John C. Calhoun Community College

Financial Statements

September 30, 2022

Snead State Community College

Table of Contents

September 30, 2022

PART I FINANCIAL STATEMENTS ....................................................................................... PAGE

Independent Auditor’s Report ..................................................................................................... 1

Management’s Discussion and Analysis ..................................................................................... 4

Statement of Net Position ............................................................................................................ 13

Statement of Financial Position – Discretely Presented Component Unit .................................. 15

Statement of Revenues, Expenses and Changes in Net Position ................................................. 16

Statement of Activities – Discretely Presented Component Unit ................................................ 17

Statement of Cash Flows ............................................................................................................. 18

Notes to the Financial Statements ............................................................................................... 20

Required Supplementary Information

Schedule of Proportionate Share of the Net Pension Liability ................................................. 54

Schedule of Pension Contributions .......................................................................................... 55

Schedule of Proportionate Share of the Net OPEB Liability ................................................... 56

Schedule of OPEB Contributions ............................................................................................. 57

Notes to Required Supplementary Information ....................................................................... 58

Listing of College Officials ...................................................................................................... 60

PART II REPORTS ON COMPLIANCE AND INTERNAL CONTROL

Independent Auditor’s Report on Internal Control over Financial Reporting and on

Compliance and Other Matters Based on an Audit of Financial Statements

Performed in Accordance with Government Auditing Standards. ............................................ 61

Independent Auditor’s Report on Compliance for Each Major Program and on

Internal Control Over Compliance Required by the Uniform Guidance .................................. 63

PART III SCHEDULES OF EXPENDITURES OF FEDERAL AWARDS

Schedule of Expenditures of Federal Awards

Year Ended September 30, 2022 .............................................................................................. 66

Notes to the Schedule of Expenditures of Federal Awards ......................................................... 69

PART IV SCHEDULES OF FINDINGS AND QUESTIONED COSTS

Section I – Summary of Auditor’s Results .................................................................................. 70

Section II – Financial Statement Findings ................................................................................... 70

Section III – Federal Award Findings and Questioned Costs

Year Ended September 30, 2022 ........................................................................ 70

Schedule of Prior Year Findings and Questioned Costs .............................................................. 71

PART I

FINANCIAL STATEMENTS

213 SOUTH HOUSTON STREET • ATHENS, AL 35611 • 256-232-2260 • 855-891-0070 • FAX 256-232-1881• www.mjcpa.com

Members of The American Institute of Certified Public Accountants

Independent Auditor’s Report

Jimmy Baker, Chancellor – Alabama Community College System

Dr. Jimmy Hodges, President – John C. Calhoun Community College

Opinion

We have audited the accompanying financial statements of John C. Calhoun Community College

(the “College”), a component unit of the State of Alabama, and its discretely presented

component unit, Calhoun College Foundation, Inc. (“the Foundation”), as of and for the year

ended September 30, 2022, and the related notes to the financial statements, which collectively

comprise the College’s basic financial statements, as listed in the table of contents.

In our opinion, based on our audit and the report of the other auditors, the financial statements

referred to above present fairly, in all material respects, the financial position of the College as of

September 30, 2022, and the changes in financial position and cash flows thereof, for the year then

ended in accordance with accounting principles generally accepted in the United States of

America.

We did not audit the financial statements of the Foundation, which represent 100% of the assets,

net position, and revenues of the discretely presented component unit as of June 30, 2022. Those

statements were audited by other auditors whose report has been furnished to us, and our opinion,

insofar as it relates to the amounts included for Calhoun College Foundation, Inc., is based solely

on the report of the other auditors.

Basis for Opinions

We conducted our audit in accordance with auditing standards generally accepted in the United

States of America (GAAS) and the standards applicable to financial audits contained in

Government Auditing Standards,

issued by the Comptroller General of the United States. Our

responsibilities under those standards are further described in the Auditor’s Responsibilities for

the Audit of the Financial Statements section of our report. The financial statements of the

Foundation were not audited in accordance with Government Auditing Standards. We are required

to be independent of the College and to meet our other ethical responsibilities, in accordance with

the relevant ethical requirements relating to our audit. We believe that the audit evidence we have

obtained is sufficient and appropriate to provide a basis for our audit opinions.

Change in Accounting Principle

As discussed in Note 1, the College implemented GASB 87 Leases during the year ended

September 30, 2022. Our opinion is not modified with respect to these matters.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in

accordance with accounting principles generally accepted in the United States of America, and for

the design, implementation, and maintenance of internal control relevant to the preparation and

fair presentation of financial statements that are free from material misstatement, whether due to

fraud or error.

2

In preparing the financial statements, management is required to evaluate whether there are

conditions or events, considered in the aggregate, that raise substantial doubt about the College’s

ability to continue as a going concern for twelve months beyond the financial statement date,

including any currently known information that may raise substantial doubt shortly thereafter.

Auditor’s Responsibility for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole

are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report

that includes our opinions. Reasonable assurance is a high level of assurance but is not absolute

assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS and

Government Auditing Standards will always detect a material misstatement when it exists. The

risk of not detecting a material misstatement resulting from fraud is higher than for one resulting

from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or

the override of internal control. Misstatements are considered material if there is a substantial

likelihood that, individually or in the aggregate, they would influence the judgment made by a

reasonable user based on the financial statements.

In performing an audit in accordance with GAAS and Government Auditing Standards, we:

• Exercise professional judgment and maintain professional skepticism throughout the audit.

• Identify and assess the risks of material misstatement of the financial statements, whether

due to fraud or error, and design and perform audit procedures responsive to those risks. Such

procedures include examining, on a test basis, evidence regarding the amounts and disclosures

in the financial statements.

• Obtain an understanding of internal control relevant to the audit in order to design audit

procedures that are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the College’s internal control. Accordingly, no such opinion is

expressed.

• Evaluate the appropriateness of accounting policies used and the reasonableness of

significant accounting estimates made by management, as well as evaluate the overall

presentation of the financial statements.

• Conclude whether, in our judgment, there are conditions or events, considered in the

aggregate, that raise substantial doubt about the College’s ability to continue as a going concern

for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other

matters, the planned scope and timing of the audit, significant audit findings, and certain internal

control–related matters that we identified during the audit.

Required Supplementary Information

Accounting principles generally accepted in the United States of America require that the

management’s discussion and analysis, the schedule of proportionate share of the net pension

liability, the schedule of pension contributions, the schedule of proportionate share of the net

OPEB liability, and the schedule of OPEB contributions, as listed in the table of contents, be

presented to supplement the basic financial statements. Such information is the responsibility of

management and, although not a part of the basic financial statements, is required by the

Governmental Accounting Standards Board who considers it to be an essential part of financial

reporting for placing the basic financial statements in an appropriate operational, economic, or

historical context. We have applied certain limited procedures to the required supplementary

information in accordance with GAAS, which consisted of inquiries of management about the

3

methods of preparing the information and comparing the information for consistency with

management’s responses to our inquiries, the basic financial statements, and other knowledge we

obtained during our audit of the basic financial statements. We do not express an opinion or

provide any assurance on the information because the limited procedures do not provide us with

sufficient evidence to express an opinion or provide any assurance.

Supplementary Information

Our audit was conducted for the purpose of forming opinions on the financial statements that

collectively comprise the College’s basic financial statements. The schedule of expenditures of

federal awards as required by Title 2 U.S. Code of Federal Regulations (CFR) Part 200, Uniform

Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards is

presented for purposes of additional analysis and is not a required part of the basic financial

statements. Such information is the responsibility of management and was derived from and relates

directly to the underlying accounting and other records used to prepare the basic financial

statements. The information has been subjected to the auditing procedures applied in the audit of

the basic financial statements and certain additional procedures, including comparing and

reconciling such information directly to the underlying accounting and other records used to

prepare the basic financial statements or to the basic financial statements themselves, and other

additional procedures in accordance with GAAS. In our opinion, the schedule of expenditures of

federal awards is fairly stated, in all material respects, in relation to the basic financial statements

as a whole.

Other Information

Management is responsible for the other information included in the report. The other information

comprises the listing of College Officials, as listed in the table of contents, but does not include

the basic financial statements and our auditor’s report thereon. Our opinion on the basic financial

statements does not cover the other information, and we do not express an opinion or any form of

assurance thereon.

In connection with our audit of the basic financial statements, our responsibility is to read the other

information and consider whether a material inconsistency exists between the other information

and the basic financial statements, or the other information otherwise appears to be materially

misstated. If, based on the work performed, we conclude that an uncorrected material misstatement

of the other information exists, we are required to describe it in our report.

Other Reporting Required by Government Auditing Standards

In accordance with Government Auditing Standards, we have also issued our report dated January

17, 2023 on our consideration of the College’s internal control over financial reporting and on our

tests of its compliance with certain provisions of laws, regulations, contracts, and grant agreements

and other matters. The purpose of that report is solely to describe the scope of our testing of internal

control over financial reporting and compliance and the results of that testing, and not to provide

an opinion on the effectiveness of the College’s internal control over financial reporting or on

compliance. That report is an integral part of an audit performed in accordance with Government

Auditing Standards in considering the College’s internal control over financial reporting and

compliance.

Athens, AL

January 17, 2023

John C. Calhoun Community College

Management’s Discussion and Analysis

September 30, 2022

4

Overview of the Financial Statements and Financial Analysis

This section of John C. Calhoun Community College’s Annual Financial Report represents

management’s discussion and analysis of the College’s financial activity during the fiscal years

ended September 30, 2021, and September 30, 2022. There are three financial statements

presented: the Statement of Net Position; the Statement of Revenues, Expenses, and Changes in

Net Position; and the Statement of Cash Flows.

Statement of Net Position

The Statement of Net Position presents the assets, deferred outflow of resources, liabilities,

deferred inflow of resources, and net position of the College. The Statement of Net Position is a

point of time financial statement. The purpose of the Statement of Net Position is to present to

the readers of the financial statements a fiscal snapshot of John C. Calhoun Community College.

The Statement of Net Position presents end-of-year data concerning Assets (current and non-

current), Deferred Outflow of Resources, Liabilities (current and non-current), Deferred Inflow of

Resources, and Net Position (Assets and Deferred Outflow of Resources minus Liabilities and

Deferred Inflows of Resources). The difference between current and non-current assets will be

discussed in the financial statement disclosures.

From the data presented, readers of the Statement of Net Position are able to determine the

assets available to continue the operations of the institution. They are also able to determine

how much the institution owes vendors, investors, and lending institutions. Finally, the

Statement of Net Position provides a picture of the net position (assets minus liabilities) and their

availability for expenditure by the institution.

Net position is divided into three major categories. The first category, invested in capital assets,

net of debt, provides the institution’s equity in property, plant and equipment owned by the

institution. The next asset category is restricted net position, which is divided into two

categories, non-expendable and expendable. The corpus of non-expendable restricted resources

is only available for investment purposes. Expendable restricted net position is available for

expenditure by the institution but must be spent for purposes as determined by donors and/or

external entities that have placed time or purpose restrictions on the use of the assets. The final

category is unrestricted net position which is available to the institution for any appropriate

purpose of the institution.

John C. Calhoun Community College

Management’s Discussion and Analysis

September 30, 2022

5

This schedule is prepared from the College’s statement of net position which is presented on an accrual basis of

accounting whereby assets are capitalized and depreciated.

Assets

Current assets consist of cash and cash equivalents, short term investments, accounts receivable,

deposits with bond trustees, and other current assets. Total assets increased $10.7 million,

consisting of $2.5 million from current assets and $8.2 million from noncurrent assets. The

largest increase in assets was Building & Alterations, $14.49 million, mainly due to the completion

of the Huntsville Wall & Roof Project in 2022. The largest decrease in assets was $8.4 million in

Construction in Progress, again due to projects completing and transferring the capitalized

Building account. Another significant decrease in assets came from a reduced Deposit with

Trustee balance of $1.67 million, down from $3.5 million in the previous year. Overall accounts

receivable increased by $1.35 million, mainly due to a $1.7 million PSCA reimbursement due at

year end for construction related costs for the Alabama Center for the Arts Student Housing.

