,492,578 0.000 0.989

Farmers Group Property & Cas Ins Co (c) 2,151 1,920 675 835 / 811 632 24,179,081 0.012 0.882

Viking Ins Co of WI * 2,760 2,681 1,278 1512 / 1623 1,210 23,957,437 0.000 0.930

USAA General Indemnity Co 1026 968 547 582 / 571 537 23,550,200 0.002 0.845

Automobile Table (continued)

A blank cell indicates this company is no longer writing this type of policy as new business but an affiliated company may write it.

* These companies consider writing non-standard insurance, primarily high risk drivers or special types of automobiles. The

other companies may have affiliated companies that may offer coverage for non-standard risks.

(a) This company only writes 12 month policies. The premium shown is for 12 months.

(b) This company only writes 12 month policies. The premium shown is fo

r

6 months only

(c) Available to employer sponsored groups only.

9

Zip Code 84511 Blanding

Premium for 6-month polic

y

(

2021 rates

)

InsuranceCompany

Single

Male

Age 20

Single

Female

Age 20

Married

Couple

Age 39

Single

Male/Female

Age 39

Married

Couple

Age 66

Earned

Premiums

(UTAH)

Complaint

Ratio Per

100K of

Earned

Premium

#

Nat'l

Comb.

Loss &

Expense

Ratio

State Farm Mutual Automobile Ins Co $1,449 $1,166 $619 $619 $568 $296,235,301 0.000 0.971

Allstate Fire & Casualty Ins Co 1,266 1,032 627 654 / 685 602 202,326,246 0.000 0.884

GEICO Casualty Co * 1,273 1,207 519 564 / 636 469 191,700,297 0.002 0.910

Mid Century Ins Co 1,584 1,458 1,300 1164 / 1228 1,154 161,955,275 0.000 1.061

Bear River Mutual Ins Co 1,013 954 591 628 / 588 614 147,481,843 0.000 0.955

Progressive Direct Ins Co 1,145 1,001 543 557 / 586 482 75,056,413 0.037 0.840

Auto Owners Ins Co 1,454 1,216 646 644 640 67,874,867 0.000 0.956

Safeco Insurance Co of IL 1,242 1,190 591 696 / 695 547 56,217,646 0.016 0.787

Progressive Classic Ins Co 1,045 915 458 485 / 515 352 55,546,375 0.004 0.842

LM General Ins Co (a) 6,031 5,505 2,794 3178 / 2974 3,275 50,910,263 0.016 0.629

Progressive Advantage Ins Co 980 859 475 490 / 512 427 48,439,860 0.027 0.879

Farm Bureau Prop & Cas Ins Co (b) 1,746 1,628 1,042 967 / 1086 998 47,346,972 0.000 1.019

Standard Fire Ins Co 1,273 1,106 533 612 / 594 567 45,543,973 0.000 0.912

USAA Casualty Ins Co 918 809 426 453 / 448 407 44,623,467 0.002 0.846

Progressive Preferred Ins Co 915 798 398 425 / 448 307 38,950,802 0.018 0.870

United Service Automobile Association 802 709 410 435 / 430 376 36,709,185 0.004 0.904

CSAA Fire & Casualty Ins Co 1,600 1,451 741 822 / 746 714 29,492,578 0.000 0.989

Farmers Group Property & Cas Ins Co (c) 2,072 1,834 661 827 / 791 604 24,179,081 0.012 0.882

Viking Ins Co of WI * 1,991 1,940 983 1157 / 1247 877 23,957,437 0.000 0.930

USAA General Indemnity Co 903 848 492 524 / 510 475 23,550,200 0.002 0.845

Automobile Table (continued)

A blank cell indicates this company is no longer writing this type of policy as new business but an affiliated company may w

r

ite it.

* These companies consider writing non-standard insurance, primarily high risk drivers or special types of automobiles. The other

companies may have affiliated companies that may offer coverage for non-standard risks.

(a) This company only writes 12 month policies. The premium shown is for 12 months.

(b) This company only writes 12 month policies. The premium shown is for 6 months only

(c) Available to employer sponsored groups only.