Investment securities of $4.7 million were purchased in the fiscal year 2022 due to improved

interest rate returns compared to the previous year.

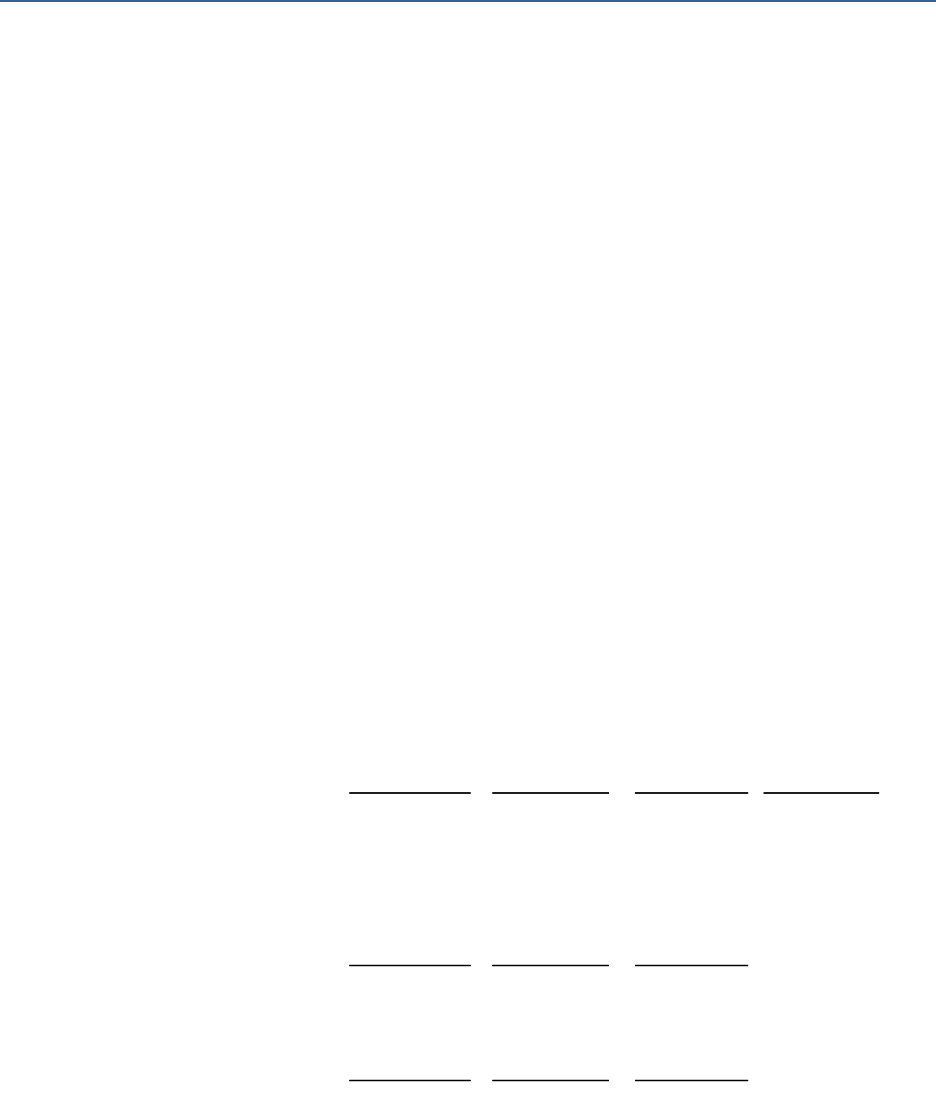

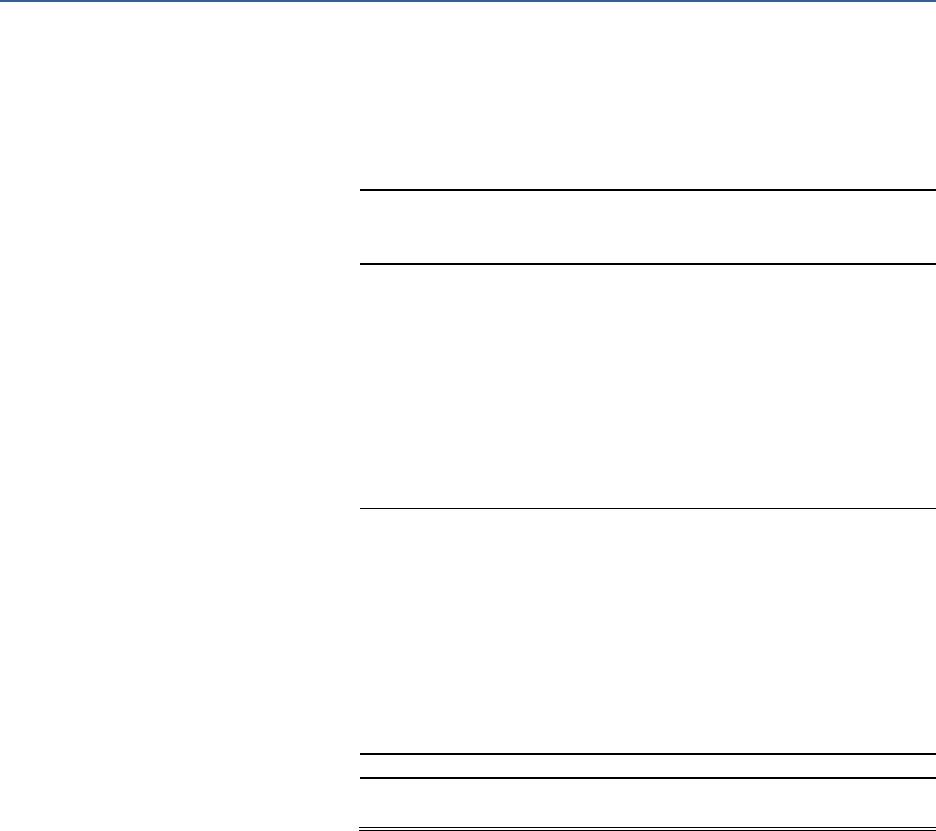

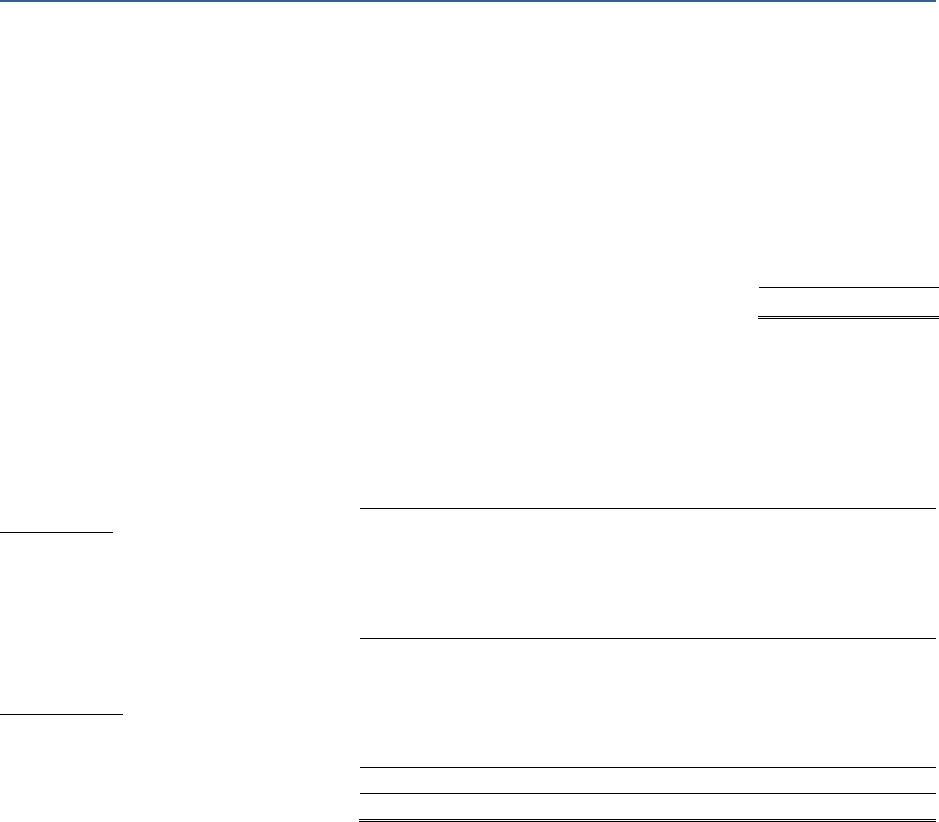

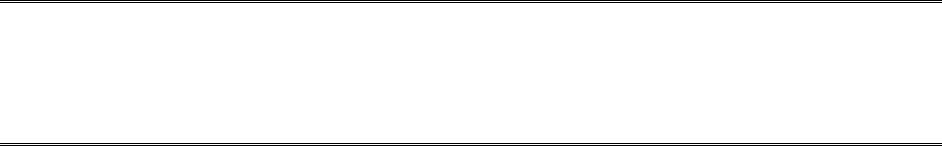

Statement of Net Position (thousands of dollars)

Increase Percent

2022 2021 (Decrease) Change

Assets:

Current Assets 72,559$ 70,046$ 2,513$ 3.59%

Noncurrent Assets, Net 127,392 119,181 8,211 6.89%

Total Assets 199,951 189,227 10,724 5.67%

Deferred Outflow of Resources 17,431 20,665 (3,234) -15.65%

Liabilities:

Current Liabilities 19,134 19,345 (211) -1.09%

Noncurrent Liabilities 70,847 89,379 (18,532) -20.73%

Total Liabilities 89,981 108,724 (18,743) -17.24%

Deferred Inflow of Resources 23,522 13,179 10,343 78.48%

Net Position:

Net Invested in Capital Assets 99,783 101,922 (2,139) -2.10%

Restricted 6,508 1,360 5,148 378.53%

Unrestricted (2,412) (15,293) 12,881 -84.23%

Total Net Position 103,879$ 87,989$ 15,890$ 18.06%

John C. Calhoun Community College

Management’s Discussion and Analysis

September 30, 2022

6

Deferred Outflows of Resources

Deferred outflows of resources are defined as a consumption of assets by the government that

is applicable to a future reporting period. The $3.2 million decrease in Deferred Outflow of

Resources is due to a decrease in both pensions ($1.67 million) and other post-employment

benefits ($1.4 million), along with a decrease from a loss on bond refunding of $140,554. The

decrease in deferred outflows related to pensions and other post-employment benefits are due

to the change in values during the 2020-2021 fiscal year. This deferred outflow of resources

represents the portion of the pension liability already paid by Calhoun for the fiscal year 2021-

2022. The deferred outflows of resources related to OPEB resulting from College contributions

subsequent to the measurement date will be recognized as a decrease of the net OPEB liability

in the year ended September 30, 2023.

Current Liabilities

Current liabilities consist of deposits, accounts payable, unearned revenue, the current portion

of compensated absences, the current portion of long-term liabilities, and other current

liabilities. Current liabilities decreased by $210,543.

Noncurrent Liabilities

Noncurrent liabilities consist of principal amounts due on bonds, notes, and leases, unfunded

pensions, and the noncurrent portion of compensated absences. Noncurrent liabilities decreased

by $18.5 million due mainly to a $3.7 million decrease in Bonds Payable, a $11.2 million decrease

in Net Pension Liability, and a $3.56 million decrease in Net OPEB Liability. The net OPEB liability,

required by GASB 75, was measured as of September 30, 2021 and the total OPEB liability used

to calculate the net OPEB liability was determined by an actuarial valuation as of September 30,

2020. The College’s proportion of the net OPEB liability was based on a projection of the College’s

long-term share of contributions to the OPEB plan relative to the projected contributions of all

participating employers, actuarially determined. The net pension liability decrease of $11.2

million was required by GASB 68.

Deferred Inflows of Resources

Deferred inflows of resources are defined as an acquisition of assets by the government that is

applicable to a future reporting period. The Deferred Inflow of Resources increased by $10.3

million due to a $9.5 million increase in pensions and a $801,067 increase in post-employment

benefits. Pension related assets and liabilities are based on the annual actuarial valuation which

may fluctuate significantly for such factors as changes in plan experience or changes in economic

or demographic assumptions.

Net Position

Net position represents the residual value in the College’s assets after all liabilities are deducted.

Overall Net Position increased by $15.9 million due to several factors including a $8.67 million

addition in capital assets, a net decrease in Pension/OPEB liabilities of $4.5 million (including

deferred inflows) and $4.7 million increase in investment assets.

John C. Calhoun Community College

Management’s Discussion and Analysis

September 30, 2022

7

GASB 68 and 75 effects on the financial statements

The College adopted Governmental Accounting Standards Board (GASB) Statement Number 75,

Accounting and Financial Reporting for Postemployment Benefits Other Than Pensions, in the

fiscal year ending September 30, 2018. The provisions of this statement establish accounting

and financial standards for OPEB that are provided to the employees of state and local

governmental employers through OPEB plans that are administered through trusts. The adoption

of this statement has a significant impact on the College’s financial statements. This liability had

previously been reported in the Teacher’s Retirement System financial statements and not on

each participating institution’s statements. The establishment of this liability on the college’s

statements in 2018 had a negative impact on the total reported Net Position, mostly due to the

required $22.3 million restatement of net position and the associated recognition of liabilities,

deferred inflows and deferred outflows. Readers of the financial statements must understand

that this new reporting requirement does not change the college’s cash position, credit

worthiness, or overall financial health. The college’s financial ability to fund daily operations,

meet debt obligations, and allocate necessary resources to achieve stated goals and objectives

remains strong. GASB 75 simply shifts the reporting of this existing liability to each member

institution. The college’s annual expenditures allocated for pension expenses did not increase

due to GASB 75, nor did its future obligations for such. GASB 75 also did not change the college’s

excellent credit rating of A1 as reported by Moody’s Investor Services. More detailed information

regarding the calculation and reporting requirements of GASB 75 can be found in the Notes to

the Financial Statements.

The College adopted Governmental Accounting Standards Board (GASB) Statement Number 68,

Accounting and Financial Reporting for Pensions, in the fiscal year ending September 30, 2015.

This required reporting change also had a negative impact on the College’s net position. GASB

68 requires the recognition of future unfunded pension liabilities by each state and local

governments, which is similar to the GASB 75 requirement to recognize unfunded OPEB. This

liability had previously been reported in the Teacher’s Retirement System financial statements

and not on each participating institution’s statements. Readers of the financial statements must

understand that this reporting requirement does not change the college’s cash position, credit

worthiness, or overall financial health. The college’s financial ability to fund daily operations,

meet debt obligations, and allocate necessary resources to achieve stated goals and objectives

remains strong. The college’s annual expenditures allocated for pension expenses did not

increase due to GASB 68, nor did its future obligations for such. GASB 68 also did not change the

college’s excellent credit rating of A1 as reported by Moody’s Investor Services. More detailed

information regarding the calculation and reporting requirements of GASB 75 can be found in the

Notes to the Financial Statements.

Neither GASB 68 nor GASB 75 changed the college’s cash position, credit rating, or overall

financial health. If readers compared current financial statements to those prior to 2015, net

position is significantly different largely due to GASB 68 and 75 reporting requirements, not a

shift in the financial health of the college.

John C. Calhoun Community College

Management’s Discussion and Analysis

September 30, 2022

8

Statement of Revenues, Expenses and Changes in Net Position

Changes in total net position as presented on the Statement of Net Position are based on the

activity presented in the Statement of Revenues, Expenses, and Changes in Net Position. The

purpose of the statement is to present the revenues received by the institution, both operating

and non-operating, and the expenses paid by the institution, operating and non-operating, and

any other revenues, expenses, gains and losses received or spent by the institution.

Generally speaking operating revenues are received for providing goods and services to the

various customers and constituencies of the institution. Operating expenses are those expenses

paid to acquire or produce the goods and services provided in return for the operating revenues

and to carry out the mission of the institution. Non-operating revenues are revenues received

for which goods and services are not provided. For example, state appropriations are non-

operating because they are provided by the Legislature to the institution without the Legislature

directly receiving commensurate goods and services for those revenues.