0

Zip Code 84642 Manti Premium for 6-month polic

y

(

2021 rates

)

InsuranceCompany

Single

Male

Age 20

Single

Female

Age 20

Married

Couple

Age 39

Single

Male/Female

Age 39

Married

Couple

Age 66

Earned Premiums

(UTAH)

Complaint

Ratio Per

100K of

Earned

Premium

#

Nat'l

Comb.

Loss &

Expense

Ratio

State Farm Mutual Automobile Ins Co $1,594 $1,282 $679 $679 $623 $296,235,301 0.000 0.971

Allstate Fire & Casualty Ins Co 1,264 1,028 623 651 / 682 598 202,326,246 0.000 0.884

GEICO Casualty Co * 1,273 1,207 519 564 / 636 469 191,700,297 0.002 0.910

Mid Century Ins Co 1,565 1,606 1,403 1088 / 1145 1,072 161,955,275 0.000 1.061

Bear River Mutual Ins Co 983 929 580 615 / 576 601 147,481,843 0.000 0.955

Progressive Direct Ins Co 1,213 1,068 580 588 / 626 512 75,056,413 0.037 0.840

Auto Owners Ins Co 1,554 1,298 685 683 678 67,874,867 0.000 0.956

Safeco Insurance Co of IL 1,359 1,299 668 788 / 781 607 56,217,646 0.016 0.787

Progressive Classic Ins Co 1,169 1,030 523 542 / 586 399 55,546,375 0.004 0.842

LM General Ins Co (a) 5,225 4,823 2,551 2870 / 2718 3,000 50,910,263 0.016 0.629

Progressive Advantage Ins Co 1,036 913 506 513 / 543 450 48,439,860 0.027 0.879

Farm Bureau Prop & Cas Ins Co (b) 1,868 1,773 1,125 1043 / 1172 1,078 47,346,972 0.000 1.019

Standard Fire Ins Co 1,384 1,193 584 667 / 649 622 45,543,973 0.000 0.912

USAA Casualty Ins Co 950 836 437 465 / 460 420 44,623,467 0.002 0.846

Progressive Preferred Ins Co 1,021 899 453 471 / 509 347 38,950,802 0.018 0.870

United Service Automobile Association 853 753 432 460 / 455 397 36,709,185 0.004 0.904

CSAA Fire & Casualty Ins Co 1,612 1,459 744 828 / 751 716 29,492,578 0.000 0.989

Farmers Group Property & Cas Ins Co (c) 2,202 1,946 706 885 / 843 643 24,179,081 0.012 0.882

Viking Ins Co of WI * 2,291 2,231 1,112 1311 / 1409 1,009 23,957,437 0.000 0.930

USAA General Indemnity Co 935 879 506 540 / 527 490 23,550,200 0.002 0.845

Automobile Table (continued)

A blank cell indicates this company is no longer writing this type of policy as new business but an affiliated company may write it.

* These companies consider writing non-standard insurance, primarily high risk drivers or special types of automobiles. The other

companies may have affiliated companies that may offer coverage for non-standard risks.

(a) This company only writes 12 month policies. The premium shown is for 12 months.

(b) This company only writes 12 month policies. The premium shown is for 6 months only

(c) Available to employer sponsored groups only.

11

Zip Code 84335 Smithfield Premium for 6-month polic

y

(

2021 rates

)

InsuranceCompany

Single

Male

Age 20

Single

Female

Age 20

Married

Couple

Age 39

Single

Male/Female

Age 39

Married

Couple

Age 66

Earned

Premiums

(UTAH)

Complaint

Ratio Per

100K of

Earned

Premium

#

Nat'l

Comb.