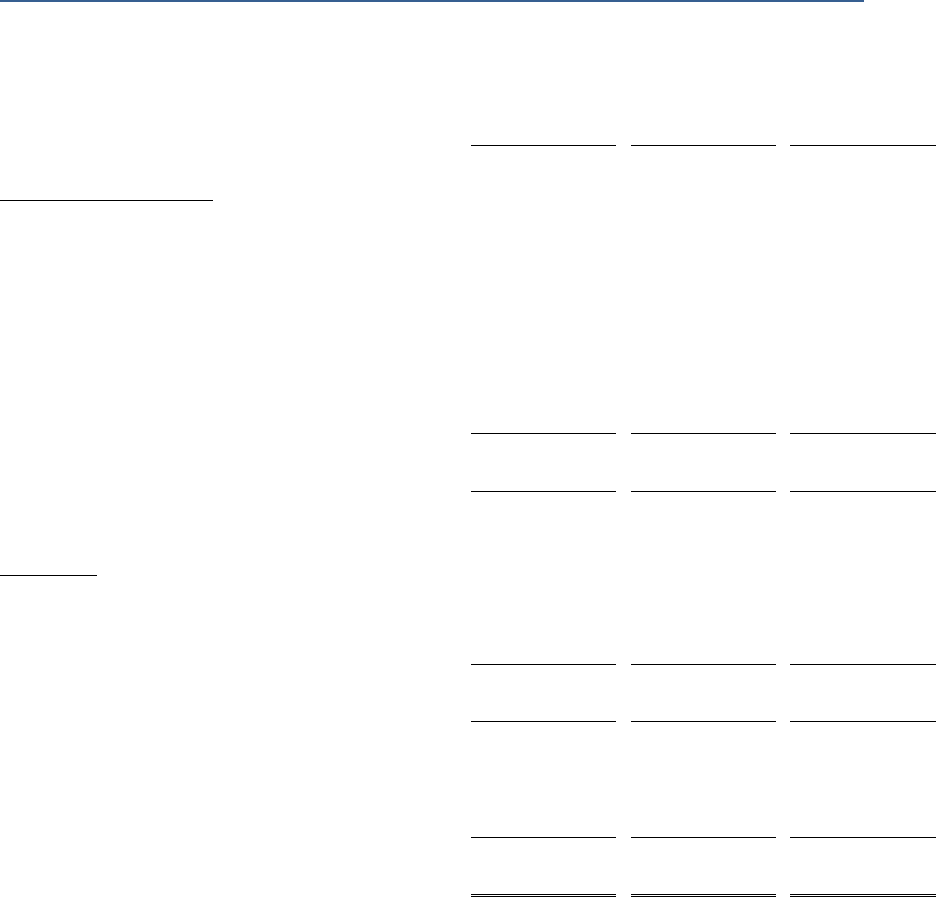

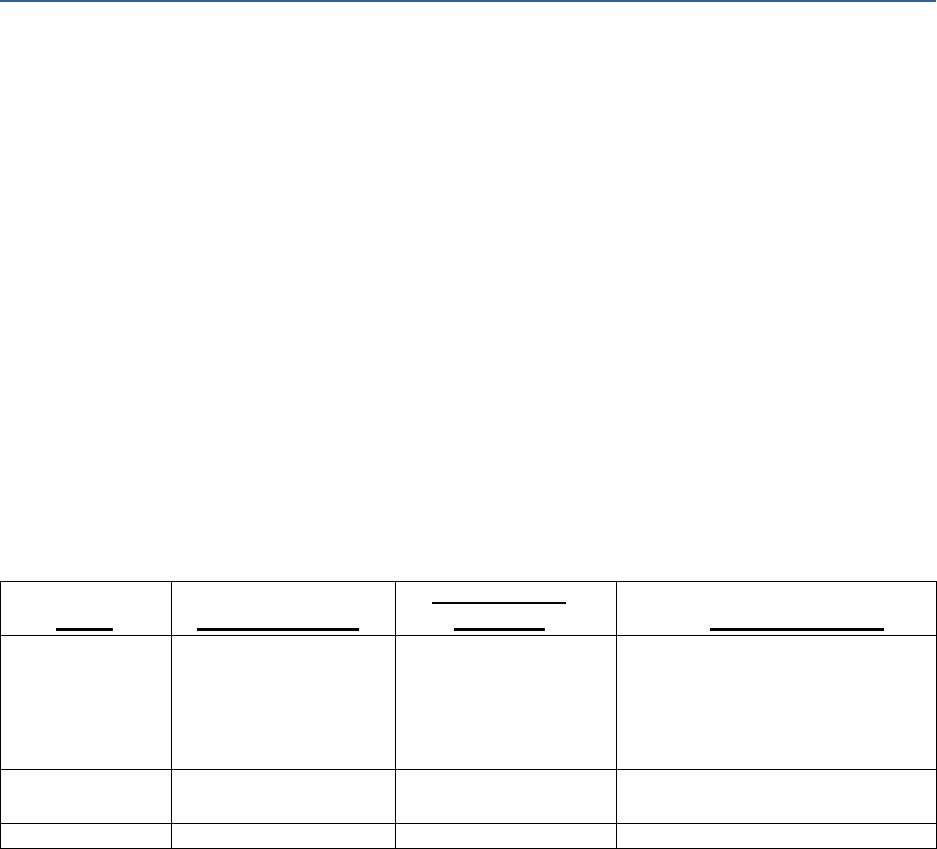

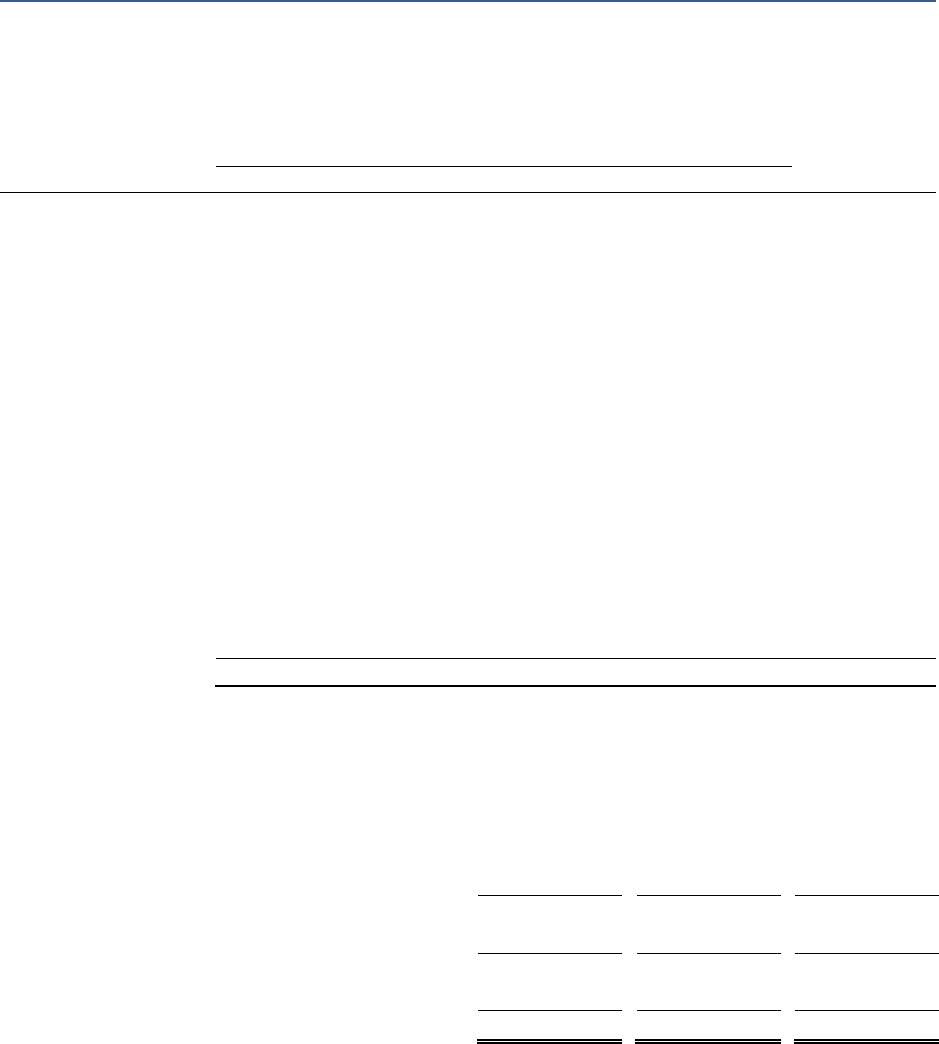

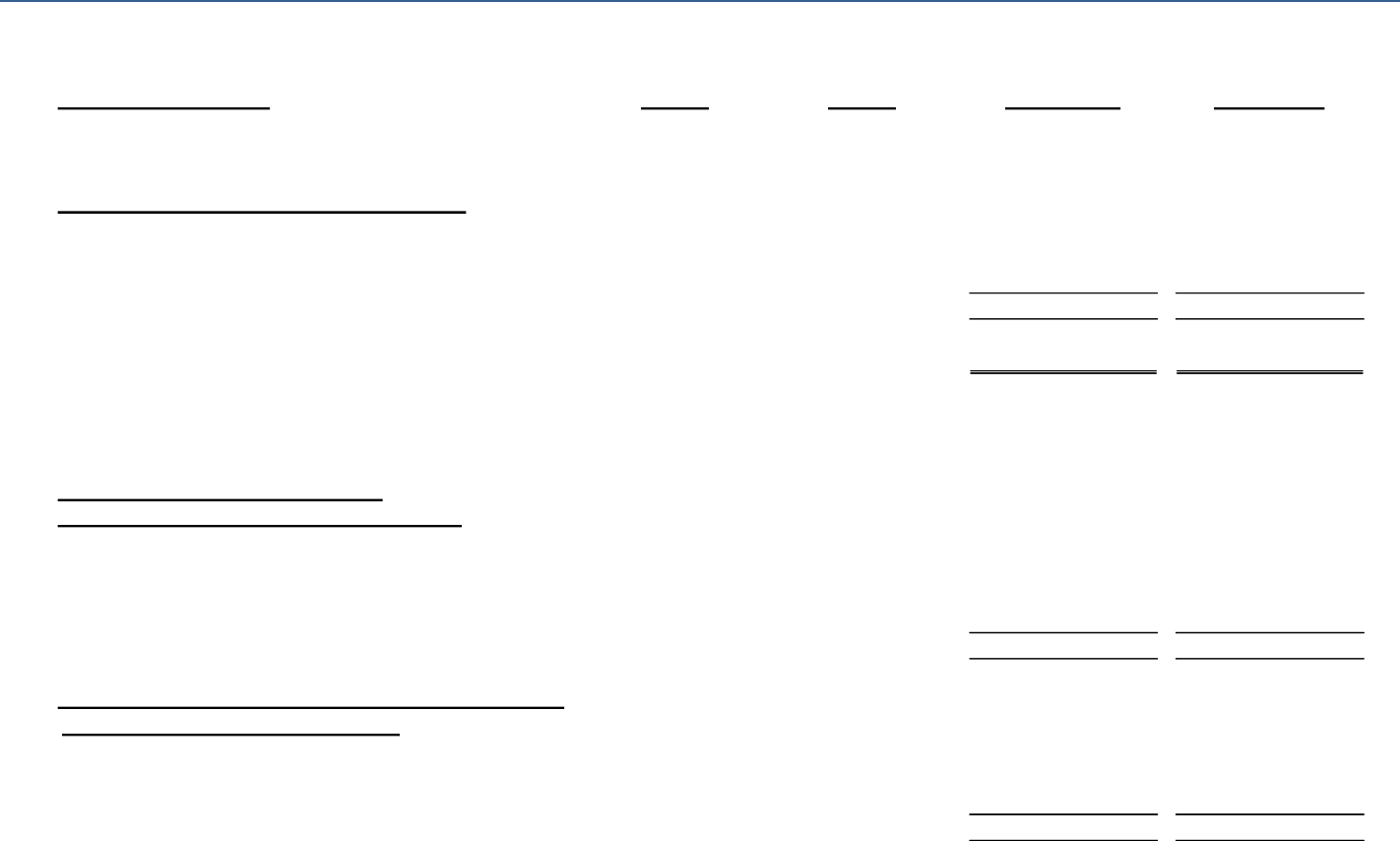

Statement of Revenues, Expenses and Changes in Net Position (thousands of dollars)

Operating Revenues

Total Operating Revenue increased by $1.6million, largely due to a $1.97 million increase in State

grants. Student tuition of $19.8 million represents the largest type of operating revenue followed

by state grant revenue. Gross tuition revenue remained steady from the previous year, however

a larger portion of the tuition and fees was paid by financial aid sources which has to be listed as

an allowance and resulted in a decrease in net tuition of $742,133.

Increase Percent

2022 2021 (Decrease) Change

Operating Revenues 27,513$ 25,914$ 1,599$ 6.17%

Operating Expenses (70,437) (77,528) 7,091 -9.15%

Operating Loss (42,924) (51,614) 8,690 -16.84%

Non-Operating Revenues and Expenses

57,275 55,326 1,949 3.52%

Other Revenues 1,539 543 996 183.43%

Increase in Net Position 15,890 4,255 11,635 273.44%

Net Position at Beginning of Year 87,989 83,733 4,256 5.08%

Net Position at End of Year 103,879$ 87,988$ 15,891$ 18.06%

John C. Calhoun Community College

Management’s Discussion and Analysis

September 30, 2022

9

The below chart displays the operating revenues by type and their relationship with one another.

Some highlights of the information presented on the Statement of Revenues, Expenses, and

Changes in Net Position are the following:

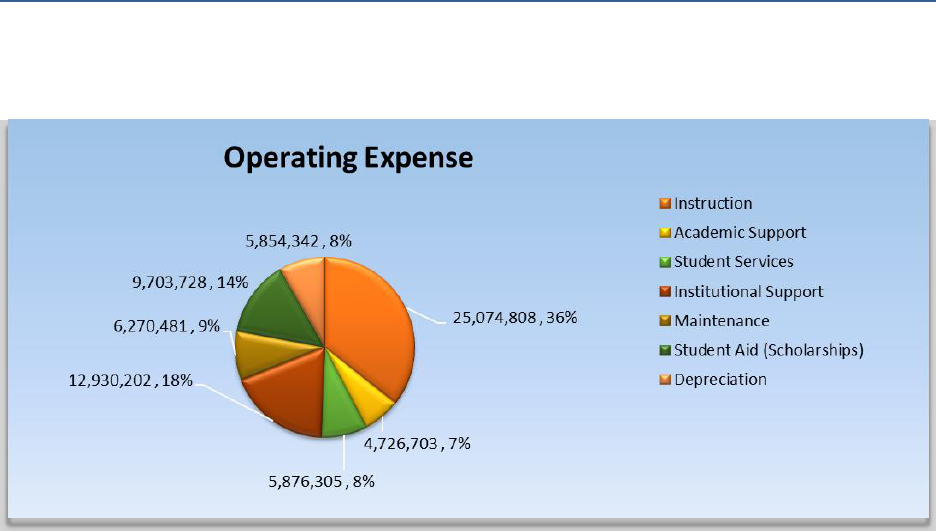

Operating Expenses

Operating expenses decreased by $7 million,, largely due to a $5.97 million decrease in Student

Aid and Scholarships. This decrease was mainly due to $9.5 million CARES Act Student Stimulus

funds being awarded in fiscal year 2021, which inflated the 2021 amounts. Instruction, Academic

Support, Student Services, Institutional Support and Maintenance saw a combined decrease of

$806,749, mainly due to a $2.7 million decrease from last fiscal year in Pension and OPEB

expenses related to GASB 68 and GASB 75 required entries, netted with increases in personnel

costs related with cost of living raises near $1 million. Depreciation expense decreased by

$307,795 due to a reclassification of building alterations depreciation being recognized (25 years)

from buildings (50 years) in the previous fiscal year 2021 which inflated depreciation for that

year.

John C. Calhoun Community College

Management’s Discussion and Analysis

September 30, 2022

10

The operating expenses by function are displayed in the following exhibit.

Non-Operating Revenues

State Appropriations increased by $6.3 million from the previous year, with $3.3 million of that

increase allocated for the Alabama Center for the Arts facilities construction/renovations. Federal

grants decreased by $4.8 million mainly due to a decrease in CARES Act revenue of $4.2 million

compared to the previous year. Investment securities reported a net unrealized loss of $244,862

which is a reflection of the related bonds dropping in market value as of 9/30/2022.

Non-Operating Expenses

Total non-operating expenses decreased by $536,632 mainly due to a decrease in disposal of

assets.

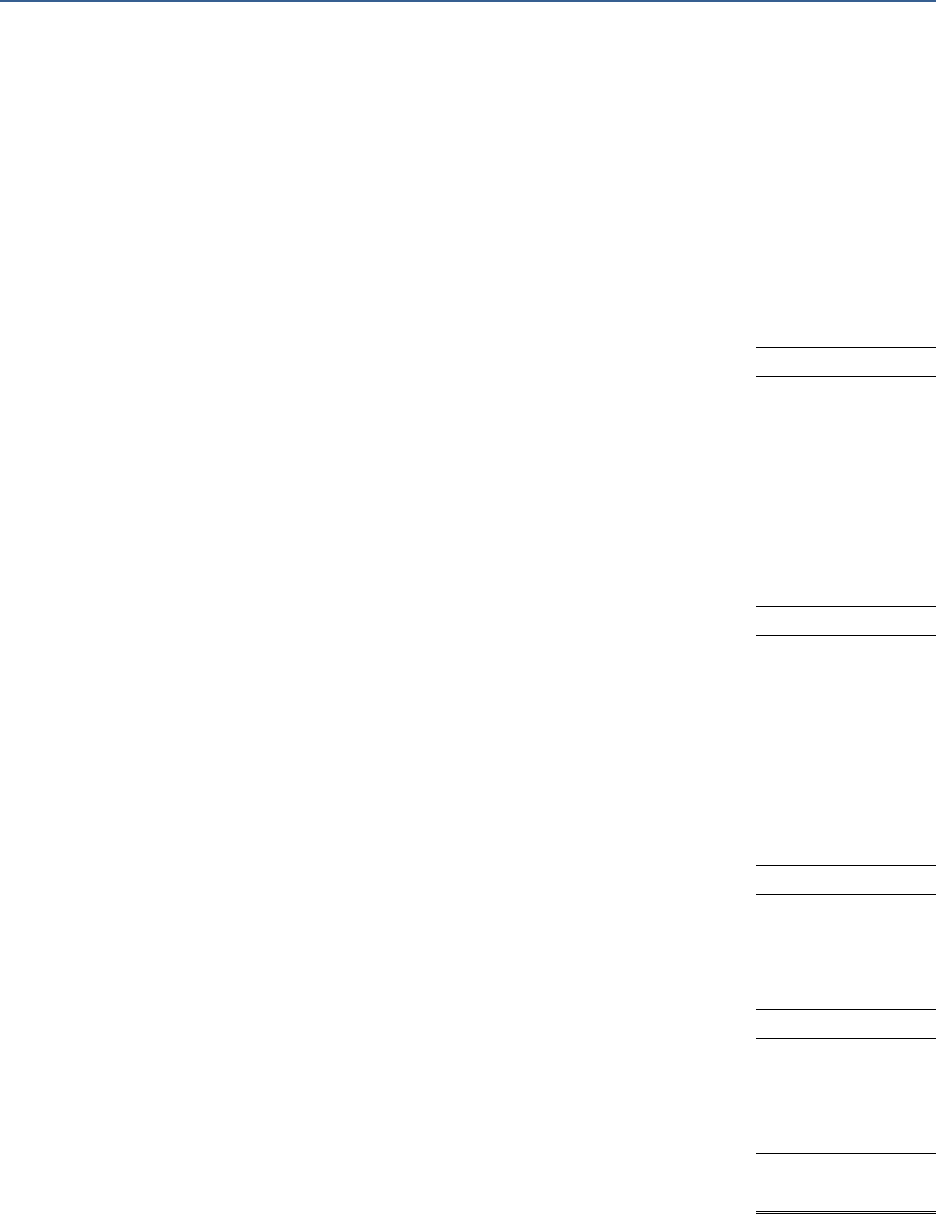

Statement of Cash Flows

The final statement presented is the Statement of Cash Flows which presents detailed

information about the cash activity of the institution during the year. The statement is divided

into five parts. The first part deals with operating cash flows and shows the net cash used by the

operating activities of the institution. The second section reflects cash flows from non-operating

activities. This section reflects the cash received and spent for non-operating (state

appropriations plus federal grants and loans), non-investing, and non-capital purposes. The third

section reflects the cash flows from the purchase of capital buildings and equipment and any

borrowings (Bond Issues) used for the funding those capital purchases. The fourth section deals

with cash flows from investing activities. The fifth section summarizes any cash transactions that

would impact any prior year adjustments made during the current fiscal year.

John C. Calhoun Community College

Management’s Discussion and Analysis

September 30, 2022

11

Operating Activities

Cash used for operating activities of $40 million decreased by $.2 million mainly due to a decrease

of $5.97 million in scholarship expenses (due to higher CARES Act Student Stimulus payments in

fiscal year 2021), offset by increases in payments to suppliers, utilities and personnel. Actual cash

receipts for tuition decreased by $3 million, but Grants and Contracts increased by $3.1 million.

Non-operating Activities

Cash from non-operating activities decreased by $1 million mainly due to a $7 million decrease

in Federal Grants cash receipts, offset by an increase of $5.8 million in State Appropriations. Pell

cash receipts increased by $681,340, while Federal Loan cash receipts decreased $652,873.

Capital and related Financing Activities

Cash used for capital and related financing activities decreased by $6.2 million mostly due to a

net change in cash flow in Deposits with Trustees. Most of the construction funds for the

Huntsville Wall & Roof project were drawn down in fiscal year 2021 (over $7 million) and the

remaining ($1.8 million) were drawn down in this current fiscal year 2022.

Investing Activities

The $7.4 million decrease in cash flow from investing activities was due to a couple of key factors:

1) the maturity of securities during the fiscal year of $2.45 million and 2) almost $5 million

decrease due to Investments purchased compared to last fiscal year. The college is also

maintaining more of these funds in cash instead of reinvesting due to the possibility of needing

liquid funds in the near future for pending large scale capital projects that have yet to be finalized

in regard to cost and funding sources.

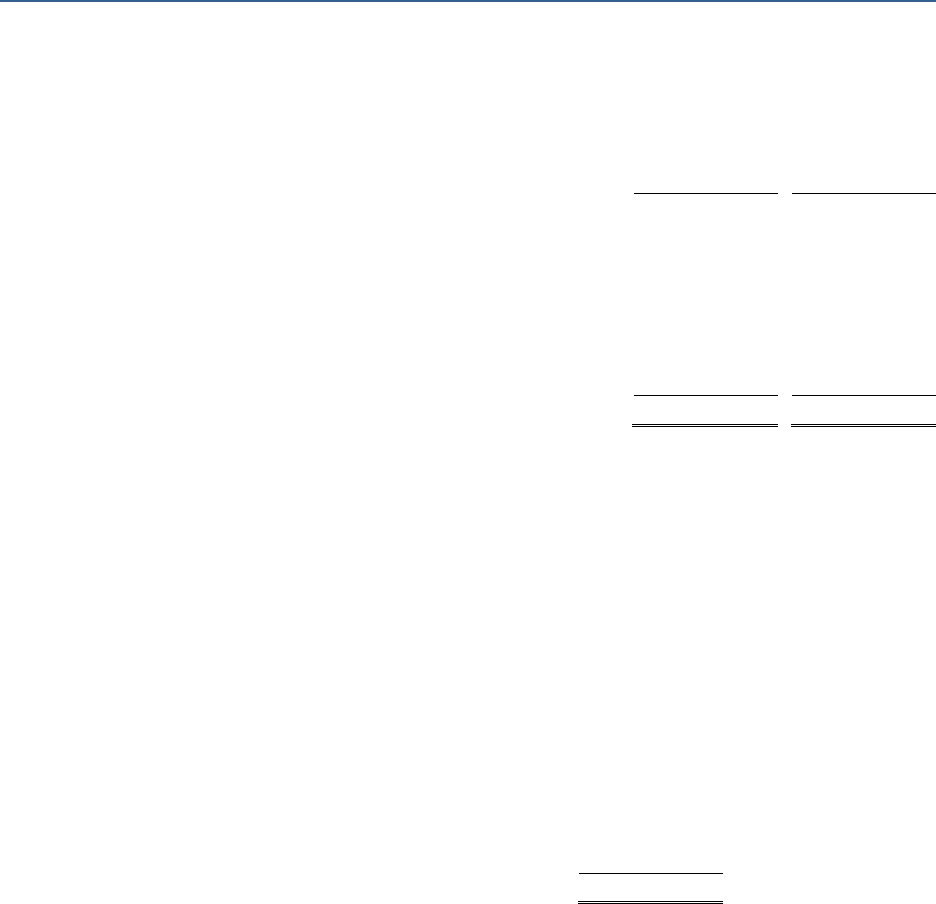

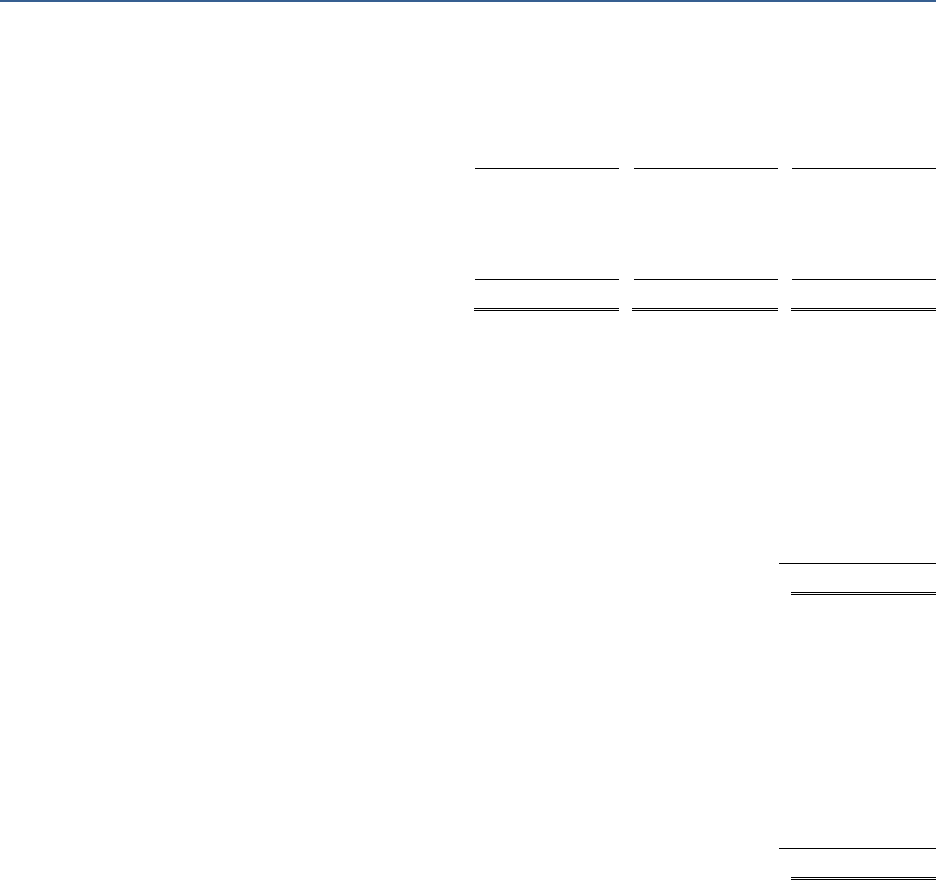

Increase Percent

2022 2021 (Decrease) Change

Cash Provided (Used) by

Operating Activities (40,275)$ (40,479)$ 204$ -0.50%

Non-Operating Activities 59,773 58,602 1,171 2.00%

Capital Activities (12,751) (6,539) (6,212) 95.00%

Investing Activities (4,897) 2,549 (7,446) -292.11%

Net Change in Cash 1,850 14,133 (12,283) -86.91%

Cash, Beginning of Year 61,246 47,112 14,134 30.00%

Cash, End of Year 63,096$ 61,245$ 1,851$ 3.02%

John C. Calhoun Community College

Management’s Discussion and Analysis

September 30, 2022

12

Economic Outlook

The college is not aware of any other currently known facts, decisions, or conditions that are

expected to have a significant effect on the financial position or results of operations during this

upcoming fiscal year.

Contacting John C. Calhoun Community College Financial Management

This financial report is designed to provide our stakeholders with a general overview of the

College's finances and to show the College's accountability for the money it receives. If you have

questions about this report or need additional financial information, contact the Calhoun

Community College Business and Finance Department located at 6250 US-31, Tanner, AL 35671.

John C. Calhoun Community College

Statement of Net Position

September 30, 2022

The accompanying notes are an integral part of these financial statements.

13

ASSETS

Current Assets

Cash and Cash Equivalents

$ 63,096,151

Short-Term Investments

1,202,975

Accounts Receivable, Net of Allowance for

Doubtful Accounts of $1,208,868

5,973,375

Inventories

17,086

Deposit with Bond Trustee

1,678,034

Other Current Assets

591,386

Total Current Assets

72,559,007

Non-Current Assets

Long-Term Investments

3,527,066

Capital Assets:

Land

4,431,544

Improvements Other Than Buildings

11,661,034

Buildings & Building Alterations

143,522,246

Equipment and Furniture

25,347,409

Library Holdings

1,419,591

Construction in Progress

2,760,462

Lease

239,653

Less: Accumulated Depreciation

(65,517,304)

Total Capital Assets, Net of Depreciation

123,864,635

Total Non-Current Assets

127,391,701

Total Assets

199,950,708

DEFERRED OUTFLOWS OF RESOURCES

Loss on Bond Refunding

93,703

Deferred Outflows of Resources Related to Pensions

10,163,000

Deferred Outflows of Resources Related to OPEB

7,174,894

Total Deferred Outflows of Resources

17,431,597

John C. Calhoun Community College

Statement of Net Position

September 30, 2022

The accompanying notes are an integral part of these financial statements.

14

LIABILITIES

Current Liabilities

Deposits

$ 22,074

Accounts Payable and Accrued Liabilities

7,634,321

Bond Surety Payable

29,388

Unearned Revenue

7,469,600

Compensated Absences

173,361

Lease Payable

80,029

Bonds Payable

3,725,239

Total Current Liabilities

19,134,012

Non-Current Liabilities

Compensated Absences

1,560,248

Lease Payable

94,964

Bonds Payable

20,275,189

Net Pension Liability

34,553,000

Net OPEB Liability

14,363,638

Total Non-Current Liabilities

70,847,039

Total Liabilities

89,981,051

DEFERRED INFLOWS OF RESOURCES

Deferred Inflows of Resources Related to Pensions

10,741,000

Deferred Inflows of Resources Related to OPEB

12,781,125

Total Deferred Inflow of Resources

23,522,125

NET POSITION

Net Position

Net Investment in Capital Assets

99,782,917

Restricted Expendable:

Capital Projects

3,380,000

Debt Service

1,533,388

Scholarships and Fellowships

861

Other

1,593,923

Unrestricted

(2,411,960)

Total Net Position

$ 103,879,129

Calhoun College Foundation

Statement of Financial Position – Discretely Presented Component Unit

June 30, 2022

The accompanying notes are an integral part of these financial statements.

15

ASSETS

Current Assets

Cash and Cash Equivalents

$ 192,354

Investments

12,923,359

Total Assets

$ 13,115,713

NET ASSETS

Without Donor Restrictions

$ 4,155,348

With Donor Restrictions

8,960,365

Total Liabilities and Net Assets

$ 13,115,713

John C. Calhoun Community College

Statement of Revenues, Expenses and Changes in Net Position

For the Year Ended September 30, 2022

The accompanying notes are an integral part of these financial statements.