Loss &

Expense

Ratio

State Farm Mutual Automobile Ins Co $1,567 $1,262 $652 $652 $605 $296,235,301 0.000 0.971

Allstate Fire & Casualty Ins Co 1,263 1,021 607 631 / 670 600 202,326,246 0.000 0.884

GEICO Casualty Co * 1,150 1,093 465 501 / 571 431 191,700,297 0.002 0.910

Mid Century Ins Co 1,577 1,451 1,268 1140 / 1199 1,121 161,955,275 0.000 1.061

Bear River Mutual Ins Co 965 908 544 583 / 543 579 147,481,843 0.000 0.955

Progressive Direct Ins Co 1,159 1,019 529 528 / 565 476 75,056,413 0.037 0.840

Auto Owners Ins Co 1,470 1,233 635 633 637 67,874,867 0.000 0.956

Safeco Insurance Co of IL 1,344 1,284 633 750 / 746 580 56,217,646 0.016 0.787

Progressive Classic Ins Co 1,075 941 452 470 / 508 358 55,546,375 0.004 0.842

LM General Ins Co (a) 4,978 4,657 2,546 2837 / 2723 3,089 50,910,263 0.016 0.629

Progressive Advantage Ins Co 985 865 461 461 / 490 419 48,439,860 0.027 0.879

Farm Bureau Prop & Cas Ins Co (b) 1,782 1,694 1,028 948 / 1064 990 47,346,972 0.000 1.019

Standard Fire Ins Co 1,434 1,228 597 682 / 663 642 45,543,973 0.000 0.912

USAA Casualty Ins Co 917 805 419 445 / 441 406 44,623,467 0.002 0.846

Progressive Preferred Ins Co 937 822 393 409 / 441 302 38,950,802 0.018 0.870

United Service Automobile Association 819 721 412 438 / 433 383 36,709,185 0.004 0.904

CSAA Fire & Casualty Ins Co 1,586 1,436 723 802 / 729 704 29,492,578 0.000 0.989

Farmers Group Property & Cas Ins Co (c) 2,029 1,805 640 791 / 761 592 24,179,081 0.012 0.882

Viking Ins Co of WI * 2,173 2,115 1,025 1209 / 1305 955 23,957,437 0.000 0.930

USAA General Indemnity Co 899 846 485 516 / 505 473 23,550,200 0.002 0.845

Coverages in an Auto Policy

Required by Utah Law

Bodily Injury Liability – Pays for injuries to another person for whom you may be found legally

responsible. Minimum limits are $25,000 per person / $65,000 per accident.

Property Damage Liability – Covers damages you cause to another person’s car or property. Minimum

limit is $15,000 per accident.

Personal Injury Protection (PIP) – Sometimes called “No-Fault” coverage. Provides benefits to all

persons injured in your auto, regardless of fault; including but not limited to, medical expenses, loss of

income and essential services. Pedestrians injured by an auto are also extended PIP benefits. Minimum limit

is $3,000 per person. Note, motorcycle policies do not have PIP coverage but can add medical payment

coverage.

Required by Law; but in writing may reject or select lower limits than your Bodily Injury limit

Uninsured Motorist Bodily Injury (UM) - Covers you and others in your automobile for bodily injury in

an accident caused primarily by a driver who does not have insurance or a hit and run. Minimum limit is

$25,000 per person / $65,000 per accident.

Underinsured Motorist Bodily Injury (UIM) – Provides protection to you and others in your motor vehicle

in an accident caused by an at-fault driver who does not have sufficient bodily injury liability limits to cover

the full amount of your loss. Minimum limit is $10,000 per person / $20,000 per accident.

Uninsured Motorist Property Damage (UM-PD) – Covers you for damage to your automobile in an

accident caused by a driver who does not have insurance. If you do not have collision coverage on your

policy, and you request this coverage the company is required to provide it. Maximum limit is $3,500 with a

$250 deductible.

Optional Coverages, but may be required if you have an auto Loan

Collision – Pays for damage to your car from a collision with another car or object or if it overturns.

Comprehensive (Other Than Collision) – Covers damage or loss to your car due to causes other than

collision. These include but are not limited to fire, hitting animals, windstorm, hail, vandalism, theft and

flood.

Other Optional Coverages

Towing - Reimburses you when your vehicle must be towed to a repair shop or other location

Rental Reimbursement – Pays the rental fee if you must rent a vehicle for a reasonable time while your

vehicle is being repaired.

Electronic Devices – These items, including cell phones are not covered under your standard auto policy.

There may be an endorsement to add coverage for these type items to your policy. These devices may be

covered by your homeowners policy.

The Department advises consumers to have an annual check-up with their insurance professionals.

If you have any questions or need additional information call the Insurance Department at 801-538-3800 or Toll free

at 1-800-439-3805.

12