16

OPERATING REVENUES

Student Tuition and Fees (Net of Scholarship Allowances of $9,811,762)

$ 19,799,439

Federal Grants and Contracts

1,794,077

State and Local Grants and Contracts

5,397,516

Sales and Services of Educational Activities

102,759

Auxiliary Enterprises:

Bookstore

327,845

Vending

41,826

Other Auxiliary Enterprises

1,017

Other

48,760

Total Operating Revenues

27,513,239

OPERATING EXPENSES

Instruction

25,074,808

Academic Support

4,726,703

Student Services

5,876,305

Institutional Support

12,930,202

Operation and Maintenance

6,270,481

Scholarships and Financial Aid

9,703,728

Depreciation

5,854,343

Auxiliary Enterprises

156

Total Operating Expenses

70,436,726

Operating Loss

(42,923,487)

NONOPERATING REVENUES (EXPENSES)

State Appropriations

36,853,690

Federal Grants

21,658,038

Investment Income

78,404

Unrealized Loss

(244,862)

Capital Grants, Contracts, and Gifts

1,705,529

Bond Surety Fee Expense

(155,856)

Other Nonoperating Expense

(223,787)

Interest on Debt

(857,225)

Net Nonoperating Revenues

58,813,931

Change in Net Position

15,890,444

Total Net Position - Beginning of Year

87,988,685

Total Net Position - End of Year

$ 103,879,129

Calhoun College Foundation

Statement of Activities – Discretely Presented Component unit

For the Year Ended June 30, 2022

The accompanying notes are an integral part of these financial statements.

17

Without

With

Donor

Donor

Restrictions

Restrictions

Total

Operating Activities

Revenue and Support:

Contributions

$ 37,679

$ 885,722

$ 923,401

Donated Goods, Services, and Facilities

338,357

-

338,357

Special Events Income

Less: Costs of Direct Benefit to Donors

-

108,031

108,031

Departments/Divisions Income

-

137,781

137,781

Investment Income, Net

(772,489)

(1,251,489)

(2,023,978)

Other Income

29,269

-

29,269

Net Assets Released from Restrictions

1,096,733

(1,096,733)

-

Total Support and Revenue

729,549

(1,216,688)

(487,139)

Expenses:

Program Services

1,443,748

-

1,443,748

General and Administrative

40,466

-

40,466

Fundraising

25,038

-

25,038

Total Expenses

1,509,252

-

1,509,252

Change in Net Assets

(779,703)

(1,216,688)

(1,996,391)

Net Assets at Beginning of Year

4,935,051

10,177,053

15,112,104

Net Assets at End of Year

$ 4,155,348

$ 8,960,365

$ 13,115,713

John C. Calhoun Community College

Statement of Cash Flows

For the Year Ended September 30, 2022

The accompanying notes are an integral part of these financial statements.

18

CASH FLOWS FROM OPERATING ACTIVITIES

Tuition and Fees

$ 19,765,100

Grants and Contracts

5,836,174

Payments to Suppliers

(14,312,571)

Payments for Utilities

(1,867,805)

Payments for Employees

(29,707,320)

Payments for Benefits

(10,844,546)

Payments for Scholarships

(9,666,643)

Sales and Service of Educational Services

102,759

Other Receipts (Payments)

48,760

Auxiliary Enterprises

370,688

Net Cash Used in Operating Activities

(40,275,404)

CASH FLOWS FROM NONCAPITAL FINANCING ACTIVITIES

State and Local Appropriations

36,853,690

Gifts and Grants for Other than Capital Purposes

1,705,529

Federal Grants

21,658,038

Federal Direct Loan Receipts

8,759,720

Federal Direct Loan Disbursements

(8,759,720)

Other Noncapital Financing

(444,303)

Net Cash Provided by Noncapital Financing Activities

59,772,954

CASH FLOWS FROM CAPITAL AND RELATED FINANCING ACTIVITIES

Capital Grants and Gifts Received

Purchase of Capital Assets and Construction

(10,628,756)

Principal Paid on Capital Debt and Leases

(3,592,239)

Interest Paid on Capital Debt and Leases

(716,671)

Deposits with Trustees

1,856,691

Proceeds from Sale of Assets

329,945

Net Cash Used in Capital and Related Financing Activities

(12,751,030)

CASH FLOWS FROM INVESTING ACTIVITIES

Investment Income

(166,458)

Purchase of Investments

(4,730,041)

Net Cash Used in Investing Activities

(4,896,499)

Net Increase in Cash and Cash Equivalents

1,850,021

Cash and Cash Equivalents - Beginning of Year

61,246,130

Cash and Cash Equivalents - End of Year

$ 63,096,151

John C. Calhoun Community College

Statement of Cash Flows

For the Year Ended September 30, 2022

The accompanying notes are an integral part of these financial statements.

19

Reconciliation of Net Operating Loss to Net

Cash Used in Operating Activities

Operating Loss

$ (42,923,487)

Adjustments to Reconcile Net Operating Loss to Net

Cash Used in Operating Activities

Depreciation Expense

5,854,343

Pension and OPEB Expense

(1,414,936)

Changes in Assets and Liabilities:

Receivables

(1,355,419)

Inventory

1,653

Other Assets

37,085

Accounts Payable and Accrued Liabilities

(440,304)

Unearned Revenue

(34,339)

Net Cash Used in Operating Activities

$ (40,275,404)

Noncash Investing, Capital, and Financing Activities:

The College recorded $239,653 in right-of-use lease assets during the year.

John C. Calhoun Community College

Notes to the Financial Statements

For the Year Ended September 30, 2022

20

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The financial statements of John C. Calhoun Community College (the “College” or “CCC”) are

prepared in accordance with accounting principles generally accepted in the United States of

America (GAAP). The Governmental Accounting Standards Board (GASB) is the accepted

standard-setting body for establishing governmental accounting and financial reporting principles.

The more significant accounting policies of John C. Calhoun Community College are described

below.

A. Reporting Entity

The College is a component unit of the State of Alabama. A component unit is a legally separate

organization for which the elected officials of the primary government are financially accountable.

The Governmental Accounting Standards Board (GASB) in Statement Number 14, “The Financial

Reporting Entity,” states that a primary government is financially accountable for a component unit

if it appoints a voting majority of an organization’s governing body and (1) it is able to impose its

will on that organization or (2) there is a potential for the organization to provide specific financial

benefits to, or impose specific financial burdens on, the primary government. In this case, the

primary government is the State of Alabama which through the Alabama Community College

System Board of Trustees governs the Alabama Community College System. The Alabama

Community College System through its Chancellor has the authority and responsibility for the

operation, management, supervision, and regulation of the College. In addition, the College

receives a substantial portion of its funding from the State of Alabama (potential to impose a

specific financial burden). Based on these criteria, the College is considered for financial reporting

purposes to be a component unit of the State of Alabama.

B. Component Units

Calhoun College Foundation (the “Foundation” or “CCF”) is a legally separate, tax-exempt

organization that is organized exclusively for charitable, scientific, and educational purposes for

the benefit of the College. Because of the significance of the relationship between the College and

the Foundation, the Foundation is considered a component unit of the College. Organizations that

are legally separate, tax-exempt entities and that meet all of the following criteria should be

discretely presented as component units. These criteria are:

• The economic resources received or held by the separate organization are entirely

or almost entirely for the direct benefit of the primary government, its component

units, or its constituents.

• The primary government, or its component units, is entitled to, or has the ability to

otherwise access, a majority of the economic resources received or held by the

separate organization.

• The economic resources received or held by an individual organization that the

specific primary government, or its component units, is entitled to, or has the ability

to otherwise access, are significant to that primary government.

John C. Calhoun Community College

Notes to the Financial Statements

For the Year Ended September 30, 2022

21

Although the College does not control the timing or amount of receipts from CCF, the majority of

resources, or income thereon that CCF holds and invests are restricted to the activities of the

College by the donors. Because these restricted resources held by CCF can only be used by, or for

the benefit of, the College, CCF is discretely presented as a component unit of the College. CCF is

reported in its original format on separate financial statements because of the difference in its

reporting model as further described below. Complete financial statements for CCF are available

from the Foundation’s director upon request.

The Foundation is a not-for-profit organization that reports its financial results under the Financial

Accounting Standard Board (FASB) Statements. Most significant to the Foundation’s operations

and reporting model is Accounting Standards Codification (ASC) 958, Not-for-Profit Entities. As

such, certain revenue recognition criteria and presentation features are different from GASB

revenue recognition criteria presentation features. No modifications have been made to the

Foundation’s financial information in the College’s financial reporting entity for these differences;

however, significant note disclosures (see Note 11) to the Foundation’s financial statements have

been incorporated into the College’s notes to the financial statements.

C. Measurement Focus, Basis of Accounting and Financial Statement Presentation

John C. Calhoun Community College follows all applicable GASB pronouncements. The financial

statements of John C. Calhoun Community College have been prepared using the economic

resources measurement focus and the accrual basis of accounting. Revenues are recorded when

earned and expenses are recorded when a liability is incurred, regardless of the timing of the related

cash flows. Grants and similar items are recognized as revenue as soon as all eligibility

requirements imposed by the provider have been met.

It is the policy of the College to first apply restricted resources when an expense is incurred and

then apply unrestricted resources when both restricted and unrestricted net position are available.

The Statement of Revenues, Expenses and Changes in Net Position distinguishes between

operating and non-operating revenues. Operating revenues, such as tuition and fees, result from

exchange transactions associated with the principal activities of the College. Exchange transactions

are those in which each party to the transactions receives or gives up essentially equal values. Non-

operating revenues arise from exchange transactions not associated with the College 's principal

activities, such as investment income and from all non-exchange transactions, such as state

appropriations.

D. Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally

accepted in the United States of America requires management to make estimates and assumptions

that affect certain reported amounts and disclosures. Accordingly, actual results could differ from

those estimates.

John C. Calhoun Community College

Notes to the Financial Statements

For the Year Ended September 30, 2022

22

E. Assets, Deferred Outflows of Resources, Liabilities, Deferred Inflows of Resources and

Net Position

1. Cash, Cash Equivalents, and Investments

Cash and cash equivalents include cash on hand, demand deposits and short-term investments with

original maturities of three months or less from the date of acquisition.

Statutes authorize the College to invest in the same type of instruments as allowed by Alabama law

for domestic life insurance companies. This includes a wide range of investments, such as direct

obligations of the United States of America, obligations issued or guaranteed by certain federal

agencies, and bonds of any state, county, city, town, village, municipality, district or other political

subdivision of any state or any instrumentality or board thereof or of the United States of America

that meet specified criteria.

Investments are measured at fair value on a recurring basis. Recurring fair value measurements are

those that Governmental Accounting Standards Board (GASB) Statements require or permit in the

Statement of Net Position at the end of each reporting period.

2. Receivables

Accounts receivable relate to amounts due from students, federal grants, state grants, third party

tuition, and auxiliary enterprise sales, such as food service, bookstore, and residence halls. The

receivables are shown net of allowance for doubtful accounts.

3. Capital Assets

Capital assets, other than intangible assets, with a unit cost of over $5,000 and an estimated useful

life in excess of one year, and all library books, are recorded at historical cost or estimated historical

cost if purchased or constructed. The capitalization threshold for intangible assets such as

capitalized software and internally generated computer software is $1 million and $100,000 for

easements and land use rights and patents, trademarks, and copyrights. In addition, works of art

and historical treasures and similar assets are recorded at their historical cost. Donated capital assets

are recorded at fair market value at the date of donation. Land, construction in progress, and

intangible assets with indefinite lives are the only capital assets that are not depreciated.

Depreciation is not allocated to a functional expense category. The costs of normal maintenance

and repairs that do not add to the value of the asset or materially extend its life are not capitalized.

Major outlays for capital assets and improvements are capitalized as projects are constructed.

Maintenance and repairs are charged to operations when incurred. Betterments and major

improvements which significantly increase values, change capacities, or extend useful lives are

capitalized. Upon the sale or retirement of fixed assets being depreciated using the straight-line

method, the cost and related accumulated depreciation are removed from the respective accounts

and any resulting gain or loss is included in the results of operation.

John C. Calhoun Community College

Notes to the Financial Statements

For the Year Ended September 30, 2022

23

The method of depreciation and useful lives of the capital assets and right-to-use leased assets are

as follows:

Assets

Depreciation Method

Useful Lives

Buildings

Straight-Line

50 years

Building Alterations

Straight-Line

25 years

Improvements other than Buildings

Straight-Line

25 years

Equipment > $25,000

Straight-Line

10 years

Equipment < $25,000

Straight-Line

5 years

Right-to-Use Leased Equipment

Straight-Line

5-10 years

Library Materials

Composite

20 years

Capitalized Software

Straight-Line

10 years

Easement and Land Use Rights

Straight-Line

20 years

Patents, Trademarks, and Copyrights

Straight-Line

20 years

4. Deferred Outflow of Resources

Deferred outflows of resources are reported in the Statement of Net Position. Deferred outflows

of resources are defined as a consumption of assets by the government that is applicable to a

future reporting period. Deferred outflows of resources increase net position, similar to assets.

5. Long-Term Obligations

Long-term debt and other long-term obligations are reported as liabilities in the Statement of Net

Position. Bonds/Warrant premiums and discounts are deferred and amortized over the life of the

bonds. Bonds/Warrants payable are reported net of the applicable bond/warrant premium or

discount.

6. Compensated Absences

No liability is recorded for sick leave. Substantially all employees of the College earn 12 days of

sick leave each year with unlimited accumulation. Payment is not made to employees for unpaid

sick leave at termination or retirement.

All non-instructional employees earn annual leave at a rate which varies from 12 to 24 days per

year depending on duration of employment, with accumulation limited to 60 days. Instructional

employees do not earn annual leave. Payment is made to employees for unused leave at termination

or retirement.

7. Deferred Inflow of Resources

Deferred inflows of resources are reported in the Statement of Net Position. Deferred inflows of

resources are defined as an acquisition of assets by the government that is applicable to a future

reporting period. Deferred inflows of resources decrease net position, similar to liabilities.

John C. Calhoun Community College

Notes to the Financial Statements

For the Year Ended September 30, 2022

24

8. Unearned Revenue

Unearned revenue consists primarily of amounts received for fall student tuition and fees that are

not earned until the next fiscal year. Unearned revenue also includes amounts received from grant

and contract sponsors that have not yet been earned.

9. Pensions

The Teachers’ Retirement System of Alabama (“TRS” or “the Plan”) financial statements are

prepared using the economic resources measurement focus and accrual basis of accounting.

Contributions are recognized as revenues when earned, pursuant to plan requirements. Benefits and

refunds are recognized as revenues when due and payable in accordance with the terms of the plan.

Expenses are recognized when the corresponding liability is incurred, regardless of when the

payment is made. Investments are reported at fair value. Financial statements are prepared in

accordance with requirements of the Governmental Accounting Standards Board (GASB). Under

these requirements, the Plan is considered a component unit of the State of Alabama and is included

in the State’s Annual Comprehensive Financial Report.

10. Postemployment Benefits Other Than Pensions (OPEB)

The Alabama Retired Education Employees’ Health Care Trust (Trust) financial statements are

prepared by using the economic resources measurement focus and accrual basis of accounting. This

includes for purposes of measuring the net OPEB liability, deferred outflows of resources and

deferred inflows of resources related to OPEB, and OPEB expense, information about the fiduciary

net position of the Trust and additions to/deductions from the Trust’s fiduciary net position. Plan

member contributions are recognized in the period in which the contributions are due. Employer

contributions are recognized when due pursuant to plan requirements. Benefits are recognized

when due and payable in accordance with the terms of the plan. Subsequent events were evaluated

by management through the date the financial statements were issued.

11. Net Position

Net position is required to be classified for accounting and reporting purposes into the following

categories:

Net Investment in Capital Assets - Capital assets, including restricted capital assets, reduced by

accumulated depreciation and by outstanding principal balances of debt attributable to the

acquisition, construction, or improvement of those assets. Deferred outflows of resources and

deferred inflows of resources that are attributable to the acquisition, construction, or improvement

of those assets or related debt are also included in this component of net position. Any unspent

related debt proceeds or inflows of resources at year-end related to capital assets are not included

in this calculation.

John C. Calhoun Community College

Notes to the Financial Statements

For the Year Ended September 30, 2022

25

Restricted:

Nonexpendable - Net position subject to externally imposed stipulations that it be maintained

permanently by the College. Such assets would include permanent endowment funds.

Expendable - Net position whose use by the College is subject to externally imposed stipulations

that can be fulfilled by actions of the College pursuant to those stipulations or that expire by the

passage of time. These include funds held in federal loan programs.

Unrestricted - Net position is the net amount of the assets, deferred outflows of resources,

liabilities, and deferred inflows of resources that are not included in the determination of net

investment in capital assets or the restricted component of net position. Unrestricted resources may

be designated for specific purposes by action of management or the Alabama Community College

System Board of Trustees.

12. Federal Financial Assistance Programs

The College participates in various federal programs. Federal programs are audited in accordance

with the Title 2 U.S. Code of Federal Regulations Part 200, Uniform Administrative Requirements,

Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance).

13. Scholarship Allowances and Student Aid

Student tuition and fees are reported net of scholarship allowances and discounts. The amount for

scholarship allowances and discounts is the difference between the stated charge for goods and

services provided by the College and the amount that is paid by the student and/or third parties

making payments on behalf of the student. The College uses the alternate method as prescribed by

the National Association of College and College Business Officers (NACUBO) in their Advisory

Report (2000-05) to determine the amount of scholarship allowances and discounts.

14. Prepaid Expenses and Unearned Scholarships

Prepaid expenses are composed predominantly of prepaid insurance. Unearned scholarship expense

results from the Fall academic term spanning across the fiscal year end. The College prorates

scholarship expense to recognize only the amounts incurred in each fiscal year.

15. New Accounting Pronouncement

During the current Fiscal Year, the College implemented the following new accounting

pronouncements issued by the Governmental Accounting Standards Board (GASB):

- GASB Statement No. 87, Leases

- GASB Statement No. 89, Accounting for Interest Cost Incurred before the End of a

Construction Period

- GASB Statement No. 92, Omnibus 2020

- GASB Statement No. 93, Replacement of Interbank Offered Rates

John C. Calhoun Community College

Notes to the Financial Statements

For the Year Ended September 30, 2022

26

NOTE 2 – DEPOSITS AND INVESTMENTS

A. Deposits

The College's deposits in banks at year-end were held by financial institutions in the State of

Alabama's Security for Alabama Funds Enhancement (SAFE) Program. The SAFE Program was

established by the Alabama Legislature and is governed by the provisions contained in the Code of

Alabama 1975, Sections 41-14A-1 through 41-14A-14. Under the SAFE Program all public funds

are protected through a collateral pool administered by the Alabama State Treasurer's Office. Under

this program, financial institutions holding deposits of public funds must pledge securities as

collateral against those deposits. In the event of failure of a financial institution, securities pledged

by that financial institution would be liquidated by the State Treasurer to replace the public deposits

not covered by the Federal Deposit Insurance Corporation (FDIC).

If the securities pledged fail to produce adequate funds, every institution participating in the pool

would share the liability for the remaining balance.

The Statement of Net Position classification "cash and cash equivalents" includes all readily

available cash such as petty cash, demand deposits, and certificates of deposits with maturities of

three months or less.

B. Investments

The College invests its funds in securities and investments in accordance with the Code of Alabama

1975, Section 16-13-2, Sections 27-1-8 and 27-1-9, and Sections 27-41-1 through 27-41-41. These

laws provide that the College may invest in the same type of instruments as allowed by Alabama

law for domestic life insurance companies. This includes a wide range of investments, such as

direct obligations of the United States of America, obligations issued or guaranteed by certain

federal agencies, and bonds of any state, county, city, town, village, municipality, district or other

political subdivision of any state or any instrumentality or board thereof of the United States of

America that meet specified criteria. The College 's investment policy permits investments in the

following: 1) U.S. Treasury bills, notes, bonds, and stripped Treasuries; 2) U.S. Agency notes,

bonds, debentures, discount notes and certificates; 3) certificates of deposit (CDs), checking and

money market accounts of savings and loan associations, mutual savings banks, or commercial

banks whose accounts are insured by FDIC/FSLIC, and who are designated a Qualified Public

Depository (QPD) under the SAFE Program; 4) mortgage backed securities (MBSs); 5) mortgage-

related securities including collateralized mortgage obligations (CMOs) and real estate mortgage

investment conduits (REMIC) securities; 6) repurchase agreements; and 7) stocks and bonds which

have been donated to the institution.

The College’s portfolio shall consist primarily of bank CDs and interest-bearing accounts, U. S.

Treasury securities, debentures of a U. S. Government Sponsored Entity (GSE) and securities

backed by collateral issued by GSEs. In order to diversify the portfolio's exposure to concentration

risk, the portfolio's maximum allocation to specific product sectors is as follows: 1) U. S. Treasury

bills, notes and bonds can be held without limitation as to amount. Stripped Treasuries shall never

exceed 50 percent of the institution’s total investment portfolio. Maximum maturity of these

John C. Calhoun Community College

Notes to the Financial Statements

For the Year Ended September 30, 2022

27

securities shall be ten years. 2) U. S. Agency securities shall have limitations of 50 percent of the

College’s total investment portfolio for each Agency, with two exceptions: TVA and SLMA shall

be limited to ten percent of total investments. Maximum maturity of these securities shall be ten

years. 3) CDs with savings and loan associations, mutual savings banks, or commercial banks may

be held without limit provided the depository is a QPD under the SAFE Program. CD maturity

shall not exceed five years. 4) The aggregate total of all MBSs may not exceed 50 percent of the

institution's total investment portfolio. The aggregate average life maturity for all holdings of MBS

shall not exceed seven years, while the maximum average life maturity of any one security shall

not exceed ten years. 5) The total portfolio of mortgage related securities shall not exceed 50

percent of the institution’s total investment portfolio. The aggregate average life maturity for all

holdings shall not exceed seven years while the average life maturity of one security shall not

exceed ten years. 6) The College may enter into a repurchase agreement so long as: (a) the

repurchase securities are legal investments under state law for colleges; (b) the College receives a

daily assessment of the market value of the repurchase securities, including accrued interest, and

maintains an adequate margin that reflects a risk assessment of the repurchase securities and the

term of the transaction; and (c) the College has entered into signed contracts with all approved

counterparties. 7) The College has discretion to determine if it should hold or sell other investments

that it may receive as a donation.

The College shall not invest in stripped mortgage-backed securities, residual interest in CMOs,

mortgage servicing rights or commercial mortgage related securities. Investment of debt proceeds

and deposits with trustees is governed by the provisions of the debt agreement. Funds may be

invested in any legally permissible document.

Endowment donations shall be invested in accordance with the procedures and policies developed

by the College and approved by the Chancellor in accordance with the “Alabama Uniform Prudent

Management of Institutional Funds Act”, Code of Alabama 1975, Section 19-3C-1 and following.

To the extent available, the College’s investments are recorded at fair value as of September 30,

2022. GASB Statement Number 72 – Fair Value Measurement and Application, defines fair value

as the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date. This statement establishes a

hierarchy of valuation inputs based on the extent to which the inputs are observable in the

marketplace. Inputs are used in applying the various valuation techniques and take into account the

assumptions that market participants use to make valuation decisions. Inputs may include price

information, credit data, interest and yield curve data, and other factors specific to the financial

instrument. Observable inputs reflect market data obtained from independent sources. In contrast,

unobservable inputs reflect the entity’s assumptions about how market participants would value the

financial instrument. Valuation techniques should maximize the use of observable inputs to the

extent available.

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any

input that is significant to the fair value measurement. The following describes the hierarchy of

inputs used to measure fair value and the primary valuation methodologies used for financial

instruments measured at fair value on a recurring basis:

John C. Calhoun Community College

Notes to the Financial Statements

For the Year Ended September 30, 2022

28

Level 1 – Investments whose values are based on quoted prices (unadjusted) for identical assets

in active markets that a government can access at the measurement date.

Level 2 – Investments with inputs – other than quoted prices included within Level 1 – that are

observable for an asset either directly or indirectly.

Level 3 – Investments classified as Level 3 have unobservable inputs for an asset and may require

a degree of professional judgement.

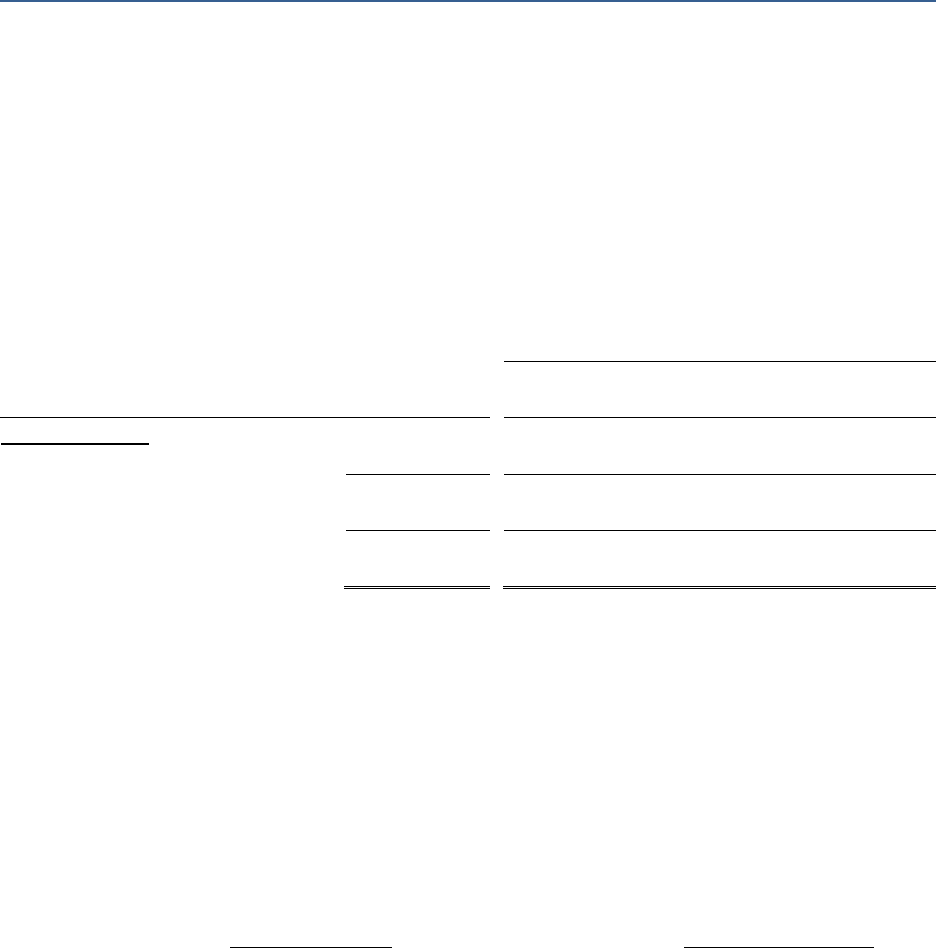

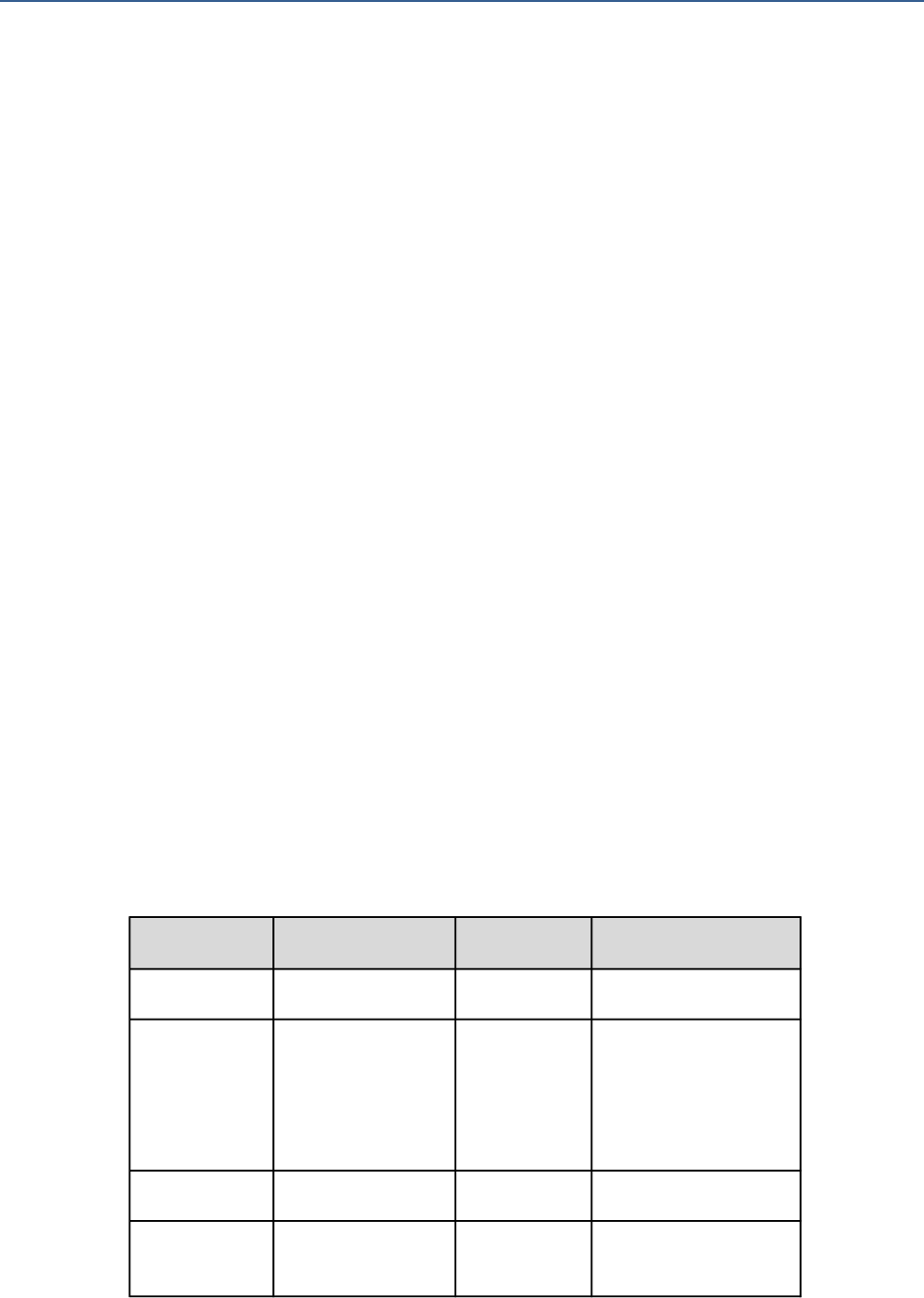

Investments’ fair value measurements are as follows at September 30, 2022:

Fair Value Measurements Using

Investments

Fair Value

Level 1

Inputs

Level 2

Inputs

Level 3

Inputs

Debt Securities

U.S. Agency Securities*

$ 4,730,041

$ 4,730,041

$ -

$ -

Other Cash Equivalents

$ 1,678,034

$ 1,678,034

$ -

$ -

Total Investments

$ 6,408,075

$ 6,408,075

$ -

$ -

*The investment on the face of the financial statement is the fair market value of $4,755,138 less unamortized discount of $25,097.

The U. S. Agency Securities in level 2 of the fair value hierarchy are valued using a matrix pricing

technique. Matrix pricing is used to value securities based on the securities’ relationship to

benchmark quoted prices.

Interest Rate Risk – This risk pertains to changes in interest rates that adversely affect the fair value

of an investment. While there is an active market for the below investments, generally, the longer

the maturity of an investment, the greater the sensitivity of its fair value to changes in market

interest rates. As a means of limiting its exposure to fair value losses arising from rising interest

rates, the College’s investment policy limits its investment maturities as follows:

Investment Type

Maximum Maturity

U.S. Treasury Bills, Notes, Bonds and Stripped Treasuries

10 years

U.S. Agencies

10 years

Certificates of Deposit

5 years

Mortgage-Backed Securities and Mortgage Related Securities

7 years*/10 years**

*Aggregate life

**Average life maturity of any one security

John C. Calhoun Community College

Notes to the Financial Statements

For the Year Ended September 30, 2022

29

At year end, the College had the following investments and maturities:

Investment Maturities (in Years)

Investment Type

Fair Value

1-5

6-10

Thereafter

U.S. Agency Securities

$ 4,730,041

$ 4,730,041

$ -

$ -

Other Cash Equivalents

$ 1,678,034

$ 1,678,034

$ -

$ -

Credit Risk – Credit risk is the risk that an issuer or other counterparty to an investment will not fulfill

its obligation. The College does not have a formal investment policy that specifically addresses its

investment choices related to this risk. The College’s U.S. Agency Securities investments in the

Federal Home Loan Mortgage Corp Agency, Federal Farm Credit Bank, and Federal Home Loan

Bank held a Moody’s rating of “Aaa” and a Standard & Poor’s rating of “AA+.”

Custodial Credit Risk – For an investment, this is the risk that, in the event of the failure of a

counterparty, the government will not be able to cover the value of its investments or collateral

securities that are in the possession of an outside party. The College does not have an investment

policy that limits the amount of securities that can be held by counterparties.

Concentration of Credit Risk – Concentration of credit risk is the risk of loss attributed to the

magnitude of a government's investment in a single issuer. The College does not have a formal

investment policy that places limits on the amount the College may invest in any one issuer to less

than 5%. Instead, the College’s policy was to limit investments by type to the percentages shown

below:

Investment Type

% of Investment

Stripped Treasuries

50%

U.S. Agencies (except for TVA and SLMA)

50%

TVA and SLMA

10%

Certificates of Deposit

No Limit

Mortgage-Backed Securities and Mortgage Related Securities

50%

NOTE 3 - RECEIVABLES

Receivables are summarized as follows:

Accounts Receivable:

Federal

$ 2,276,796

State and Local

710,551

Third Party

443,213

Student

1,730,392

Auxiliary

11,044

Interest

47,678

Other

1,962,569

Less: Allowance for Doubtful Accounts

(1,208,868)

Total Accounts Receivables, Net

$ 5,973,375

John C. Calhoun Community College

Notes to the Financial Statements

For the Year Ended September 30, 2022

30

NOTE 4 - CAPITAL ASSETS

Capital asset activity for the year ended September 30, 2022, was as follows:

Beginning

Deductions &

Ending

Balance

Additions

Adjustments

Transfers

Balance

Capital Assets Not Being Depreciated:

Land

$ 4,380,954

$ 50,590

$ -

$ -

$ 4,431,544

Construction in Progress

11,173,108

2,731,823

-

(11,144,469)

2,760,462

Total Capital Assets Not Being Depreciated:

15,554,062

2,782,413

-

(11,144,469)

7,192,006

Capital Assets Being Depreciated:

Buildings

113,196,668

2,932,817

(30,280)

10,860,844

126,960,049

Building Alterations

15,836,819

441,753

-

283,625

16,562,197

Improvements Other than Buildings

11,588,372

72,662

-

-

11,661,034

Equipment > $25,000

11,358,473

2,197,166

(1,303,704)

-

12,251,935

Equipment < $25,000

11,770,274

2,188,620

(863,420)

-

13,095,474

Lease Equipment

-

239,653

-

-

239,653

Library Holdings

1,410,210

13,325

(3,944)

-

1,419,591

Total Capital Assets Being Depreciated

165,160,816

8,085,996

(2,201,348)

11,144,469

182,189,933

Less Accumulated Depreciation:

Buildings

31,750,148

2,426,265

(6,056)

-

34,170,357

Building Alterations

5,317,238

661,870

-

-

5,979,108

Improvements Other than Buildings

6,739,153

413,444

-

-

7,152,597

Equipment > $25,000

7,646,028

829,653

(1,087,244)

-

7,388,437

Equipment < $25,000

8,927,700

1,431,069

(774,159)

-

9,584,610

Lease Equipment

-

61,380

-

-

61,380